Annual Audit Manual

COPYRIGHT NOTICE — This document is intended for internal use. It cannot be distributed to or reproduced by third parties without prior written permission from the Copyright Coordinator for the Office of the Auditor General of Canada. This includes email, fax, mail and hand delivery, or use of any other method of distribution or reproduction. CPA Canada Handbook sections and excerpts are reproduced herein for your non-commercial use with the permission of The Chartered Professional Accountants of Canada (“CPA Canada”). These may not be modified, copied or distributed in any form as this would infringe CPA Canada’s copyright. Reproduced, with permission, from the CPA Canada Handbook, The Chartered Professional Accountants of Canada, Toronto, Canada.

11031 Auditing executive and board compensation, and travel, hospitality, conference and event expenditures

Oct-2019

In This Section

Overview

This section explains:

- when we audit executive and board compensation, travel, hospitality, conference and event expenditures;

- understanding the authorities framework that governs entities in these areas;

- factors to consider when identifying and assessing risk in these areas;

- the impact on the audit approach;

- when and who to consult; and

- how to report issues found.

OAG Guidance

As part of our annual financial audits, we may perform audit procedures concerning executive and board compensation, and travel, hospitality, conference and event expenditures. When performing risk assessment procedures on these expenditures, auditors consider the materiality of these expenditures and legislative authorities including the significance of non-compliance with authorities that should be reported.

The objective of any work performed on executive and board compensation and travel, hospitality, conference and event expenditures is to determine if they comply with relevant authorities of the organization and if any non-compliance matters should be reported.

OAG Guidance

For an effective and efficient audit, it is important that auditors understand the authorities that govern the entity relating to executive and board compensation, and travel, hospitality, conference and event expenditures.

Executive and board compensation

Legislative authorities and other relevant documents related to executive and board compensation that the auditor may consider include:

-

Section 108 of the Financial Administration Act and Crown Corporation General Regulations, 1995;

-

Orders in Council;

-

the enabling legislation of the entity;

-

the entity’s by-laws;

-

Terms and conditions of employment for full-time and part-time Governor in Council (GIC) Appointees (for federal crown corporations); and

-

board resolutions.

Auditors may find information on the organizations to which the GIC makes appointments at http://www.appointments-nominations.gc.ca/, as well as a complete list of appointees to those organizations, the date of their nomination and the end of their mandate. Auditors should be aware that information on this web-site is not always current and should be confirmed with the entity. The guidelines and policies related to Governor in Council appointments are available on the web-site for the Privy Council Office at http://pco-bcp.gc.ca and include:

- Remuneration Guidelines for Part-time Governor in Council Appointees in Agencies, Boards and Commissions;

- Remuneration Guidelines for Part-time Governor in Council Appointees in Crown Corporations;

- Salary Ranges and Maximum performance pay for Governor in Council Appointees; and

- Terms and Conditions of Employment for Full-Time Governor in Council Appointees.

Travel, hospitality, conference and event expenditures

A directive was issued to Crown corporations in July 2015 pursuant to section 89 of the Financial Administration Act (FAA). Certain entities have been directed by the Governor in Council to align their policies, guidelines, and practices with Treasury Board policies, directives and related instruments on travel, hospitality, conference and event expenditures, in a manner that is consistent with their legal obligations.

Legislative authorities and other relevant documents related to travel, hospitality, conference and event expenditures that the auditor may consider include:

- Treasury Board directive on travel, hospitality, conference and event expenditures;

- National Joint Council travel directive;

- Special travel authorities;

- Treasury Board rules on proactive disclosure of expenditures;

- the entity’s by-laws;

- Terms and conditions of employment for full-time and part-time Governor In Council (CIG) Appointees; and

- board resolutions.

