Annual Audit Manual

COPYRIGHT NOTICE — This document is intended for internal use. It cannot be distributed to or reproduced by third parties without prior written permission from the Copyright Coordinator for the Office of the Auditor General of Canada. This includes email, fax, mail and hand delivery, or use of any other method of distribution or reproduction. CPA Canada Handbook sections and excerpts are reproduced herein for your non-commercial use with the permission of The Chartered Professional Accountants of Canada (“CPA Canada”). These may not be modified, copied or distributed in any form as this would infringe CPA Canada’s copyright. Reproduced, with permission, from the CPA Canada Handbook, The Chartered Professional Accountants of Canada, Toronto, Canada.

8015 Determine and communicate key audit matters

Dec-2023

In This Section

Matters that required significant auditor attention

Areas of higher assessed risk of material misstatement, or significant risks

Significant events or transactions that occurred during the period

Communicating key audit matters

Key audit matters not communicated in the auditor’s report

No key audit matters determined

CAS Requirement

For purposes of the CASs, the following term has the meaning attributed below:

Key audit matters—Those matters that, in the auditor’s professional judgment, were of most significance in the audit of the financial statements of the current period. Key audit matters are selected from matters communicated with those charged with governance (CAS 701.8)

The purpose of communicating key audit matters is to enhance the communicative value of the auditor’s report by providing greater transparency about the audit that was performed. Communicating key audit matters provides additional information to intended users of the financial statements (“intended users”) to assist them in understanding those matters that, in the auditor’s professional judgment, were of most significance in the audit of the financial statements of the current period. Communicating key audit matters may also assist intended users in understanding the entity and areas of significant management judgment in the audited financial statements (CAS 701.2).

The communication of key audit matters in the auditor’s report may also provide intended users a basis to further engage with management and those charged with governance about certain matters relating to the entity, the audited financial statements, or the audit that was performed (CAS 701.3).

Communicating key audit matters in the auditor’s report is in the context of the auditor having formed an opinion on the financial statements as a whole. Communicating key audit matters in the auditor’s report is not (CAS 701.4):

(a) A substitute for disclosures in the financial statements that the applicable financial reporting framework requires management to make, or that are otherwise necessary to achieve fair presentation;

(b) A substitute for the auditor expressing a modified opinion when required by the circumstances of a specific audit engagement in accordance with CAS 705;

(c) A substitute for reporting in accordance with CAS 570 2 when a material uncertainty exists relating to events or conditions that may cast significant doubt on an entity’s ability to continue as a going concern; or

(d) A separate opinion on individual matters.

This CAS applies to audits of complete sets of general purpose financial statements of listed entities, excluding listed entities required to comply with National Instrument 81‑106, Investment Fund Continuous Disclosure. This CAS also applies when the auditor decides to communicate key audit matters in the auditor’s report or when the auditor is required by law or regulation to communicate key audit matters in the auditor’s report. However, CAS 705 prohibits the auditor from communicating key audit matters when the auditor disclaims an opinion on the financial statements, unless such reporting is required by law or regulation. [In ISA 701, the first sentence states: This ISA applies to audits of complete sets of general purpose financial statements of listed entities and circumstances when the auditor otherwise decides to communicate key audit matters in the auditor’s report.] (CAS 701.C5)

CAS Guidance

Significance can be described as the relative importance of a matter, taken in context. The significance of a matter is judged by the auditor in the context in which it is being considered. Significance can be considered in the context of quantitative and qualitative factors, such as relative magnitude, the nature and effect on the subject matter and the expressed interests of intended users or recipients. This involves an objective analysis of the facts and circumstances, including the nature and extent of communication with those charged with governance (CAS 701.A1).

Users of financial statements have expressed an interest in those matters about which the auditor had the most robust dialogue with those charged with governance as part of the two‑way communication required by CAS 260 and have called for additional transparency about those communications. For example, users have expressed particular interest in understanding significant judgments made by the auditor in forming the opinion on the financial statements as a whole, because they are often related to the areas of significant management judgment in preparing the financial statements (CAS 701.A2).

Requiring auditors to communicate key audit matters in the auditor’s report may also enhance communications between the auditor and those charged with governance about those matters, and may increase attention by management and those charged with governance to the disclosures in the financial statements to which reference is made in the auditor’s report (CAS 701.A3).

CAS 320 explains that it is reasonable for the auditor to assume that users of the financial statements (CAS 701.A4):

(a) Have a reasonable knowledge of business and economic activities and accounting and a willingness to study the information in the financial statements with reasonable diligence;

(b) Understand that the financial statements are prepared, presented and audited to levels of materiality;

(c) Recognize the uncertainties inherent in the measurement of amounts based on the use of estimates, judgment and the consideration of future events; and

(d) Make reasonable economic decisions on the basis of the information in the financial statements.

