Annual Audit Manual

COPYRIGHT NOTICE — This document is intended for internal use. It cannot be distributed to or reproduced by third parties without prior written permission from the Copyright Coordinator for the Office of the Auditor General of Canada. This includes email, fax, mail and hand delivery, or use of any other method of distribution or reproduction. CPA Canada Handbook sections and excerpts are reproduced herein for your non-commercial use with the permission of The Chartered Professional Accountants of Canada (“CPA Canada”). These may not be modified, copied or distributed in any form as this would infringe CPA Canada’s copyright. Reproduced, with permission, from the CPA Canada Handbook, The Chartered Professional Accountants of Canada, Toronto, Canada.

8032 Obtaining the other information

Apr-2018

In This Section

Our responsibilities in relation to other information

Documents comprising the annual report

Other information obtained after the date of the auditor’s report

Overview

This topic explains:

- Our responsibilities in relation to other information

- Documents comprising the annual report

- Communicating with management

- Other information obtained after the date of the Auditors report

- Other information on the electronic sites

CAS Guidance

This CAS requires the auditor to read and consider the other information because other information that is materially inconsistent with the financial statements or the auditor’s knowledge obtained in the audit may indicate that there is a material misstatement of the financial statements or that a material misstatement of the other information exists, either of which may undermine the credibility of the financial statements and the auditor’s report thereon. Such material misstatements may also inappropriately influence the economic decisions of the users for whom the auditor’s report is prepared (CAS 720.3).

This CAS may also assist the auditor in complying with relevant ethical requirements that require the auditor to avoid being associated with information that the auditor knows or should know is false or misleading. [In ISA 720, this paragraph states: This ISA may also assist the auditor in complying with relevant ethical requirements that require the auditor to avoid being knowingly associated with information that the auditor believes contains a materially false or misleading statement, statements or information furnished recklessly, or omits or obscures information required to be included where such omission or obscurity would be misleading.] (CAS 720.C4)

The auditor’s responsibilities relating to other information (other than applicable reporting responsibilities) apply regardless of whether the other information is obtained by the auditor prior to, or after, the date of the auditor’s report (CAS 720.6).

The auditor’s responsibilities under this CAS do not constitute an assurance engagement on other information or impose an obligation on the auditor to obtain assurance about the other information (CAS 720.8).

Law or regulation may impose additional obligations on the auditor in relation to other information that are beyond the scope of this CAS (CAS 720.9).

