Annual Audit Manual

COPYRIGHT NOTICE — This document is intended for internal use. It cannot be distributed to or reproduced by third parties without prior written permission from the Copyright Coordinator for the Office of the Auditor General of Canada. This includes email, fax, mail and hand delivery, or use of any other method of distribution or reproduction. CPA Canada Handbook sections and excerpts are reproduced herein for your non-commercial use with the permission of The Chartered Professional Accountants of Canada (“CPA Canada”). These may not be modified, copied or distributed in any form as this would infringe CPA Canada’s copyright. Reproduced, with permission, from the CPA Canada Handbook, The Chartered Professional Accountants of Canada, Toronto, Canada.

7071 Introduction

Sep-2022

In This Section

Nature of Accounting Estimates

Estimation Uncertainty, Inherent Risk Factors and Other Key Concepts

Examples of Accounting Estimates

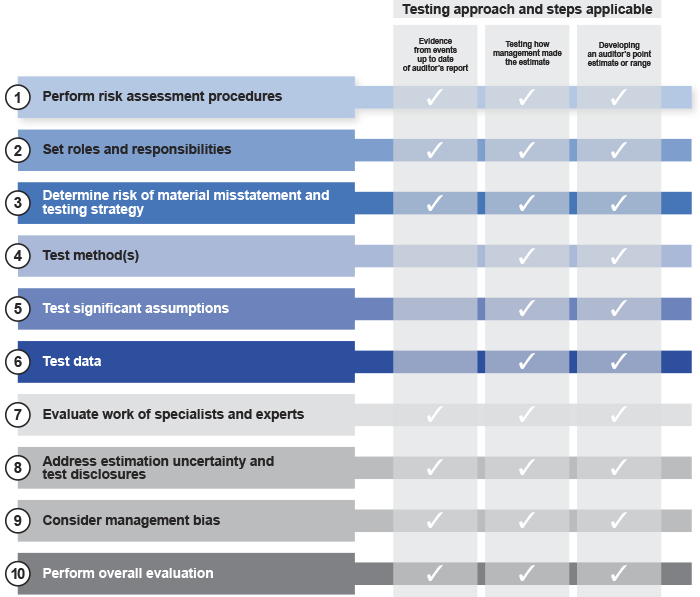

10 Step Framework for Auditing Accounting Estimates

Scaling to the Engagement and Entity Facts and Circumstances

CAS Objective

The objective of the auditor is to obtain sufficient appropriate audit evidence about whether accounting estimates and related disclosures in the financial statements are reasonable in the context of the applicable financial reporting framework (CAS 540.11).

CAS Guidance

Accounting estimates vary widely in nature and are required to be made by management when the monetary amounts cannot be directly observed. The measurement of these monetary amounts is subject to estimation uncertainty, which reflects inherent limitations in knowledge or data. These limitations give rise to inherent subjectivity and variation in the measurement outcomes. The process of making accounting estimates involves selecting and applying a method using assumptions and data, which requires judgment by management and can give rise to complexity in measurement. The effects of complexity, subjectivity or other inherent risk factors on the measurement of these monetary amounts affects their susceptibility to misstatement (CAS 540.2).

A method is a measurement technique used by management to make an accounting estimate in accordance with the required measurement basis. For example, one recognized method used to make accounting estimates relating to share-based payment transactions is to determine a theoretical option call price using the Black Scholes option pricing formula. A method is applied using a computational tool or process, sometimes referred to as a model, and involves applying assumptions and data and taking into account a set of relationships between them (CAS 540.A2).

Assumptions involve judgments based on available information about matters such as the choice of an interest rate, a discount rate, or judgments about future conditions or events. An assumption may be selected by management from a range of appropriate alternatives. Assumptions that may be made or identified by a management’s expert become management’s assumptions when used by management in making an accounting estimate (CAS 540.A3).

For purposes of this CAS, data is information that can be obtained through direct observation or from a party external to the entity. Information obtained by applying analytical or interpretive techniques to data is referred to as derived data when such techniques have a well-established theoretical basis and therefore less need for management judgment. Otherwise, such information is an assumption. (CAS 540.A4)

Examples of data include (CAS 540.A5):

- Prices agreed in market transactions;

- Operating times or quantities of output from a production machine;

- Historical prices or other terms included in contracts, such as a contracted interest rate, a payment schedule, and term included in a loan agreement;

- Forward-looking information such as economic or earnings forecasts obtained from an external information source, or

- A future interest rate determined using interpolation techniques from forward interest rates (derived data).