Because the auditor’s report accompanies the audited financial statements, the users of the auditor’s report are considered to be the same as the intended users of the financial statements.

OAG Guidance

Introduction

Through the descriptions of key audit matters (KAMs), including how we addressed them in the audit, we have an opportunity to provide insight into those matters that, in our judgment, were of most significance in the audit of the financial statements of the current period. Our descriptions can demonstrate more visibly that we have taken a risk based approach to our audit of the entity’s financial statements. They can also assist users in obtaining a better understanding of areas of significant management judgment in the audited financial statements and, through our descriptions of how the KAMs were addressed in our audits, explain how we exercised professional skepticism and obtained audit evidence in those areas.

New auditor reporting standards—Scope of applicability

The new auditor reporting standards, including CAS 701, are effective for audits of financial statements for periods ending on or after 15 December 2018 (e.g., audit reports issued for calendar 2018 year end audits).

KAMs are required to be included in the audit reports when the auditor is required by law or regulation to communicate them in the auditor’s report, but KAMs may also be included in audit reports for other entities in circumstances when the auditor decides to communicate them in the auditor’s report. This guidance applies to those audits meeting the application requirements of CAS 701.

Voluntary application

The CASs permit us to include KAMs in audit reports on other audit engagements, for example in the audit of an entity where KAMs is not required by law or regulation or in the audit of special purpose financial statements. If asked by an entity to include KAMs in such an engagement, consultation with Audit Services is required. If we accept such an engagement, this section of OAG Audit applies.

Practical suggestions on communications

The determination of KAMs occurs throughout the audit process, concluding at the completion stage of the audit when we consider all audit evidence obtained. However, we consider and communicate to management of the entity and those charged with governance potential KAMs as part of planning the audit. Timely communication of KAMs allows us to have robust and timely two‑way communication with management and those charged with governance. This would provide them enough time to consider and provide feedback about our determined KAMs, to review drafts of how we intend to communicate them in our audit report, and to consider their own disclosures. Note that it is our responsibility to appropriately describe the KAMs in our audit report, but we may communicate with management and those charged with governance to understand their views on the matters and determine that we obtained all relevant information from them, as appropriate. OAG Audit 2210 provides guidance on audit communications at various stages of the audit.

This section provides guidance on determining the KAMs to include in our auditor’s report.

Other voluntary disclosures

We may be permitted or required to disclose in our audit report matters relating to our audit approach (e.g., audit scope and materiality in the context of communicating key audit matters).

CAS Requirement

The auditor shall determine, from the matters communicated with those charged with governance, those matters that required significant auditor attention in performing the audit. In making this determination, the auditor shall take into account the following (CAS 701.9):

(a) Areas of higher assessed risk of material misstatement, or significant risks identified in accordance with CAS 315.

(b) Significant auditor judgments relating to areas in the financial statements that involved significant management judgment, including accounting estimates that are subject to a high degree of estimation uncertainty.

(c) The effect on the audit of significant events or transactions that occurred during the period.

The auditor shall determine which of the matters determined in accordance with paragraph 9 were of most significance in the audit of the financial statements of the current period and therefore are the key audit matters (CAS 701.10).

CAS Guidance

The auditor’s decision making process in determining key audit matters is designed to select a smaller number of matters from the matters communicated with those charged with governance, based on the auditor’s judgment about which matters were of most significance in the audit of the financial statements of the current period (CAS 701.A9).

The auditor’s determination of key audit matters is limited to those matters of most significance in the audit of the financial statements of the current period, even when comparative financial statements are presented (i.e., even when the auditor’s opinion refers to each period for which financial statements are presented) (CAS 701.A10).

Notwithstanding that the auditor’s determination of key audit matters is for the audit of the financial statements of the current period and this CAS does not require the auditor to update key audit matters included in the prior period’s auditor’s report, it may nevertheless be useful for the auditor to consider whether a matter that was a key audit matter in the audit of the financial statements of the prior period continues to be a key audit matter in the audit of the financial statements of the current period (CAS 701.A11).

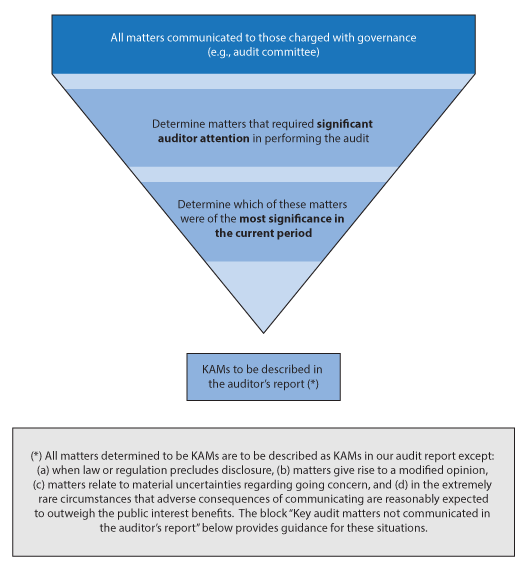

OAG Guidance

The following chart illustrates our decision process in determining key audit matters (KAMs):

The population of items to be considered as potential KAMs starts from matters communicated to those charged with governance. We need to consider all written and oral communications made to those charged with governance in accordance with CAS 260. Refer to OAG Audit 2210 for the items we are required to communicate to those charged with governance.