OAG Guidance

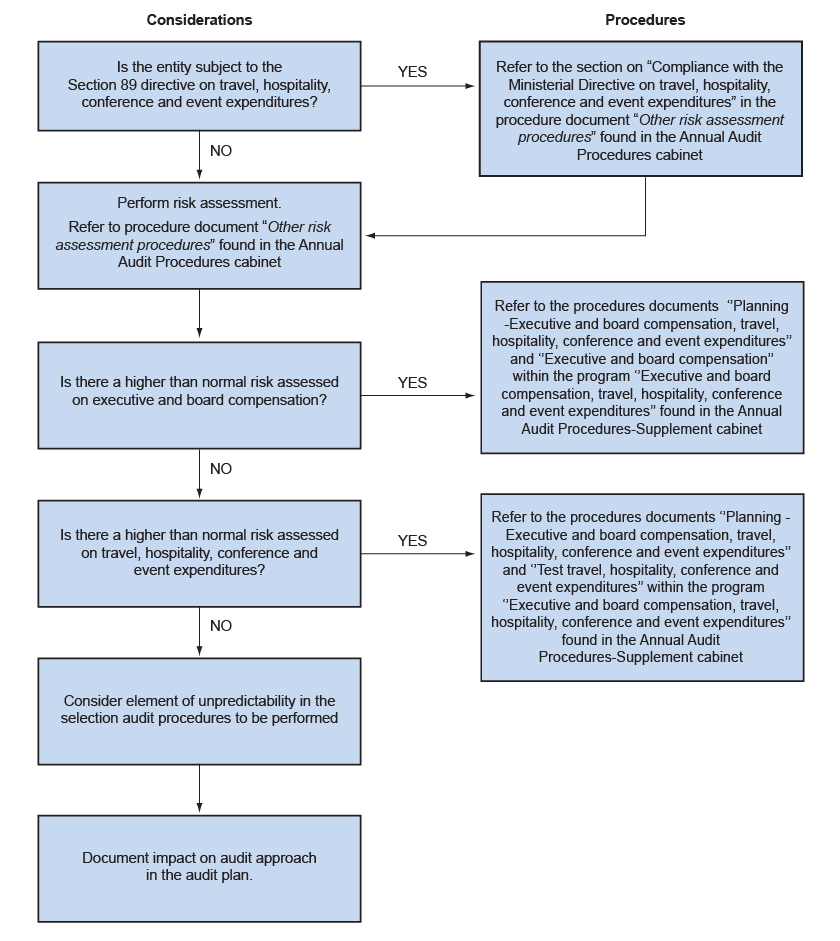

Audit teams of an entity that has received the directive issued pursuant to section 89 of the FAA shall assess the risk of non-compliance with the Directive on travel, hospitality, conference and event expenditures and design their audit to obtain sufficient appropriate audit evidence with respect to their report on compliance with specified authorities included in the auditor’s report. Audit teams would also assess whether there is a higher than normal risk on board and executive compensation.

If the entity is not subject to a directive issued under section 89 of the FAA, audit teams assess the risks of board and executive compensation as well as travel, hospitality, conference and event expenditures. This includes assessing the risk of abuse that could result in personal benefit and that could indicate lapses in values or ethics, weak governance, and/or inadequate oversight and control. Risk assessments in this area should recognize qualitative and quantitative risks including public sensitivity.

Audit teams may consider the following in assessing risk:

-

Have concerns about board and/or executive compensation, travel, hospitality, conferences and events been raised in the past, either by us or others?

-

Have there been changes in the entity’s policies or procedures in these areas? Have those changes been subject to review and approval by the appropriate authority?

-

Have there been any new appointments or departures at the entity?

-

Is the team, from any aspect of the audit, aware of expenditures that might not be consistent with public sector or comparable private sector norms (e.g., spousal travel, excessive international travel, use of business class for short distances, payments to related parties, and additional compensation to board members or executives)?

-

Does the organization’s governance structure include an independent audit committee or equivalent oversight body?

-

If yes, does the audit team, based on its cumulative audit knowledge and experience, consider the audit committee or equivalent oversight body to be effective?

