Annual Audit Manual

COPYRIGHT NOTICE — This document is intended for internal use. It cannot be distributed to or reproduced by third parties without prior written permission from the Copyright Coordinator for the Office of the Auditor General of Canada. This includes email, fax, mail and hand delivery, or use of any other method of distribution or reproduction. CPA Canada Handbook sections and excerpts are reproduced herein for your non-commercial use with the permission of The Chartered Professional Accountants of Canada (“CPA Canada”). These may not be modified, copied or distributed in any form as this would infringe CPA Canada’s copyright. Reproduced, with permission, from the CPA Canada Handbook, The Chartered Professional Accountants of Canada, Toronto, Canada.

2101 Introduction

Sep-2022

In This Section

Determine Materiality and Perform Understanding Procedures Required by CASs other than CAS 315

CAS Objective

The objective of the auditor is to apply the concept of materiality appropriately in planning and performing the audit. (CAS 320.8)

CAS Requirement

Materiality in the context of an audit

The concept of materiality is applied by the auditor both in planning and performing the audit, and in evaluating the effect of identified misstatements on the audit and of uncorrected misstatements, if any, on the financial statements and in forming the opinion in the auditor’s report (CAS 320.5).

Risk Assessment Procedures and Related Activities

The auditor shall design and perform risk assessment procedures to obtain audit evidence that provides an appropriate basis for (CAS 315.13):

(a) The identification and assessment of risks of material misstatement, whether due to fraud or error, at the financial statement and assertion levels; and

CAS Guidance

Risk Assessment Procedures and Related Activities

The risks of material misstatement to be identified and assessed include both those due to fraud and those due to error, and both are covered by this CAS. However, the significance of fraud is such that further requirements and guidance are included in CAS 240 in relation to risk assessment procedures and related activities to obtain information that is used to identify and assess the risks of material misstatement due to fraud. In addition, the following CASs provide further requirements and guidance on identifying and assessing risks of material misstatement regarding specific matters or circumstances (CAS 315.A11):

- CAS 540 16 in regard to accounting estimates;

- CAS 550 in regard to related party relationships and transactions;

- CAS 570 17 in regard to going concern; and

- CAS 600 18 in regard to group financial statements.

OAG Guidance

Determining materiality

We apply the concept of materiality in planning and performing an audit, in evaluating the effect of identified misstatements on the audit, and to determine the effect of any uncorrected misstatements on the financial statements when forming the opinion in the auditor’s report. As noted in CAS 320.6, when we are planning an audit, we make judgments about misstatements that will be considered material that are used as the basis for:

- Determining the nature, timing and extent of risk assessment procedures;

- Identifying and assessing the risks of material misstatement; and

- Determining the nature, timing and extent of further audit procedures.

Audit risk and materiality affect the application of our audit methodology and need to be considered together in determining the nature, timing, and extent of auditing procedures and in evaluating the results of those procedures.

Why is this important?

|

Materiality The purpose of an audit is to enhance the degree of confidence of intended users in the financial statements by the expression of an opinion by the auditor as to whether the financial statements, as a whole, have been prepared by management, in all material respects, in accordance with the applicable financial reporting framework. We therefore need to determine materiality in order to plan and perform an audit that provides a reasonable basis for our opinion including guiding us in designing and performing testing in the areas where we assess there to be a reasonably possible risk of material misstatement in order to obtain sufficient appropriate audit evidence that the risk has been reduced to an acceptably low level. Determining materiality involves consideration of how misstatements may influence the economic decisions intended users may make on the basis of the financial statements as a whole. Understanding procedures required by other CASs The risk assessment requirements included in CASs other than CAS 315 support us in performing targeted risk assessment procedures in areas where risks of material misstatement are more likely to arise. |

Performing understanding procedures required by CASs other than CAS 315

CAS 315 provides the overall framework for identifying and assessing risks of material misstatement, including both those due to fraud and those due to error. However, a range of other CASs provide further requirements and guidance on identifying and assessing risks of material misstatement arising from specific matters or circumstances, including CAS 240, which addresses considerations specific to the risks of material misstatement due to fraud.

Guidance addressing the requirements of CASs other than CAS 315 related to identifying and assessing risks of material misstatements is included in the following OAG Audit sections:

| CAS 240 – The Auditor’s Responsibilities Relating to Fraud in an Audit of Financial Statements | OAG Audit 5501 Conduct Fraud Risk Assessment |

| CAS 250 – Consideration of Laws and Regulations in an Audit of Financial Statements | OAG Audit 7511 Consideration of Laws and Regulations |

| CAS 402 – Audit Considerations Relating to an Entity Using a Service Organization | OAG Audit 6041 Service Organizations |

| CAS 501 – Audit Evidence - Specific Considerations for Selected Items | OAG Audit 7540 Litigation and Claims OAG Audit 7550 Segment Information |

| CAS 510 – Initial Audit Engagements – Opening Balances | OAG Audit 3050 Initial Audits |

| CAS 540 – Auditing Accounting Estimates and Related Disclosures | OAG Audit 7070 Auditing Accounting Estimates and Related Disclosures |

| CAS 550 – Related Parties | OAG Audit 7530 Related Parties |

| CAS 570 – Going Concern | OAG Audit 7520 Conclude on Entity’s Ability to Continue as a Going Concern |

| CAS 600 – Special Considerations – Audits of Group Financial Statements (Including the Work of Component Auditors) | OAG Audit 2300 Group Audit Considerations |