We may communicate with those charged with governance during each phase of the audit, and we consider all of these communications when determining which KAMs we will report:

-

Planning phase—at the planning stage of the engagement, items communicated would normally include items such as significant risks or other higher risk areas and the planned timing and scope of the audit procedures to be performed.

-

Execution phase—As we obtain audit evidence throughout the audit, certain matters may result in additional communications to those charged with governance.

-

Completion phase—We communicate to those charged with governance our final views and conclusions resulting from the audit.

It is at the completion stage when we make the final determination of items to communicate as KAMs. Due to the judgment needed to determine KAMs, it is generally expected that senior members of the engagement team (including engagement leader and quality reviewer where appropriate) will be involved in this process.

CAS Requirement

The auditor shall determine, from the matters communicated with those charged with governance, those matters that required significant auditor attention in performing the audit. In making this determination, the auditor shall take into account the following (CAS 701.9):

(a) Areas of higher assessed risk of material misstatement, or significant risks identified in accordance with CAS 315.

(b) Significant auditor judgments relating to areas in the financial statements that involved significant management judgment, including accounting estimates that are subject to a high degree of estimation uncertainty.

(c) The effect on the audit of significant events or transactions that occurred during the period.

The auditor shall determine which of the matters determined in accordance with paragraph 9 were of most significance in the audit of the financial statements of the current period and therefore are the key audit matters (CAS 701.10).

CAS Guidance

The concept of significant auditor attention recognizes that an audit is risk‑based and focuses on identifying and assessing the risks of material misstatement of the financial statements, designing and performing audit procedures responsive to those risks, and obtaining audit evidence that is sufficient and appropriate to provide a basis for the auditor’s opinion. For a particular account balance, class of transactions or disclosure, the higher an assessed risk of material misstatement at the assertion level, the more judgment is often involved in planning and performing the audit procedures and evaluating the results thereof. In designing further audit procedures, the auditor is required to obtain more persuasive audit evidence the higher the auditor’s assessment of risk. When obtaining more persuasive audit evidence because of a higher assessment of risk, the auditor may increase the quantity of the evidence, or obtain evidence that is more relevant or reliable, for example, by placing more emphasis on obtaining third party evidence or by obtaining corroborating evidence from a number of independent sources (CAS 701.A12).

Accordingly, matters that pose challenges to the auditor in obtaining sufficient appropriate audit evidence or pose challenges to the auditor in forming an opinion on the financial statements may be particularly relevant in the auditor’s determination of key audit matters (CAS 701.A13).

Areas of significant auditor attention often relate to areas of complexity and significant management judgment in the financial statements, and therefore often involve difficult or complex auditor judgments. In turn, this often affects the auditor’s overall audit strategy, the allocation of resources and extent of audit effort in relation to such matters. These effects may include, for example, the extent of involvement of senior personnel on the audit engagement or the involvement of an auditor’s expert or individuals with expertise in a specialized area of accounting or auditing, whether engaged or employed by the firm to address these areas (CAS 701.A14).

Various CASs require specific communications with those charged with governance and others that may relate to areas of significant auditor attention. For example (CAS 701.A15):

-

CAS 260 requires the auditor to communicate significant difficulties, if any, encountered during the audit with those charged with governance. The CASs acknowledge potential difficulties in relation to, for example:

-

Related party transactions, in particular limitations on the auditor’s ability to obtain audit evidence that all other aspects of a related party transaction (other than price) are equivalent to those of a similar arm’s length transaction.

-

Limitations on the group audit, for example, where access to information or people may have been restricted.

-

-

CAS 220 establishes requirements for the engagement partner in relation to undertaking appropriate consultation on difficult or contentious matters, matters on which the firm's policies or procedures require consultation, and other matters that in the engagement partner's professional judgment, require consultation. For example, the auditor may have consulted with others within the firm or outside the firm on a significant technical matter, which may be an indicator that it is a key audit matter. The engagement partner is also required to discuss, among other things, significant matters and significant judgments arising during the audit engagement with the engagement quality reviewer.