-

If no such body exists, are there adequate compensating controls within the organization or outside (e.g., government approval of compensation and benefits)?

-

-

Are executive and board compensation, travel, hospitality, conference and event expenditures reported regularly to the audit committee or equivalent oversight body? Does the audit committee devote sufficient attention to reviewing, questioning and approving these expenditures?

-

Does internal audit and the Senior Financial Officer have unrestricted access to the details of such expenditures? If so, do these functions regularly review for compliance with corporate policies and probity? Are reports on expenditures made to the audit committee, board or other appropriate authority?

-

Does the entity have a code of conduct or business ethics? Does the audit committee, board or other appropriate authority have a means of ensuring compliance with the code?

-

Does the entity have special post-employment benefit arrangements for senior executives or board members? If so,

-

Have these arrangements and the level of potential post-employment benefit been fully and clearly communicated to those responsible for approving the arrangements?

-

Has appropriate approval been received?

-

-

Does the board of directors have a compensation committee or documented approach to compensation arrangements?

-

Are board decisions on executive and board benefits supported by the assistance of independent professionals?

-

Does the board or compensation committee assess the reasonableness of the compensation and benefits approved for executives and board members (including post-employment benefits)?

-

Are senior executives engaged using long term personnel service contracts? Are these being used to avoid the appearance of an employee-employer relationship that exists in reality?

-

Have there been concerns related to compensation for part-time work by the board?

-

Are there adequate controls over the recording and use of vacation and management leave, awarding of performance pay and classification and reclassification of senior management positions? Is the information reported to the appropriate authority (e.g., audit committee)? Are the amounts reported in these areas reasonable?

-

Does the entity report publicly on their expenditures and arrangements?

-

Have those charged with governance asked us to perform work on senior executive and board compensation, travel, hospitality, conference and event expenditures?

This list is not intended to be comprehensive nor is every question relevant for every audit. As with any area subject to our audit, organizations with good governance, accountability and oversight practices should present a lower risk in this area. The list above is intended to provide audit teams with examples of the types of factors to consider in assessing accountability, oversight and governance practices. As with any area that we audit, teams shall use judgment in deciding whether any factors identified indicate a higher than normal risk.

OAG Guidance

Where an entity has received a directive issued pursuant to section 89 of the FAA, the audit team will gather sufficient and appropriate audit evidence to assess the alignment of the entity’s policies, guidelines, and practices with Treasury Board policies, directives and related instruments on travel, hospitality, conference and event expenditures. Where the audit team has assessed a higher than normal risk in the area of board or executive compensation, the need for additional procedures should be considered.

For entities not subject to the section 89 directive but where the audit team identifies a higher than normal risk in the area of board or executive compensation, travel, hospitality, conferences and events, the need for additional procedures should be considered.

OAG Guidance

Consultation with Legal Services or with internal specialists such as a Human Resources Specialist, Internal Specialist for Fraud and Internal Specialist for Compliance with Authorities may be appropriate in certain circumstances.

OAG Guidance

For entities subject to a section 89 directive, issues identified as a result of work should be considered in the reporting on compliance with specified authorities section of the auditor’s report.

In conjunction with the audit of the [consolidated] financial statements, we have audited transactions of [the] [Entity’s name] [and its wholly-owned subsidiaries] coming to our notice for compliance with specified authorities. The specified authorities against which compliance was audited are [identify the specified authorities, for example: Part X of the Financial Administration Act and regulations, the [insert name of enabling legislation] and regulations, and the [charter/articles and] by laws of [the] [Entity’s name] [and its wholly-owned subsidiaries], and the directive issued pursuant to section 89 of the Financial Administration Act.

For all entities, issues identified should also be considered for reporting in management letters, reports to the audit committee or equivalent or as an other matter paragraph.

Related guidance

Consultations—OAG Audit 3081 and OAG Audit 3082

Fraud—OAG Audit 5500

Controls tests—OAG Audit 6000

Substantive tests—OAG Audit 7000