OAG Guidance

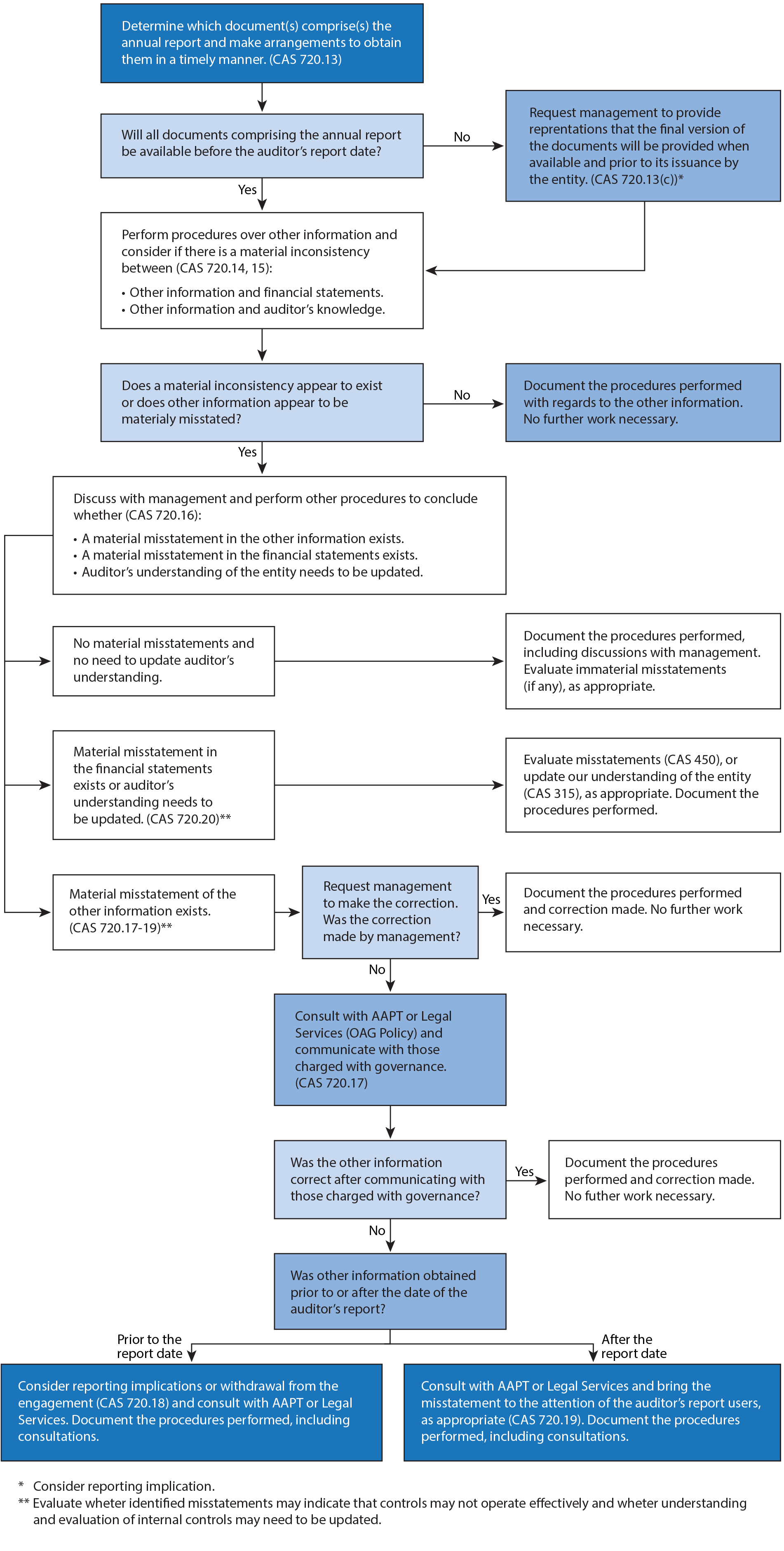

The following chart summarizes key requirements related to the procedures we perform with regards to other information:

We are responsible for evaluating other information included in an entity’s annual report and to respond appropriately if such information could undermine the credibility of the audited financial statements and our report thereon.

It is not our primary purpose to identify material misstatements within other information, as we are not required to obtain audit evidence on the other information (unless prescribed by laws and regulations). Nonetheless, we can become aware that other information appears to be inconsistent with the audited financial statements or our knowledge of the entity, or appears to be materially misstated. We do not knowingly allow our auditor’s report on the financial statements to be included in an annual report that contains material misstatements of other information (including material omission of fact).

When we are obliged to report specifically on the other information included in an annual report, our responsibilities are determined by the nature and terms of the engagement as well as by legislation and professional standards. When such responsibilities involve the audit or review of other information, follow the guidance in the appropriate professional standards.

See OAG Audit 8012 for guidance when supplementary information is presented together with the financial statements that is not covered by the auditor’s opinion.

CAS Requirement

The auditor shall (CAS 720.13):

(a) Determine, through discussion with management, which document(s) comprises the annual report, and the entity’s planned manner and timing of the issuance of such document(s);

(b) Make appropriate arrangements with management to obtain in a timely manner and, if possible, prior to the date of the auditor’s report, the final version of the document(s) comprising the annual report; and

(c) When some or all of the document(s) determined in (a) will not be available until after the date of the auditor’s report, request management to provide a written representation that the final version of the document(s) will be provided to the auditor when available, and prior to its issuance by the entity, such that the auditor can complete the procedures required by this CAS.

CAS Guidance

Determining the document(s) that is or comprises the annual report is often clear based on law, regulation or custom. In many cases, management or those charged with governance may have customarily issued a package of documents that together comprise the annual report, or may have committed to do so. In some cases, however, it may not be clear which document(s) is or comprises the annual report. In such cases, the timing and purpose of the documents (and for whom they are intended) are matters that may be relevant to the auditor’s determination of which document(s) is or comprises the annual report (CAS 720.A11).

When the annual report is translated into other languages pursuant to law or regulation (such as may occur when a jurisdiction has more than one official language), or when multiple "annual reports" are prepared under different legislation (for example, when an entity is listed in more than one jurisdiction), consideration may need to be given as to whether one, or more than one of the "annual reports" form part of the other information. Local law or regulation may provide further guidance in this respect (CAS 720.A12).