Considerations in Determining Those Matters that Required Significant Auditor Attention

The auditor may develop a preliminary view at the planning stage about matters that are likely to be areas of significant auditor attention in the audit and therefore may be key audit matters. The auditor may communicate this with those charged with governance when discussing the planned scope and timing of the audit in accordance with CAS 260. However, the auditor’s determination of key audit matters is based on the results of the audit or evidence obtained throughout the audit (CAS 701.A16).

Paragraph 9 includes specific required considerations in the auditor’s determination of those matters that required significant auditor attention. These considerations focus on the nature of matters communicated with those charged with governance that are often linked to matters disclosed in the financial statements, and are intended to reflect areas of the audit of the financial statements that may be of particular interest to intended users. The fact that these considerations are required is not intended to imply that matters related to them are always key audit matters; rather, matters related to such specific considerations are key audit matters only if they are determined to be of most significance in the audit in accordance with paragraph. As the considerations may be interrelated (e.g., matters relating to the circumstances described in paragraphs 9(b)‑(c) may also be identified as significant risks), the applicability of more than one of the considerations to a particular matter communicated with those charged with governance may increase the likelihood of the auditor identifying that matter as a key audit matter (CAS 701.A17).

In addition to matters that relate to the specific required considerations in paragraph 9, there may be other matters communicated with those charged with governance that required significant auditor attention and that therefore may be determined to be key audit matters in accordance with paragraph 10. Such matters may include, for example, matters relevant to the audit that was performed that may not be required to be disclosed in the financial statements. For example, the implementation of a new IT system (or significant changes to an existing IT system) during the period may be an area of significant auditor attention, in particular if such a change had a significant effect on the auditor’s overall audit strategy or related to a significant risk (e.g., changes to a system affecting revenue recognition) (CAS 701.A18).

OAG Guidance

From the matters we communicated to those charged with governance, we use our judgment to identify those that required significant auditor attention in performing the current period’s audit.

The concept of significant auditor attention recognizes that audits are risk‑based and that our audit procedures are designed to be responsive to identified and assessed risks of material misstatement. Matters that require significant auditor attention will be areas of significant risks or other higher risks (e.g., elevated risks) that involved more judgment in planning and performing audit procedures and evaluating the results, areas where we had challenges in obtaining sufficient appropriate audit evidence or in forming our opinion, areas that involved significant management judgment, or other significant events or transactions during the period that impacted the audit. While the matters we determine to require significant auditor attention will often include areas we assessed as significant risks, they are not restricted to being significant risks and can include other areas of higher risk (e.g., elevated risks). More often than not they will relate to those areas in the financial statements that are complex and involved significant management judgment.

The concept of significant auditor attention is not intended to be measured solely based on level of audit effort. The following considerations may be indicative of the level of complexity and judgment involved, and useful to consider when assessing the audit attention given to an audit matter:

a) Allocation of audit resources

The allocation of staff to various areas of the audit may give an indication of the audit effort and attention given to an audit area. For example, the hours of involvement by senior members of the engagement team can provide an indication where significant audit judgment is exercised.

b) Changes in planned audit approach

There may be cases where we change our initially‑planned audit approach that necessitated significant auditor attention. Examples of such situations may include:

-

A new significant risk is identified causing us to significantly change the approach to testing

-

We initially intended to rely on controls but identified control deficiencies resulted in changes to the audit strategy and plan.

-

Audit evidence obtained resulted in us deciding to obtain more corroborative audit information.

c) Accounting estimates

Accounting estimates with high estimation uncertainty may indicate significant auditor attention. Refer to the block below Significant judgments and CAS 701.A23–A24 for guidance.

d) Use of experts and specialists

Involvement of experts and specialists may indicate significant auditor attention.

e) New/Revised accounting policies

The adoption of new accounting policies or revisions to existing accounting policies of the entity may result in significant auditor attention due to the judgment necessary to assess the reasonableness of these policies and their application in the financial statements. We consider these accounting policies in light of the risk and materiality of the transactions being accounted for.

f) Identified misstatements

Areas where misstatements were identified may indicate significant auditor attention.

g) Group audit considerations

The group engagement team identifies areas requiring significant auditor attention in the context of the group audit as a whole. The audit work for areas identified as requiring significant auditor attention may be performed by a component engagement team.

h) Initial audit engagements

Auditing opening balances in an initial audit may involve significant auditor attention. For an initial audit engagement where we are the incoming auditor, the objective of these audit procedures is to obtain evidence regarding:

- Whether the opening balances contain material misstatements which may affect the current period’s financial statements,

- Whether the comparative information has been presented, in all material respects, in accordance with the applicable financial reporting framework.

With this in mind, if a matter relating to comparative information was an area involving significant auditor attention in obtaining sufficient appropriate audit evidence in order to be able to form an opinion on the financial statements of the current period, it could be considered to be a key audit matter. This may be the case both when the prior period financial statements were audited by a predecessor auditor, and when financial statements for the prior period were not audited.

