Annual Audit Manual

COPYRIGHT NOTICE — This document is intended for internal use. It cannot be distributed to or reproduced by third parties without prior written permission from the Copyright Coordinator for the Office of the Auditor General of Canada. This includes email, fax, mail and hand delivery, or use of any other method of distribution or reproduction. CPA Canada Handbook sections and excerpts are reproduced herein for your non-commercial use with the permission of The Chartered Professional Accountants of Canada (“CPA Canada”). These may not be modified, copied or distributed in any form as this would infringe CPA Canada’s copyright. Reproduced, with permission, from the CPA Canada Handbook, The Chartered Professional Accountants of Canada, Toronto, Canada.

7042 Targeted testing

Jun-2018

In This Section

Application to 100 percent of the population

Application to less than 100 percent of the population

Defining and evaluating misstatements found through targeted testing

Evaluating the risk of material misstatement at the assertion level on the remaining balance

Overview

This topic explains:

- The concept of targeted testing

- Application of targeted testing to 100 percent of the population

- Application of targeted testing to less than 100 percent of the population

- Defining targets

- Evaluating misstatements found

- Consideration of the remaining untested balance

OAG Guidance

Targeted testing involves selecting items to be tested based on some characteristic. It is our preferred approach for tests of details as it provides the opportunity to exercise significant judgment over what items are to be tested. Targeted testing can be applied to either a specific part of an account or the whole of the account. The results from targeted testing are not projected to the untested items in a population. The specific type of detailed test we use (e.g., physical examination, confirmation, cut‑off test) in our targeted testing will depend on the financial statement assertion(s) we are testing.

CAS Guidance

The auditor may decide that it will be most appropriate to examine the entire population of items that make up a class of transactions or account balance (or a stratum within that population). 100% examination may be appropriate when, for example (CAS 500.A54):

-

The population constitutes a small number of large value items;

-

There is a significant risk and other means do not provide sufficient appropriate audit evidence; or

-

The repetitive nature of a calculation or other process performed automatically by an information system makes a 100% examination cost effective.

OAG Guidance

A “population” does not need to be an entire account balance or class of transactions. For example:

-

Cut-off testing might examine transactions initiated for a period prior and subsequent to year‑end. Note that these two periods are treated as separate populations with separate transactions selected.

-

We might examine all items within an account balance or class of transactions that are individually significant due to their monetary value or that represent significant risk regardless of size.

Examples of risk-based considerations are:

-

Transactions or balances that are subject to a high degree of management involvement or a high probability of misstatement.

-

Transactions or balances that are not in the ordinary course of business, especially with related parties.

-

Balances with no activity for an extended period of time (e.g., slow‑moving items in inventory or old receivable balances).

-

Anomalies identified through scanning analytics, e.g., suspicious or unusual items, apparent deviations from the norm and items that appear more prone to error.

-

Items that have a history of error.

-

Period-end and/or manual adjustments.

The list above can also be used when considering risk based selection when applying targeted testing to less than 100 percent of the population.

See OAG Audit 4028.4 for guidance on the reliability of information generated by an IT application used in our audit.

CAS Guidance

While selective examination of specific items from a class of transactions or account balance will often be an efficient means of obtaining audit evidence, it does not constitute sampling. The results of audit procedures applied to items selected in this way cannot be projected to the entire population; accordingly, selective examination of specific items does not provide audit evidence concerning the remainder of the population (CAS 500.A56).

OAG Guidance

When we are target testing less than 100 percent of a population, we test all items that meet our target definition.

When applying targeted testing to less than 100 percent of a population, coverage and risk‑based selection are the two selection methods commonly used, either on their own or in combination:

Coverage

Testing a relatively limited number of large monetary items so as to obtain significant coverage as a percentage of the total value of the population. We may decide to examine items whose values exceed a certain amount to verify a large proportion of the total amount of an account balance or class of transactions. For example, if 8 large items constitute 85 percent of the total value of a population, then a high level of evidence can be obtained in relation to existence and accuracy by testing the eight items.

Generally, coverage-based targeted testing alone is not appropriate where material monetary understatement is equally likely to be found in small‑value or “no‑value” recorded amounts, for example in accounts receivable balances, accounts payable balances, or legal fees. In these cases we consider examining small‑value or “no‑value” items through targeted testing or audit sampling.

When understatement is also a concern, combining targeted testing of large items with audit sampling to test the remaining population can be effective. In addition to monetary coverage, the selection can be “weighted” according to different criteria. For example, tests for completeness of trade payables might be weighted by selecting high‑volume suppliers rather than large payable balances.