Where those charged with governance are to approve the other information prior to its issuance by the entity, the final version of such other information is the one that has been approved by those charged with governance for issuance (CAS 720.A15).

In some cases, the entity’s annual report may be a single document to be released, in accordance with law or regulation or the entity’s reporting practice, shortly after the entity’s financial reporting period such that it is available to the auditor prior to the date of the auditor’s report. In other cases, such a document may not be required to be released until a later time, or at a time of the entity’s choosing. There may also be circumstances when the entity’s annual report is a combination of documents, each subject to different requirements or reporting practice by the entity with respect to the timing of their release (CAS 720.A16).

There may be circumstances when, at the date of the auditor’s report, the entity is considering the development of a document that may be part of the entity’s annual report (for example, a voluntary report to stakeholders) but management is unable to confirm to the auditor the purpose or timing of such a document. If the auditor is unable to ascertain the purpose or timing of such a document, the document is not considered other information for purposes of this CAS (CAS 720.A17).

OAG Guidance

Where the content of an annual report is not defined by laws and regulations or when the content is defined but management chooses to provide additional information in an annual report, consider prior audit experience (e.g., what was included in the entity’s annual report in previous years) and discuss with management and those charged with governance, as appropriate, to obtain an understanding of the scope and content of other information that will be included in the entity’s annual report. Refer to Appendix I of CAS 720 for examples of the information that may be included in the entity’s annual report.

What should be the scope of review for translations?

Office methodology and professional standards specifically associate the independent auditor with translations of documents containing the audited financial statements.

During planning, the engagement leader is required to consider whether the collective competencies of the team are sufficient to perform the audit, including their ability to review translations of documents containing audited financial statements. If a gap in the team’s competencies is identified, appropriate responses should be planned.

The auditor is required to review the “appropriateness of the translation” by comparing translated documents for consistency with the original document that the auditor reviewed in accordance with CAS 720. As such, this translation review should not be as onerous (extensive) and, therefore, does not need to be performed by the same person who reviewed the original document. In fact, teams may wish to assign this translation review to less senior members of the engagement team, administrative staff, or translators with the appropriate written language competencies.

When translation review is to be performed by someone other than a member of the existing audit team, including internal and external specialists, the engagement leader should determine if the individual(s) meet the definition of an engagement team member and if so confirm their independence (for example, administrative assistants, or other OAG employees who have the necessary language skills).

Do we have to review draft versions of the documents?

Review of draft versions of the documents is not mandatory, but a review of the final version must occur before providing clearance for publication. The auditor may choose to review draft versions of documents based on past experience with the entity’s publication process, when documents become available for review, and where there is the risk of material inconsistencies or misstatements of fact in the final documents. Alternatively, if the entity historically has not had material inconsistencies or misstatements of fact that would preclude the auditor from providing clearance for publication, the audit team may wish to become involved later in the publication process.

CAS Requirement

The auditor shall (CAS 720.13):

(a) Determine, through discussion with management, which document(s) comprises the annual report, and the entity’s planned manner and timing of the issuance of such document(s);

(b) Make appropriate arrangements with management to obtain in a timely manner and, if possible, prior to the date of the auditor’s report, the final version of the document(s) comprising the annual report; and

(c) When some or all of the document(s) determined in (a) will not be available until after the date of the auditor’s report, request management to provide a written representation that the final version of the document(s) will be provided to the auditor when available, and prior to its issuance by the entity, such that the auditor can complete the procedures required by this CAS.

CAS Guidance

Management, or those charged with governance, is responsible for preparing the annual report. The auditor may communicate with management or those charged with governance (CAS 720.A13):

- The auditor’s expectations in relation to obtaining the final version of the annual report (including a combination of documents that together comprise the annual report) in a timely manner prior to the date of the auditor’s report such that the auditor can complete the procedures required by this CAS before the date of the auditor’s report, or if that is not possible, as soon as practicable and in any case prior to the entity’s issuance of such information.

- The possible implications when the other information is obtained after the date of the auditor’s report.

- The communications referred to in paragraph A13 may be particularly appropriate for example (CAS 720.A14):

- In an initial audit engagement.

- When there has been a change in management or those charged with governance.