Refer to OAG Audit 3050 for guidance on initial audit engagements. For guidance on other areas that may require significant auditor attention, refer to the block below Significant judgments and the block Significant events or transactions that occurred during the period.

CAS Requirement

The auditor shall determine, from the matters communicated with those charged with governance, those matters that required significant auditor attention in performing the audit. In making this determination, the auditor shall take into account the following (CAS 701.9):

(a) Areas of higher assessed risk of material misstatement, or significant risks identified in accordance with CAS 315.

CAS Guidance

CAS 260 requires the auditor to communicate with those charged with governance about the significant risks identified by the auditor. Paragraph A13 of CAS 260 explains that the auditor may also communicate with those charged with governance about how the auditor plans to address areas of higher assessed risks of higher assessed risks of material misstatement (CAS 701.A19).

CAS 315 defines a significant risk as an identified risk of material misstatement for which the assessment of inherent risk is close to the upper end of the spectrum of inherent risk due to the degree to which the inherent risk factors affect the combination of the likelihood of a misstatement occurring and the magnitude of the potential misstatement should that misstatement occur. Areas of significant management judgment and significant unusual transactions may often be identified as significant risks. Significant risks are therefore often areas that require significant auditor attention (CAS 701.A20).

However, this may not be the case for all significant risks. For example, CAS 240 presumes that there are risks of fraud in revenue recognition and requires the auditor to treat those assessed risks of material misstatement due to fraud as significant risks. In addition, CAS 240 indicates that, due to the unpredictable way in which management override of controls could occur, it is a risk of material misstatement due to fraud and thus a significant risk. Depending on their nature, these risks may not require significant auditor attention, and therefore would not be considered in the auditor’s determination of key audit matters in accordance with paragraph 10 (CAS 701.A21).

CAS 315 explains that the auditor’s assessment of the risks of material misstatement at the assertion level may change during the course of the audit as additional audit evidence is obtained. Revision to the auditor’s risk assessment and reevaluation of the planned audit procedures with respect to a particular area of the financial statements (i.e., a significant change in the audit approach, for example, if the auditor’s risk assessment was based on an expectation that certain controls were operating effectively and the auditor has obtained audit evidence that they were not operating effectively throughout the audit period, particularly in an area with higher assessed risk of material misstatement) may result in an area being determined as one requiring significant auditor attention (CAS 701.A22).

OAG Guidance

Risk of management override of controls and, normally, risk of fraud in revenue recognition are considered significant risks and communicated to those charged with governance. However, we use judgment to determine whether these significant risks are risks that involved significant auditor attention in performing the audit and whether they are of the most significance in the current period, and therefore communicated as key audit matters (KAMs).

CAS Requirement

The auditor shall determine, from the matters communicated with those charged with governance, those matters that required significant auditor attention in performing the audit. In making this determination, the auditor shall take into account the following (CAS 701.9):

(b) Significant auditor judgments relating to areas in the financial statements that involved significant management judgment, including accounting estimates that are subject to a high degree of estimation uncertainty.

CAS Guidance

CAS 260 requires the auditor to communicate with those charged with governance the auditor’s views about significant qualitative aspects of the entity’s accounting practices, including accounting policies, accounting estimates and financial statement disclosures. In many cases, this relates to critical accounting estimates and related disclosures, which are likely to be areas of significant auditor attention, and also may be identified as significant risks (CAS 701.A23).

However, users of the financial statements have highlighted their interest in accounting estimates that are subject to a high degree of estimation uncertainty (see CAS 540) that may have not been determined to be significant risks. Among other things, such estimates are highly dependent on management judgment and are often the most complex areas of the financial statements, and may require the involvement of both a management’s expert and an auditor’s expert. Users have also highlighted that accounting policies that have a significant effect on the financial statements (and significant changes to those policies) are relevant to their understanding of the financial statements, especially in circumstances where an entity’s practices are not consistent with others in its industry (CAS 701.A24).

CAS Requirement

The auditor shall determine, from the matters communicated with those charged with governance, those matters that required significant auditor attention in performing the audit. In making this determination, the auditor shall take into account the following (CAS 701.9):

(c) The effect on the audit of significant events or transactions that occurred during the period.

CAS Guidance

Events or transactions that had a significant effect on the financial statements or the audit may be areas of significant auditor attention and may be identified as significant risks. For example, the auditor may have had extensive discussions with management and those charged with governance at various stages throughout the audit about the effect on the financial statements of significant transactions with related parties or significant transactions that are outside the normal course of business for the entity or that otherwise appear to be unusual. Management may have made difficult or complex judgments in relation to recognition, measurement, presentation or disclosure of such transactions, which may have had a significant effect on the auditor’s overall strategy (CAS 701.A25).