Data can come from a wide range of sources. For example, data can be (CAS 540.A6):

- Generated within the organization or externally;

- Obtained from a system that is either within or outside the general or subsidiary ledgers;

- Observable in contracts; or

- Observable in legislative or regulatory pronouncements.

OAG Guidance

An accounting estimate is defined in CAS 540 as a monetary amount for which the measurement, in accordance with the requirements of the applicable financial reporting framework, is subject to estimation uncertainty. Estimation uncertainty arises when the monetary amount of an item recognized or disclosed in the financial statements cannot be measured with precision through direct observation of the cost, price or other observable data.

Where management has access to knowledge and observable data that enable precise measurement of a financial statement item, we may conclude that there is no estimation uncertainty and that item does not meet the definition of an accounting estimate.

For example, where an entity is invoiced quarterly in arrears for rental on its office premises, and the invoicing period is not coterminous with the entity’s period end, it will be necessary for management to book an accrual for the rent payable as at the balance sheet date. Where this accrual is based on an agreed contractual rental rate, or on a rent invoice received after the period end but prior to issuance of the financial statements, there is no estimation uncertainty because the entry is based on observable data that enables precise measurement of the balance.

In this circumstance, we may conclude that the accrual would not meet the definition of an accounting estimate and would not be in the scope of CAS 540, though we would still need to perform risk assessment procedures required by CAS 315 and obtain sufficient appropriate audit evidence over this balance in accordance with CAS 330. In contrast, an accrual for utilities based on estimated usage, where no supplier invoice has been received, is subject to estimation uncertainty and we would conclude that this is an estimate and therefore subject to CAS 540 risk assessment and further audit procedures.

The passage of time, including the timing of receipt by management of information relevant to the measurement of account balances, classes of transactions or disclosures can influence the degree to which an estimate is subject to estimation uncertainty. When there is a longer period between the balance sheet date and the date of the auditor’s report, the auditor’s consideration of events in this period may provide sufficient audit evidence for some accounting estimates (other than those involving fair value measurements where information after the balance sheet date may not be relevant to fair value at the balance sheet date).

For example, the further after period end management measures provisions for impairment of accounts receivable and obsolescence of inventory, the more likely it is that a greater volume of observable data will be available to support this measurement (e.g., evidence of cash receipts against invoices outstanding at the period end, and the post-period end sale of inventory providing evidence as to its net realizable value). Because this enables management to measure these estimates with a greater level of precision, we may conclude that estimation uncertainty, and consequently the assessed level of inherent risk, is decreased.

As explained in OAG Audit 5042, when identifying and assessing risks at the assertion level, we are focused on significant FSLIs and their relevant assertions that represent the risk of material misstatement (i.e., represent a reasonable possibility of material misstatement). Assessing the risk of material misstatement associated with an accounting estimate (and the development of further audit procedures to address that risk) is therefore performed in respect of significant FSLIs. Estimates relating to FSLIs that are not significant would not be subject to the requirements of CAS 540. We would not, for example, perform CAS 540 risk assessment and execution procedures on management’s impairment provision for accounts receivable that do not represent a significant FSLI.

In addition, estimated monetary amounts that form an immaterial part of a larger significant FSLI, such as a specific estimated amount within a larger account balance, may not need to be subject to the risk assessment and further audit procedures required by CAS 540. For example, where an entity uses standard inventory costing and has capitalized a portion of variances into year‑end inventory, if variances for the full period are themselves immaterial, we might conclude that the estimated amount to be capitalized could not be material to the financial statements and therefore may also decide not to subject the estimate to the requirements of CAS 540.