- When other information is expected to be obtained after the date of the auditor’s report.

OAG Guidance

Communicate with management to understand the timing of the annual report preparation. We would expect to obtain the annual report from management sufficiently far in advance of our auditor’s report date to facilitate timely evaluation of the other information. If the annual report or any information that is part of the annual report is not expected to be obtained prior to the date of the auditor’s report or if expected information is delayed and not obtained prior to the date of the auditor’s report, refer to the block below “Other information obtained after the date of the auditor’s report for guidance.”

CAS Requirement

The auditor shall (CAS 720.13):

(a) Determine, through discussion with management, which document(s) comprises the annual report, and the entity’s planned manner and timing of the issuance of such document(s);

(b) Make appropriate arrangements with management to obtain in a timely manner and, if possible, prior to the date of the auditor’s report, the final version of the document(s) comprising the annual report; and

(c) When some or all of the document(s) determined in (a) will not be available until after the date of the auditor’s report, request management to provide a written representation that the final version of the document(s) will be provided to the auditor when available, and prior to its issuance by the entity, such that the auditor can complete the procedures required by this CAS.

CAS Guidance

Obtaining the other information in a timely manner prior to the date of the auditor’s report enables any revisions that are found to be necessary to be made to the financial statements, the auditor’s report, or the other information prior to their issuance. The audit engagement letter may make reference to an agreement with management to make available to the auditor the other information in a timely manner, and if possible prior to the date of the auditor’s report (CAS 720.A18).

The auditor is not precluded from dating or issuing the auditor’s report if the auditor has not obtained some or all of the other information (CAS 720.A20).

When the other information is obtained after the date of the auditor’s report, the auditor is not required to update the procedures performed in accordance with paragraphs 6 and 7 of CAS 560 (CAS 720.A21).

CAS 580 8 establishes requirements and provides guidance on the use of written representations. The written representation required to be requested by paragraph 13(c) regarding other information that will be available only after the date of the auditor’s report is intended to support the auditor’s ability to complete the procedures required by this CAS with respect to such information. In addition, the auditor may find it useful to request other written representations, for example, that (CAS 720.A22):

- Management has informed the auditor of all the documents that it expects to issue that may comprise other information;

- The financial statements and any other information obtained by the auditor prior to the date of the auditor’s report are consistent with one another, and the other information does not contain any material misstatements; and

- With regard to other information that has not been obtained by the auditor prior to the date of the auditor’s report, that management intends to prepare and issue such other information and the expected timing of such issuance.

OAG Guidance

We would normally expect to obtain other information prior to the date of the auditor’s report. When some or all of the information to be included in the annual report is not provided before the date of the auditor’s report, check that the management representation letter includes the representation required by CAS 720.13(c).

When information is provided after the date of the auditor’s report, we still need to document our procedures performed with regards to other information following the requirements and guidance of CAS 720. In such cases follow the guidance in OAG Audit 1173 on documenting matters arising after the date of the auditor’s report.

For guidance on evaluating misstatements in other information obtained after the date of the auditor’s report, refer to OAG Audit 8035.

CAS Requirement

The auditor shall (CAS 720.13):

(a) Determine, through discussion with management, which document(s) comprises the annual report, and the entity’s planned manner and timing of the issuance of such document(s);

(b) Make appropriate arrangements with management to obtain in a timely manner and, if possible, prior to the date of the auditor’s report, the final version of the document(s) comprising the annual report; and

(c) When some or all of the document(s) determined in (a) will not be available until after the date of the auditor’s report, request management to provide a written representation that the final version of the document(s) will be provided to the auditor when available, and prior to its issuance by the entity, such that the auditor can complete the procedures required by this CAS.

CAS Guidance

When other information is only made available to users via the entity’s website, the version of the other information obtained from the entity, rather than directly from the entity’s website, is the relevant document on which the auditor would perform procedures in accordance with this CAS. The auditor has no responsibility under this CAS to search for other information, including other information that may be on the entity’s website, nor to perform any procedures to confirm that other information is appropriately displayed on the entity’s website or otherwise has been appropriately transmitted or displayed electronically (CAS 720.A19).

OAG Guidance

An entity may make other information available on their website or similar electronic venues (hereinafter, ‘electronic site’). Once it has been posted electronically, limitless numbers of people have access to, and might rely on, such information.