Significant economic, accounting, regulatory, industry, or other developments that affected management’s assumptions or judgments may also affect the auditor’s overall approach to the audit and result in a matter requiring significant auditor attention (CAS 701.A26).

CAS Requirement

The auditor shall determine which of the matters determined in accordance with paragraph 9 were of most significance in the audit of the financial statements of the current period and therefore are the key audit matters (CAS 701.10).

CAS Guidance

Matters that required significant auditor attention also may have resulted in significant interaction with those charged with governance. The nature and extent of communication about such matters with those charged with governance often provides an indication of which matters are of most significance in the audit. For example, the auditor may have had more in depth, frequent or robust interactions with those charged with governance on more difficult and complex matters, such as the application of significant accounting policies that were the subject of significant auditor or management judgment (CAS 701.A27).

The concept of matters of most significance is applicable in the context of the entity and the audit that was performed. As such, the auditor’s determination and communication of key audit matters is intended to identify matters specific to the audit and to involve making a judgment about their importance relative to other matters in the audit (CAS 701.A28).

Other considerations that may be relevant to determining the relative significance of a matter communicated with those charged with governance and whether such a matter is a key audit matter include (CAS 701.A29):

-

The importance of the matter to intended users’ understanding of the financial statements as a whole, in particular, its materiality to the financial statements.

-

The nature of the underlying accounting policy relating to the matter or the complexity or subjectivity involved in management’s selection of an appropriate policy compared to other entities within its industry.

-

The nature and materiality, quantitatively or qualitatively, of corrected and accumulated uncorrected misstatements due to fraud or error related to the matter, if any.

-

The nature and extent of audit effort needed to address the matter, including:

-

The extent of specialized skill or knowledge needed to apply audit procedures to address the matter or evaluate the results of those procedures, if any.

-

The nature of consultations outside the engagement team regarding the matter.

-

-

The nature and severity of difficulties in applying audit procedures, evaluating the results of those procedures, and obtaining relevant and reliable evidence on which to base the auditor’s opinion, in particular as the auditor’s judgments become more subjective.

-

The severity of any control deficiencies identified relevant to the matter.

-

Whether the matter involved a number of separate, but related, auditing considerations. For example, long‑term contracts may involve significant auditor attention with respect to revenue recognition, litigation or other contingencies, and may have an effect on other accounting estimates.

Determining which, and how many, of those matters that required significant auditor attention were of most significance in the audit of the financial statements of the current period is a matter of professional judgment. The number of key audit matters to be included in the auditor’s report may be affected by the size and complexity of the entity, the nature of its business and environment, and the facts and circumstances of the audit engagement. In general, the greater the number of matters initially determined to be key audit matters, the more the auditor may need to reconsider whether each of these matters meets the definition of a key audit matter. Lengthy lists of key audit matters may be contrary to the notion of such matters being those of most significance in the audit (CAS 701.A30).

OAG Guidance

Once the matters that were or will be communicated to those charged with governance have been identified and assessed to determine which required significant auditor attention, we determine which of those matters were of most significance in the audit of the financial statements of the current period and therefore will be communicated as key audit matters (KAMs).

Our decision making process in determining KAMs is designed to select a smaller number of matters from the matters communicated with those charged with governance to be communicated in the auditor’s report, limited to those matters of most significance in the audit of the financial statements of the current period.

In assessing whether the matter was considered to be one of most significance in the current period, the specific circumstances of the entity and our audit are considered. These circumstances could include circumstances of the industry or the underlying complexity in financial reporting. Other examples of circumstances mentioned in CAS 701 include:

-

Economic conditions that affected the auditor’s ability to obtain audit evidence, for example illiquid markets for certain financial instruments.

-

New or emerging accounting policies, for example entity specific or industry specific matters on which the engagement team consulted others.

-

Changes in the entity’s strategy or business model that had a material effect on the financial statements.

-

Identified misstatements related to the matter

CAS Requirement

The auditor shall describe each key audit matter, using an appropriate subheading, in a separate section of the auditor’s report under the heading “Key Audit Matters,” unless the circumstances in paragraphs 14 or 15 apply. The introductory language in this section of the auditor’s report shall state that (CAS 701.11):

(a) Key audit matters are those matters that, in the auditor’s professional judgment, were of most significance in the audit of the financial statements [of the current period]; and

(b) These matters were addressed in the context of the audit of the financial statements as a whole, and in forming the auditor’s opinion thereon, and the auditor does not provide a separate opinion on these matters.

Key Audit Matters Not a Substitute for Expressing a Modified Opinion

The auditor shall not communicate a matter in the Key Audit Matters section of the auditor’s report when the auditor would be required to modify the opinion in accordance with CAS 705 as a result of the matter (CAS 701.12).