CAS Guidance

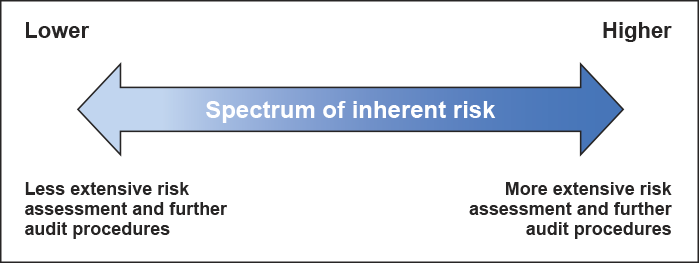

CAS 315 requires a separate assessment of inherent risk for identified risks of material misstatement at the assertion level. In the context of CAS 540, and depending on the nature of a particular accounting estimate, the susceptibility of an assertion to a misstatement that could be material may be subject to or affected by estimation uncertainty, complexity, subjectivity or other inherent risk factors, and the interrelationship among them. Accordingly, the assessment of inherent risk depends on the degree to which the inherent risk factors affect the likelihood or magnitude of misstatement, and varies on a scale that is referred to as the spectrum of inherent risk (CAS 540.4).

Inherent risk factors are characteristics of events or conditions that affect susceptibility to misstatement, whether due to fraud or error, of an assertion about a class of transactions, account balance or disclosures, before consideration of controls. Appendix 1 further explains the nature of these inherent risk factors, and their interrelationships, in the context of making accounting estimates and their presentation in the financial statements (CAS 540.A8).

When assessing the risks of material misstatement at the assertion level, in addition to estimation uncertainty, complexity, and subjectivity, the auditor also takes into account the degree to which inherent risk factors included in CAS 315 (other than estimation uncertainty, complexity, and subjectivity) affect susceptibility of assertions to misstatement about the accounting estimate. Such additional inherent risk factors include (CAS 540.A9):

- Change in the nature or circumstances of the relevant financial statement items, or requirements of the applicable financial reporting framework which may give rise to the need for changes in the method, assumptions or data used to make the accounting estimate.

- Susceptibility to misstatement due to management bias or other fraud risk factors insofar as they affect inherent risk, in making the accounting estimate.

- Uncertainty, other than estimation uncertainty.

Not all accounting estimates are subject to a high degree of estimation uncertainty. For example, some financial statement items may have an active and open market that provides readily available and reliable information on the prices at which actual exchanges occur. However, estimation uncertainty may exist even when the valuation method and data are well defined. For example, valuation of securities quoted on an active and open market at the listed market price may require adjustment if the holding is significant or is subject to restrictions in marketability. In addition, general economic circumstances prevailing at the time, for example, illiquidity in a particular market, may impact estimation uncertainty (CAS 540.A16).

This CAS refers to relevant requirements in CAS 315 and CAS 330, and provides related guidance, to emphasize the importance of the auditor’s decisions about controls relating to accounting estimates, including decisions about whether (CAS 540.5):

- There are controls required to be identified by CAS 315, for which the auditor is required to evaluate their design and determine whether they have been implemented.

- To test the operating effectiveness of controls.

CAS 315 also requires a separate assessment of control risk when assessing the risks of material misstatement at the assertion level. In assessing control risk, the auditor takes into account whether the auditor’s further audit procedures contemplate planned reliance on the operating effectiveness of controls. If the auditor does not plan to test the operating effectiveness of controls, or does not intend to rely on the operating effectiveness of controls, the auditor’s assessment of control risk is such that the assessment of the risk of material misstatement is the same as the assessment of inherent risk (CAS 540.6).

In assessing control risk at the assertion level in accordance with CAS 315, the auditor takes into account whether the auditor plans to test the operating effectiveness of controls. When the auditor is considering whether to test the operating effectiveness of controls, the auditor’s evaluation that controls are effectively designed and have been implemented supports an expectation, by the auditor, about the operating effectiveness of the controls in establishing the plan to test them (CAS 540.A10).

This CAS emphasizes that the auditor’s further audit procedures (including, where appropriate, tests of controls) need to be responsive to the reasons for the assessed risks of material misstatement at the assertion level, taking into account the effect of one or more inherent risk factors and the auditor’s assessment of control risk. (CAS 540.7)

The exercise of professional skepticism in relation to accounting estimates is affected by the auditor’s consideration of inherent risk factors, and its importance increases when accounting estimates are subject to a greater degree of estimation uncertainty or are affected to a greater degree by complexity, subjectivity or other inherent risk factors. Similarly, the exercise of professional skepticism is important when there is greater susceptibility to misstatement due to management bias or other fraud risk factors insofar as they affect inherent risk (CAS 540.8).