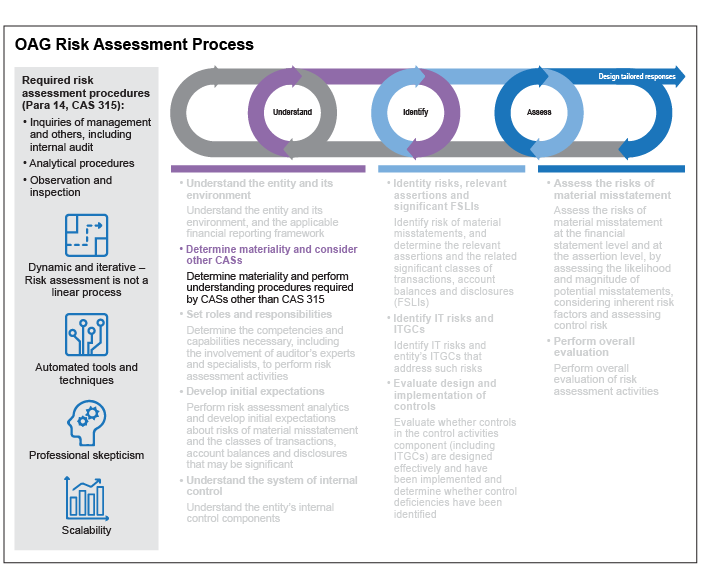

OAG Risk Assessment Process

Within this section, we discuss in more detail the Determine materiality and consider other CASs element of the OAG Risk Assessment Process illustrated below.

CAS Guidance

In conducting an audit of financial statements, the overall objectives of the auditor are to obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether due to fraud or error, thereby enabling the auditor to express an opinion on whether the financial statements are prepared, in all material respects, in accordance with an applicable financial reporting framework; and to report on the financial statements, and communicate as required by the CASs, in accordance with the auditor’s findings. The auditor obtains reasonable assurance by obtaining sufficient appropriate audit evidence to reduce audit risk to an acceptably low level. Audit risk is the risk that the auditor expresses an inappropriate audit opinion when the financial statements are materially misstated. Audit risk is a function of the risks of material misstatement and detection risk. Materiality and audit risk are considered throughout the audit, in particular, when (CAS 320.A1):

(a) identifying and assessing the risks of material misstatement;

(b) determining the nature, timing and extent of further audit procedures; and

(c) evaluating the effect of uncorrected misstatements, if any, on the financial statements and in forming the opinion in the auditor’s report.

Identifying and assessing the risks of material misstatement involves the use of professional judgment to identify those classes of transactions, account balances and disclosures, including qualitative disclosures, the misstatement of which could be material (i.e., in general, misstatements are considered to be material if they could reasonably be expected to influence the economic decisions of users taken on the basis of the financial statements as a whole). When considering whether misstatements in qualitative disclosures could be material, the auditor may identify relevant factors such as (CAS 320.A2):

- The circumstances of the entity for the period (for example, the entity may have undertaken a significant business combination during the period).

- The applicable financial reporting framework, including changes therein (for example, a new financial reporting standard may require new qualitative disclosures that are significant to the entity).

- Qualitative disclosures that are important to users of the financial statements because of the nature of an entity (for example, liquidity risk disclosures may be important to users of the financial statements for a financial institution).

OAG Guidance

In order to assess and respond to risks of material misstatement, we consider materiality for:

- the financial statements as a whole (OAG Audit 2102),

- planning which classes of transactions, account balances or disclosures to select for examination (OAG Audit 2103),

- particular classes of transactions, account balances or disclosures (OAG Audit 2104), and

- evaluating the effect of misstatements (OAG Audit 2105).

The risk of material misstatement at the overall financial statement level refers to risks of material misstatement that relate pervasively to the financial statements as a whole and potentially affect many classes of transactions, account balances, disclosures and their underlying assertions. Risks of this nature often relate to the entity’s control environment (although these risks may also relate to other factors, such as declining economic conditions), and are not necessarily risks identifiable with specific assertions at the class of transactions, account balance, or disclosure level. Rather, this overall risk represents circumstances that increase the risk that there could be material misstatements in any number of different assertions (e.g., through management override of internal control). Financial statement level risks may be especially relevant to our consideration of the risk of material misstatement arising from fraud.

OAG Guidance

As discussed in CAS 320.6, we determine materiality as part of establishing the overall strategy for the audit. Materiality is discussed by the engagement team during mobilisation as part of discussing the overall approach to the performance of the audit. Include materiality discussion on the agenda of the team planning meeting(s) (OAG Audit 4010).

If materiality is set too high, audit procedures might fail to identify a misstatement that intended users of the financial statements would consider material. If materiality is set too low, the engagement team may tend to perform more audit work than necessary. Therefore, agreement up front as a team, with engagement leader involvement to facilitate sharing of their insights of the entity and its industry, is vital to determining materiality.

For special considerations relating to materiality for multi-location entities, including materiality for a group audit, refer to OAG Audit 2333.

CAS Requirements

The auditor shall communicate with those charged with governance an overview of the planned scope and timing of the audit, which includes communicating about the significant risks identified by the auditor (CAS 260.15).

CAS Guidance

Matters communicated may include: The application of the concept of materiality in the context of an audit (CAS 260.A13).

OAG Guidance

Our communication may include a general explanation of how materiality is applied on the audit, and, if the engagement leader considers it appropriate, it may also include an indication of the broad quantitative range within which our overall materiality judgement will lie; the broad impact that this will have on our performance materiality; and the de minimis SUM posting level. However, make clear that there are also qualitative factors which will impact on our assessment of whether misstatements identified during the audit are material.

Guard against our communication compromising the effectiveness of the audit, for example, by making our audit procedures too predictable. Consequently, what we communicate, including its precision, will depend on the client and audit circumstances, and our relationship with the client, including with the audit committee. Refer to OAG Audit 2210 for further guidance on communicating our summary audit strategy.

If we have communicated our materiality assessments to the client and our approach to materiality changes significantly during the course of the audit, consider communicating the change to the client.