Descriptions of Individual Key Audit Matters

The description of each key audit matter in the Key Audit Matters section of the auditor’s report shall include a reference to the related disclosure(s), if any, in the financial statements and shall address (CAS 701.13):

(a) Why the matter was considered to be one of most significance in the audit and therefore determined to be a key audit matter; and

(b) How the matter was addressed in the audit.

Circumstances in Which a Matter Determined to Be a Key Audit Matter Is Not Communicated in the Auditor’s Report

The auditor shall describe each key audit matter in the auditor’s report unless (CAS 701.14):

(a) Law or regulation precludes public disclosure about the matter; or

(b) In extremely rare circumstances, the auditor determines that the matter should not be communicated in the auditor’s report because the adverse consequences of doing so would reasonably be expected to outweigh the public interest benefits of such communication. This shall not apply if the entity has publicly disclosed information about the matter.

Interaction between Descriptions of Key Audit Matters and Other Elements Required to Be Included in the Auditor’s Report

A matter giving rise to a modified opinion in accordance with CAS 705, or a material uncertainty related to events or conditions that may cast significant doubt on the entity’s ability to continue as a going concern in accordance with CAS 570, are by their nature key audit matters. However, in such circumstances, these matters shall not be described in the Key Audit Matters section of the auditor’s report and the requirements in paragraphs 13‑14 do not apply. Rather, the auditor shall (CAS 701.15):

(a) Report on these matter(s) in accordance with the applicable CAS(s); and

(b) Include a reference to the Basis for Qualified (Adverse) Opinion or the Material Uncertainty Related to Going Concern section(s) in the Key Audit Matters section.

Form and Content of the Key Audit Matters Section in Other Circumstances

If the auditor determines, depending on the facts and circumstances of the entity and the audit, that there are no key audit matters to communicate or that the only key audit matters communicated are those matters addressed by paragraph 15, the auditor shall include a statement to this effect in a separate section of the auditor’s report under the heading “Key Audit Matters.” (CAS 701.16)

OAG Policy

Consult Audit Services and Legal Services if the audit team intends to report a key audit matter that will not be publicly disclosed by either management or those charged with governance. [Jun‑2020]

OAG Guidance

Our reports are expected to include both a description of the matter, including, whenever possible, a cross reference to the related financial statement line items, disclosures or transaction being described, and a description of how we addressed the KAM in our audit.

We aim to make our audit report informative, insightful and tailored to the circumstances. The level of detail in describing an individual KAM is a matter of professional judgment. A good description will provide a fairly succinct and balanced explanation but also one that enables readers to understand why the matter was one of most significance in the audit and tailored to the specific circumstances of the audit and the entity.

When we intend to report a KAM that will not be publicly disclosed by either management or those charged with governance, consultation is required as per the above OAG Policy.

Disclaimer of Opinion

CAS 705 prohibits us from communicating KAMs when we disclaim an opinion on the financial statements, unless such reporting is required by law or regulation.

CAS Requirement

The auditor shall describe each key audit matter in the auditor’s report unless (CAS 701.14):

(a) Law or regulation precludes public disclosure about the matter; or

(b) In extremely rare circumstances, the auditor determines that the matter should not be communicated in the auditor’s report because the adverse consequences of doing so would reasonably be expected to outweigh the public interest benefits of such communication. This shall not apply if the entity has publicly disclosed information about the matter.

CAS Guidance

Law or regulation may preclude public disclosure by either management or the auditor about a specific matter determined to be a key audit matter. For example, law or regulation may specifically prohibit any public communication that might prejudice an investigation by an appropriate authority into an actual, or suspected, illegal act (e.g., matters that are or appear to be related to money laundering) (CAS 701.A52).

As indicated by paragraph 14(b), it will be extremely rare for a matter determined to be a key audit matter not to be communicated in the auditor’s report. This is because there is presumed to be a public interest benefit in providing greater transparency about the audit for intended users. Accordingly, the judgment not to communicate a key audit matter is appropriate only in cases when the adverse consequences to the entity or the public as a result of such communication are viewed as so significant that they would reasonably be expected to outweigh the public interest benefits of communicating about the matter (CAS 701.A53).

The determination not to communicate a key audit matter takes into account the facts and circumstances related to the matter. Communication with management and those charged with governance helps the auditor understand management’s views about the significance of the adverse consequences that may arise as a result of communicating about a matter. In particular, communication with management and those charged with governance helps to inform the auditor’s judgment in determining whether to communicate the matter by (CAS 701.A54):

-

Assisting the auditor in understanding why the matter has not been publicly disclosed by the entity (e.g., if law, regulation or certain financial reporting frameworks permit delayed disclosure or non disclosure of the matter) and management’s views as to the adverse consequences, if any, of disclosure. Management may draw attention to certain aspects in law or regulation or other authoritative sources that may be relevant to the consideration of adverse consequences (e.g., such aspects may include harm to the entity’s commercial negotiations or competitive position). However, management’s views about the adverse consequences alone do not alleviate the need for the auditor to determine whether the adverse consequences would reasonably be expected to outweigh the public interest benefits of communication in accordance with paragraph 14(b).