Paragraphs A60, A95, A96, A137 and A139 are examples of paragraphs that describe ways in which the auditor can exercise professional skepticism. Paragraph A152 provides guidance on ways in which the auditor’s exercise of professional skepticism may be documented, and includes examples of specific paragraphs in this CAS for which documentation may provide evidence of the exercise of professional skepticism. (CAS 540.A11)

This CAS requires the auditor to evaluate, based on the audit procedures performed and the audit evidence obtained, whether the accounting estimates and related disclosures are reasonable in the context of the applicable financial reporting framework, or are misstated. For purposes of this CAS, reasonable in the context of the applicable financial reporting framework means that the relevant requirements of the applicable financial reporting framework have been applied appropriately, including those that address (CAS 540.9):

- The making of the accounting estimate, including the selection of the method, assumptions and data in view of the nature of the accounting estimate and the facts and circumstances of the entity;

- The selection of management’s point estimate; and

- The disclosures about the accounting estimate, including disclosures about how the accounting estimate was developed and that explain the nature, extent, and sources of estimation uncertainty.

Other considerations that may be relevant to the auditor’s consideration of whether the accounting estimates and related disclosures are reasonable in the context of the applicable financial reporting framework include whether (CAS 540.A12):

- The data and assumptions used in making the accounting estimate are consistent with each other and with those used in other accounting estimates or areas of the entity’s business activities; and

- The accounting estimate takes into account appropriate information as required by the applicable financial reporting framework.

The term “applied appropriately” as used in paragraph 9 means in a manner that not only complies with the requirements of the applicable financial reporting framework but, in doing so, reflects judgments that are consistent with the objective of the measurement basis in that framework. (CAS 540.A13)

OAG Guidance

Estimation uncertainty and inherent risk factors

Our assessment of inherent risk is based on an evaluation of the degree to which an estimate is affected by estimation uncertainty, complexity, subjectivity and other inherent risk factors and how these factors interact with each other. This will vary from estimate to estimate, and the extent of risk assessment and audit procedures we perform, and the persuasiveness of evidence to be obtained, needs to be responsive to the assessed level of inherent risk.

Estimation uncertainty is defined in CAS 540.12(c) as ‘susceptibility to an inherent lack of precision in measurement’, and it gives rise to a number of other factors that impact the risk associated with an accounting estimate. For example, the degree of estimation uncertainty may increase the need for management to exercise judgement, which itself may lead to subjectivity and opportunities for management bias.

Moreover, management’s response to estimation uncertainty is typically to develop a method or model to calculate its point estimate, and this may involve complexity in the way this model operates, in how data is identified and stratified, and in the relationships between assumptions input into the model.

Depending on the circumstances, these factors may impact the estimate in isolation or in combination with one another, and the relationships between factors and how they interact with each other may be linear or complex. Guidance on these factors, including the relationships they have with each other and with our assessment of inherent risk, can be found in OAG Audit 7073.3 in the sections Inherent Risk Factors and Our Risk Assessment Framework and Interrelationships Between Inherent Risk Factors.

Note that in addition to the inherent risk factors of estimation uncertainty, complexity, and subjectivity, which are specifically included in CAS 540, we also need to evaluate other inherent risk factors which are specifically included in CAS 315. These include inherent risk factors of change and susceptibility to bias or other fraud risk factors. For general guidance on evaluating inherent risk factors in accordance with CAS 315, refer to OAG Audit 5043.3.

Inherent risk and control risk

CAS 540 and CAS 315 require a separate assessment of inherent risk and control risk. Guidance on assessing inherent risk and control risk can be found in OAG Audit 7073.3 in the sections Assess Level of Inherent Risk and Assess Control Risk respectively.

Professional skepticism

Given the level of judgment and subjectivity that may be inherent in certain accounting estimates, and the potential for management bias and fraud, it is of particular importance that we exercise professional skepticism when auditing estimates. The importance of skepticism increases where estimates are subject to a higher degree of estimation uncertainty or the more they are impacted by inherent risk factors.

CAS 540 incorporates the need for skepticism in several areas, for example:

- In requiring the auditor to understand the nature of accounting estimates and related disclosures it expects to be included in the entity’s financial statements (CAS 540.13(d)); and

- Requiring the auditor to perform an overall evaluation of each estimate, taking into account all evidence whether corroborative or contradictory.