Risk-Based

Testing a subset of items that have a particular characteristic associated with increased risk (see listing of risk‑based considerations above).

Related Guidance

See OAG Audit 7044 for further guidance on sampling

CAS Guidance

The auditor may decide to select specific items from a population. In making this decision, factors that may be relevant include (CAS 500.A55):

-

The auditors understanding of the entity,

-

The assessed risks of material misstatement, and

-

The characteristics of the population being tested.

The judgmental selection of specific items is subject to non‑sampling risk. Specific items selected may include:

-

High value or key items. The auditor may decide to select specific items within a population because they are of high value, or exhibit some other characteristic, for example, items that are suspicious, unusual, particularly risk‑prone or that have a history of error.

-

All items over a certain amount. The auditor may decide to examine items whose recorded values exceed a certain amount as to verify a large proportion of the total amount of a class of transactions or account balance.

-

Items to obtain information. The auditor may examine items to obtain information about matters such as the nature of the entity of the nature of transactions.

OAG Guidance

Define targets with care, considering which testing unit will be providing the most effective means of testing. Once defined, we test the entire applicable target. If we determine for some reason that this is not practical, we need to revisit and redefine our target, with the understanding that we only “take credit” for testing actually performed.

For example, if our procedure is to vouch fixed assets acquired during the year, we select high dollar additions as our target. We note that by testing the 10 largest additions, each over $250,000, we can get obtain assurance on 74 percent of the total account balance. However, once our client provides us with the details of each of the fixed asset additions, we note that each one is comprised of between 5 to 30 invoices, requiring us to test 150 invoices. Based on our initial target definition, we need to test each invoice for each selected fixed asset addition. We cannot just decide to test a portion of the items targeted.

However, if we note that each fixed asset addition is comprised of one or two invoices of over $100,000 each and the rest are much smaller invoices, we may decide to redefine our target. In this case we may decide to use invoices of $100,000 or more that are part of any single fixed asset addition aggregating in excess of $250,000. We then determine that there are 17 items in our newly defined target, which will give us assurance on 68 percent of the total fixed asset addition account balance.

Reassessment of Coverage Following Redefining of Target

It is important to note that we can “take credit” only for the items we actually test, in this case the sum of each of the 17 invoices, and not the sum of the 10 individual fixed asset addition account balances in total. We then reassess whether this 68 percent coverage obtained is enough testing to address the applicable assertions, after considering other assurance obtained from controls testing and substantive analytics. If this targeted test is the only assurance obtained over the fixed asset addition balance, the untested amount will be compared to performance materiality to assess whether further testing is required.

Materiality Considerations

It would generally not be appropriate to use the de minimis SUM posting level as our testing threshold, as it is likely to be too conservative and, consequently, inefficient.

Where we determined materiality for particular classes of transactions, account balances or disclosures, we take those levels into account when determining the threshold.

Selection Criteria

Document the selection criteria. For example, if all items over a specified monetary amount are to be selected from a listing, we describe in our documentation the listing and the scope (e.g., all invoices over $25,000 from the December sales listing).

Adding Elements of Unpredictability to Our Testing to Detect Misstatements

We may also choose to target test a number of seemingly routine transactions, and/or transactions with no particular monetary significance, for the sole purpose of adding an element of unpredictability to our testing in connection with our efforts to detect misstatements due to error or fraud. These would be risk‑based selections.

For example, when testing accounts receivable, we may decide that, in addition to confirming all accounts receivable balances above performance materiality (a monetary‑based target), and all accounts receivable balances above a specified monetary amount that have been outstanding for greater than 90 days (a risk‑based target), we will also choose to target an additional 10 receivable balances with a monetary amount below a specified amount, selected on a haphazard basis from the accounts receivable listing.

OAG Guidance

Clearly define what will be considered a misstatement before executing the targeted testing. The definition of misstatement will depend on our test objective (e.g., existence, cut‑off), but with targeted testing it usually involves a difference between monetary amounts in the client records and amounts supported by audit evidence from our testing.

When a misstatement is identified, consider if it needs to be included in the Summary of Uncorrected Misstatements (see OAG Audit 9010).