In addition to complying with the requirements of CAS 540, follow the guidance in OAG Audit 1041 as regards exercising professional skepticism.

CAS Guidance

Examples of accounting estimates related to classes of transactions, account balances and disclosures include (CAS 540.A1):

- Inventory obsolescence.

- Depreciation of property and equipment.

- Valuation of infrastructure assets.

- Valuation of financial instruments.

- Outcome of pending litigation.

- Provision for expected credit losses.

- Valuation of insurance contract liabilities.

- Warranty obligations.

- Employee retirement benefits liabilities.

- Share-based payments.

- Fair value of assets or liabilities acquired in a business combination, including the determination of goodwill and intangible assets.

- Impairment of long-lived assets or property or equipment held for disposal.

- Non-monetary exchanges of assets or liabilities between independent parties.

- Revenue recognized for long-term contracts.

OAG Guidance

The list of example estimates in CAS 540.A1 is not exhaustive and does not define the scope of the standard, which is introduced in CAS 540.3, and clarified above in this section.

Entity specific facts and circumstances may require that management estimate the measurement of account balances, classes of transactions or disclosures that are not included in the list above. Furthermore, the relevant financial reporting framework may also include examples of estimates or designate certain line items as estimates. For example, many entities estimate the lower of cost or net realizable value of inventories or evaluate assets for impairment using models to estimate fair value.

The section Nature of Accounting Estimates the Auditor Expects to be Included in the Financial Statements of OAG Audit 7072 provides guidance on identifying estimates we would expect to be included in the financial statements, based on our understanding of the entity and its environment. Common estimates, and their typical attributes such as methods, assumptions and data, are included in the Practice Aid–Obtaining and Documenting an Understanding of Common Accounting Estimates which facilitates obtaining and documenting an understanding of accounting estimates and other risk assessment procedures.

CAS Guidance

Financial reporting frameworks often call for neutrality, that is, freedom from bias. Estimation uncertainty gives rise to subjectivity in making an accounting estimate. The presence of subjectivity gives rise to the need for judgment by management and the susceptibility to unintentional or intentional management bias (for example, as a result of motivation to achieve a desired profit target or capital ratio). The susceptibility of an accounting estimate to management bias increases with the extent to which there is subjectivity in making the accounting estimate. (CAS 540.A17)

Management bias may be difficult to detect at an account level and may only be identified by the auditor when considering groups of accounting estimates, all accounting estimates in aggregate, or when observed over a number of accounting periods. For example, if accounting estimates included in the financial statements are considered to be individually reasonable but management’s point estimates consistently trend toward one end of the auditor’s range of reasonable outcomes that provide a more favorable financial reporting outcome for management, such circumstances may indicate possible bias by management. (CAS 540.A133)

OAG Guidance

The process of making estimates, including the selection and application of a method, assumptions and data, requires management to make judgments which may be susceptible to bias.

Accordingly, even when management’s estimation process involves competent personnel using relevant and reliable data (including, in some cases, the involvement of management’s experts), the need to make judgments and the subjectivity inherent in the estimation process may give rise to management bias, whether intentional or unintentional. It is therefore important that we adopt an attitude of professional skepticism in planning and executing risk assessment and audit procedures over accounting estimates, and in performing an overall evaluation of management’s estimates and evidence obtained.

The following are examples of opportunities during the audit process to identify susceptibility to, or indicators of, bias in management’s judgments around accounting estimates:

- In understanding relevant regulatory factors, including whether any regulatory frameworks provide an indication of areas where management might exercise bias to meet regulatory expectations (OAG Audit 7072);

- In assessing and responding to the risk of fraud, as required by CAS 240;

- When reviewing the outcome or re‑estimation of previous accounting estimates (OAG Audit 7073.1);

- When testing adjustments to the initial output of a model used to develop an accounting estimate (OAG Audit 7073.4);

- When designing and performing procedures to test management’s methods, significant assumptions and data, including considering the rationale for changes therein from prior periods (OAG Audit 7073.4, OAG Audit 7073.5 and OAG Audit 7073.6);

- When testing the appropriateness of management’s selection of assumptions where multiple alternative assumptions are available (OAG Audit 7073.5);

- When comparing our own methods, assumptions or data, used in developing an auditor’s point estimate or range, to management’s methods, assumptions or data (OAG Audit 7073.3); or

- When performing an overall evaluation of accounting estimates, based on procedures performed and audit evidence obtained (OAG Audit 7073.10).

Related Guidance

For further guidance, including examples of indicators of possible management bias, see OAG Audit 7073.9.

OAG Guidance

We audit accounting estimates and related disclosures following a standard 10 step framework (hereafter, “10 Step framework”), developed to assist engagement teams in complying with the requirements of CAS 540 while planning and executing an effective and efficient audit of accounting estimates.

10 Step framework for auditing accounting estimates

CAS 540 requires one, or a combination of, the following approaches to respond to risks of material misstatement at the assertion level (CAS 540.18):

- Obtaining audit evidence from events occurring up to the date of the auditor’s report;

- Testing how management made the accounting estimate; or

- Developing an auditor’s point estimate or range.

We apply the 10 Step framework on an estimate-by-estimate basis to any type of estimate and can apply the framework to any of the three testing approaches required by CAS 540 or any combination of these approaches.

Where we conclude that obtaining audit evidence from events occurring up to the date of the auditor’s report will provide sufficient audit evidence without the need to combine this with one of the other approaches, steps 4 to 6 of the framework will not be necessary and therefore may be bypassed. Further guidance on obtaining audit evidence from events occurring up to the date of the auditor’s report is included in the section Obtain Evidence from Events Occurring up to Date of Auditor’s Report in OAG Audit 7073.3.

Where we develop our own point estimate or range, audit procedures are required to address the appropriateness of the methods, significant assumptions and data applied in determining our point estimate or range. As such, steps 4 to 6 will be relevant although we need to adapt the steps as necessary to reflect that we are establishing our own point estimate or range. Further guidance on developing an auditor’s point estimate or range, including the application of the 10 Step framework to this testing approach, is included in the section Develop Auditor’s Point Estimate or Range in OAG Audit 7073.3.

The scalability mechanism set out in the section below is relevant when applying the 10 Step framework such that the nature, timing and extent of audit procedures performed within the 10 Step framework can be adjusted to respond to the assessed level and nature of risks of material misstatement.

CAS Guidance

Although this CAS applies to all accounting estimates, the degree to which an accounting estimate is subject to estimation uncertainty will vary substantially. The nature, timing and extent of the risk assessment and further audit procedures required by this CAS will vary in relation to the estimation uncertainty and the assessment of the related risks of material misstatement. For certain accounting estimates, estimation uncertainty may be very low, based on their nature, and the complexity and subjectivity involved in making them may also be very low. For such accounting estimates, the risk assessment procedures and further audit procedures required by this CAS would not be expected to be extensive. When estimation uncertainty, complexity or subjectivity are very high, such procedures would be expected to be much more extensive. This CAS contains guidance on how the requirements of this CAS can be scaled. (CAS 540.3).

Examples of paragraphs that include guidance on how the requirements of this CAS can be scaled include paragraphs A20–A22, A63, A67, and A84. (CAS 540.A7)

The nature, timing and extent of the auditor’s procedures to obtain the understanding of the entity and its environment, the applicable financial reporting framework, and the entity’s system of internal control, related to the entity’s accounting estimates, may depend, to a greater or lesser degree, on the extent to which the individual matter(s) apply in the circumstances. For example, the entity may have few transactions or other events or conditions that give rise to the need for accounting estimates, the applicable financial reporting requirements may be simple to apply, and there may be no relevant regulatory factors. Further, the accounting estimates may not require significant judgments, and the process for making the accounting estimates may be less complex. In these circumstances, the accounting estimates may be subject to, or affected by, estimation uncertainty, complexity, subjectivity, or other inherent risk factors to a lesser degree, and there may be fewer identified controls in the control activities component. If so, the auditor’s risk identification and assessment procedures are likely to be less extensive and may be obtained primarily through inquiries of management with appropriate responsibilities for the financial statements, such assimple walk-throughs of management’s process for making the accounting estimate (including when evaluating whether identified controls in that process are designed effectively and when determining whether the control has been implemented) (CAS 540.A20).