OAG Guidance

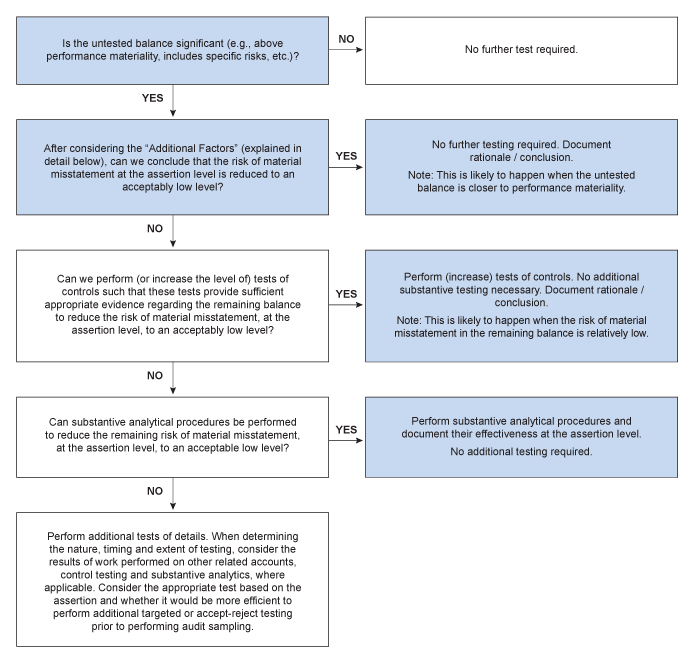

After applying targeted testing to less than 100 percent of a population we need to evaluate the remaining risk of material misstatement of the untested balance at the assertion level. The following flowchart provides an overview of the steps to be considered with more detailed guidance in the following paragraphs:

While it is not appropriate to project misstatements from targeted testing to the entire population as is done in audit sampling, targeted testing may allow us, to make judgments about the untested items in the population, depending on the nature of the test and the population. For example, if coverage is the method used and all transactions are processed in the same way by the same system, then the items target tested would likely provide some information about untested items. However, items targeted because they are unusual or near period‑end may provide little or no information about untested items.

When targeted testing is applied to less than 100 percent of a population, consider whether additional evidence is needed for the remaining balance not subject to targeted testing. When the total value of the account balance not subject to targeted testing exceeds performance materiality, understand the characteristics of the remaining population and use professional judgment to evaluate the risk of a material misstatement at the assertion level by considering factors such as the following in order to determine if sufficient appropriate audit evidence has been obtained:

-

Significance of the potential misstatement in the relevant assertion and the likelihood of its having a material effect, individually or aggregated with other potential misstatements, on the financial statements.

-

Effectiveness of management’s responses and controls to address the risks.

-

Experience gained during previous audits with respect to similar potential misstatements.

-

Results of audit procedures performed in the audit of financial statements, including whether the evidence obtained supports or contradicts management’s assertions and whether such audit procedures identified specific instances of fraud or error.

-

Our risk assessment.

-

Source and reliability of available information.

-

The appropriateness (i.e. the relevance and reliability) and persuasiveness of the audit evidence.

-

Understanding of the entity and its environment, including its internal control.

As the risk of material misstatement of the account balance not subjected to targeted testing increases (e.g., because of the significance of the untested balance or the results of the targeted testing), the more likely it is that we need to obtain additional audit evidence related to the account balance not subjected to targeted testing, either through substantive analytics and/or additional targeted testing or possibly by obtaining more evidence about the effectiveness of applicable controls.

Considering the Factors

In considering the likelihood of its having a material effect on the financial statements, the composition or characteristics of the remaining balance not subject to targeted testing may result in a lower likelihood of a material misstatement and we may be able to conclude that no additional testing is necessary. For example, if the remaining untested balance is made up of numerous small items and most would have to be misstated for there to be a material misstatement, we may be able to conclude that the likelihood of a material misstatement is low and after considering the factors noted above we have sufficient appropriate audit evidence.

In considering results of audit procedures performed, consider controls testing, analytical procedures, inferences drawn from our targeted testing and/or other audit work, including procedures performed on related balances (e.g., accounts receivable confirmations and cash collections supporting the revenue account) before performing additional tests of details. Based on the results of other audit procedures performed, we may be able to conclude that we have sufficient assurance or evidence and that no additional testing is necessary.

In considering the significance of the potential misstatement in the relevant assertion, if the magnitude of the remaining balance not subject to targeted testing is closer to performance materiality, we may be able to conclude that we have obtained sufficient evidence to provide us with reasonable assurance and that no additional testing is necessary. In contrast, if the remaining untested balance is significantly greater than performance materiality, we may conclude that we need to obtain additional evidence. For example, if performance materiality is $1 million and the remaining balance after targeted testing is $1.5 million, we may conclude after considering the factors noted above that we have sufficient evidence. Conversely, if the remaining balance after targeted testing is $3 million, after considering the factors noted above, we may conclude additional testing in the form of substantive analytics and/or additional targeted testing or possibly by obtaining more evidence about the effectiveness of applicable controls is required.