By contrast, the accounting estimates may require significant judgments by management, and the process for making the accounting estimates may be complex and involve the use of complex models. In addition, the entity may have a more sophisticated information system, and more extensive controls over accounting estimates. In these circumstances, the accounting estimates may be subject to or affected by estimation uncertainty, subjectivity, complexity or other inherent risk factors to a greater degree. If so, the nature or timing of the auditor’s risk assessment procedures are likely to be different, or be more extensive, than in the circumstances in paragraph A20. (CAS 540.A21)

The following considerations may be relevant for entities with only simple businesses, which may include many smaller entities: (CAS 540.A22)

- Processes relevant to accounting estimates may be uncomplicated because the business activities are simple or the required estimates may have a lesser degree of estimation uncertainty.

- Accounting estimates may be generated outside of the general and subsidiary ledgers, controls over their development may be limited, and an owner-manager may have significant influence over their determination. The owner-manager’s role in making the accounting estimates may need to be taken into account by the auditor both when identifying the risks of material misstatement and when considering the risk of management bias.

Specialized Skills or Knowledge

Many accounting estimates do not require the application of specialized skills or knowledge. For example, specialized skills or knowledge may not be needed for a simple inventory obsolescence calculation. However, for example, for expected credit losses of a banking institution or an insurance contract liability for an insurance entity, the auditor is likely to conclude that it is necessary to apply specialized skills or knowledge. (CAS 540.A63)

Inherent Risk Factors

The reasons for the auditor’s assessment of inherent risk at the assertion level may result from one or more of the inherent risk factors of estimation uncertainty, complexity, subjectivity or other inherent risk factors. For example (CAS 540.A67):

- Accounting estimates of expected credit losses are likely to be complex because the expected credit losses cannot be directly observed and may require the use of a complex model. The model may use a complex set of historical data and assumptions about future developments in a variety of entity specific scenarios that may be difficult to predict. Accounting estimates for expected credit losses are also likely to be subject to high estimation uncertainty and significant subjectivity in making judgments about future events or conditions. Similar considerations apply to insurance contract liabilities.

- An accounting estimate for an obsolescence provision for an entity with a wide range of different inventory types may require complex systems and processes, but may involve little subjectivity and the degree of estimation uncertainty may be low, depending on the nature of the inventory.

- Other accounting estimates may not be complex to make but may have high estimation uncertainty and require significant judgment, for example, an accounting estimate that requires a single critical judgment about a liability, the amount of which is contingent on the outcome of the litigation.

Further Audit Procedures

The nature, timing and extent of the auditor’s further audit procedures are affected by, for example (CAS 540.A84):

- The assessed risks of material misstatement, which affect the persuasiveness of the audit evidence needed and influence the approach the auditor selects to audit an accounting estimate. For example, the assessed risks of material misstatement relating to the existence or valuation assertions may be lower for a straightforward accrual for bonuses that are paid to employees shortly after period end. In this situation, it may be more practical for the auditor to obtain sufficient appropriate audit evidence by evaluating events occurring up to the date of the auditor’s report, rather than through other testing approaches.

- The reasons for the assessed risks of material misstatement.

OAG Guidance

CAS 540.3 acknowledges that the nature, timing and extent of risk assessment and further audit procedures will vary depending on the impact on an estimate of estimation uncertainty, complexity and subjectivity, with more extensive risk assessment and execution procedures expected if the level of inherent risk is higher.

This concept is referred to in OAG Audit as ‘scalability’ and in addition to the guidance in this section, practical examples of how the requirements of CAS 540 might be scaled up and down depending on engagement and estimate specific facts and circumstances are included throughout OAG Audit 7070.

This variability of required audit effort responsive to the degree of inherent risk factors is consistent with the inherent risk spectrum discussed in OAG Audit 5043.3, which demonstrates that the level of inherent risk and consequently required audit evidence increases as the magnitude and likelihood of potential misstatements get higher.

Further guidance on the assessment of inherent risk factors, and its impact on our assessment of the level of inherent risk, is set out in the section Inherent Risk Factors and Our Risk Assessment Framework in OAG Audit 7073.3.

Practical examples of application of the scalability principle are included in the following areas:

- OAG Audit 7073.1 - Obtaining an understanding of accounting estimates - scalability

- OAG Audit 7073.3 - Assessing inherent risk - scalability

- OAG Audit 7073.8– Responses to the assessed risks of material misstatement - scalability