The lower the risk of material misstatement of the account balance not subjected to targeted testing (e.g., because the remaining untested balance is less than or close to performance materiality and the composition of the remaining balance is lower risk), the more likely it is that increasing the level of controls reliance (i.e., moving from None to Partial controls reliance or Partial to High controls reliance) through additional tests of controls may provide sufficient appropriate evidence regarding the account balance. As the risk of material misstatement of the account balance not subjected to targeted testing increases (e.g., because of the significance of the untested balance or the results of the targeted testing), the more likely it is that we will need additional substantive audit evidence related to the account balance not subjected to targeted testing. If we determine that additional substantive audit evidence is needed, consider the work performed on other related accounts, and the extent of evidence obtained regarding the effectiveness of controls in determining the nature, timing and extent of the additional procedures performed. Such additional evidence may be obtained through substantive analytics or other substantive tests of details (i.e., additional targeted testing, audit sampling). Our reliance on controls cannot eliminate the need to perform additional substantive procedures when the risk of material misstatement in the untested portion of the account balance has not been reduced to an appropriately low level because of the significance of the untested balance or the results of targeted testing. In the case of revenue and cost of sales, it may be appropriate to perform substantive analytical procedures to obtain moderate or low assurance when the targeted test and control reliance do not indicate a likelihood of errors and other pre‑conditions are met. See further guidance in OAG Audit 7011 and OAG Audit 7033.2.

In situations where tests of details are deemed necessary, consider the assertions being addressed and whether it would be more efficient to perform targeted or accept‑reject testing before defaulting to audit sampling.

Audit Sampling Considerations

If targeted testing covered a significant percentage of the balances that makes up an account and we were performing substantive analytical procedures on the relevant assertions for the account, it would be unusual to apply audit sampling to the remaining balance after targeted testing even if we had no controls reliance. For example, if we achieved 60 percent coverage of fixed asset additions from targeted testing with no exceptions, tested all additions which individually are above performance materiality and performed substantive analytical procedures on the relevant assertions no further work may be necessary, even though we have no controls reliance and the remaining balance not subject to targeted testing exceeds multiples of performance materiality. However, in this circumstance, the precision of the substantive analytics are evaluated to conclude that they provide sufficient evidence about the untested balance.

Illustrative Examples

The following table provides information that could be useful in assessing the additional evidence that may be necessary with respect to a balance remaining after targeted testing. For example, let’s assume that performance materiality is 10% of the balance remaining (i.e., the account balance for purposes of the table below). Let’s also further assume that based on the results of our targeted testing (which identified no misstatements) and the overall level of substantive evidence planned, we desire a Low level of substantive evidence related to the remaining balance which is composed of more than 200 items that are sufficiently similar such that we have concluded we can appropriately project the results of our testing over the total remaining balance. Based on this information and the table below, we could select eight additional items for testing to achieve a Low level of assurance.

The table below is provided to demonstrate certain relative relationships. Our sampling template would be used to determine our actual sample sizes.

| Relationship of PM to Account Balance Remaining After Targeted Testing* |

Level of Assurance / Sample Size** | |||||||

|---|---|---|---|---|---|---|---|---|

| PM as a % of Account Balance |

Suppl | Low | Mod | High | Suppl | Low | Mod | High |

| Populations of > 200 | Populations of < 60*** | |||||||

|

50% |

1 |

2 |

4 |

6 |

1 |

1 |

2 |

4 |

|

20% |

2 |

4 |

9 |

15 |

2 |

3 |

5 |

9 |

|

10% |

4 |

8 |

18 |

30 |

3 |

5 |

10 |

17 |

|

8% |

5 |

10 |

23 |

38 |

3 |

6 |

13 |

21 |

|

6% |

7 |

14 |

30 |

50 |

4 |

8 |

17 |

28 |

|

5% |

8 |

16 |

36 |

60 |

5 |

9 |

20 |

33 |

|

4% |

10 |

20 |

45 |

75 |

6 |

11 |

25 |

42 |

|

3% |

14 |

27 |

60 |

100 |

8 |

15 |

33 |

55 |

|

* Assumes performance materiality (PM) is equal to tolerable misstatement. ** Sample sizes reflect an estimated misstatement of zero in the population. *** For populations of 60 and less, the sample size represents 55% of the sample size provided by the formula (see Step 4: Determine Sample Size in OAG Audit 7044.1) |

||||||||

Documentation

Document the rationale for the disposal of the untested balance. Tests of details documentation template assists with addressing documentation requirements.

OAG Guidance

When performing targeted testing we are strongly encouraged to use the Targeted Testing template and the relevant Standard Documentation Sheet within the Test of Details template Menu.