-

Highlighting whether there have been any communications with applicable regulatory, enforcement or supervisory authorities in relation to the matter, in particular whether such discussions would appear to support management’s assertion as to why public disclosure about the matter is not appropriate.

-

Enabling the auditor, where appropriate, to encourage management and those charged with governance to make public disclosure of relevant information about the matter. In particular, this may be possible if the concerns of management and those charged with governance about communicating are limited to specific aspects relating to the matter, such that certain information about the matter may be less sensitive and could be communicated.

The auditor also may consider it necessary to obtain a written representation from management as to why public disclosure about the matter is not appropriate, including management’s view about the significance of the adverse consequences that may arise as a result of such communication.

It may also be necessary for the auditor to consider the implications of communicating about a matter determined to be a key audit matter in light of relevant ethical requirements. In addition, the auditor may be required by law or regulation to communicate with applicable regulatory, enforcement or supervisory authorities in relation to the matter, regardless of whether the matter is communicated in the auditor’s report. Such communication may also be useful to inform the auditor’s consideration of the adverse consequences that may arise from communicating about the matter (CAS 701.A55).

The issues considered by the auditor regarding a decision to not communicate a matter are complex and involve significant auditor judgment. Accordingly, the auditor may consider it appropriate to obtain legal advice (CAS 701.A56).

OAG Policy

Consult Audit Services and Legal Services if the audit team does not intend to report a key audit matter because the audit team has determined the adverse consequences are reasonably expected to outweigh the public interest benefits or when law or regulation precludes disclosure of a key audit matter. [Jun‑2020]

OAG Guidance

Once key audit matters (KAMs) have been determined, we communicate them in the audit report, except in extremely rare circumstances. Refer to the block above Key audit matters for guidance on determining KAMs.

In the extremely rare circumstances that we conclude we do not intend to report an identified KAM, consultation is required by the above OAG policy.

In making a determination not to report an identified KAM, it is important for us to document our discussions with management and those charged with governance and demonstrate why we believe disclosure of the KAM would result in adverse consequences to the entity that outweigh the public interest benefits served by reporting the matter. We use professional judgment to make this determination. Refer to the above OAG Policy requiring consultation. In addition, we may consider it necessary to obtain a written representation from management indicating that they believe we should not disclose the matter and why. Refer to OAG Audit 9050.

If the entity has publicly disclosed information about the matter, whether in the financial statements or elsewhere (e.g., in the annual report, press releases etc.; see CAS 701.A35), it would not be appropriate for us to conclude that there would be adverse consequences of disclosing the matter in our report. Furthermore, the judgment regarding adverse consequences needs to take into account more than management’s views. We need to independently conclude that the adverse consequences would reasonably be expected to outweigh the public interest benefits.

It may be possible to describe relevant aspects of the matter in a way that avoids disclosure that could lead to adverse consequences.

As per CAS 200, compliance with the CAS is not intended to override laws and regulations that govern an audit of financial statements. Consult with Audit Services and Legal Services in accordance with the above policy when law or regulation precludes disclosure of a key audit matter.

CAS Requirement

If the auditor determines, depending on the facts and circumstances of the entity and the audit, that there are no key audit matters to communicate or that the only key audit matters communicated are those matters addressed by paragraph 15, the auditor shall include a statement to this effect in a separate section of the auditor’s report under the heading “Key Audit Matters.” (CAS 701.16)

CAS Guidance

The determination of key audit matters involves making a judgment about the relative importance of matters that required significant auditor attention. Therefore, it may be rare that the auditor of a complete set of general purpose financial statements communicating in accordance with CAS 701 would not determine at least one key audit matter from the matters communicated with those charged with governance to be communicated in the auditor’s report. However, in certain limited circumstances (e.g., for a listed entity that has very limited operations), the auditor may determine that there are no key audit matters in accordance with paragraph 10 because there are no matters that required significant auditor attention. [In ISA 701, the second sentence states: Therefore, it may be rare that the auditor of a complete set of general purpose financial statements of a listed entity would not determine at least one key audit matter from the matters communicated with those charged with governance to be communicated in the auditor’s report.] (CAS 701.CA59)

OAG Guidance

It will be rare that the auditor of a complete set of general purpose financial statements communicating in accordance with CAS 701 would not determine at least one key audit matters from the matters communicated with those charged with governance to be communicated in the auditor’s report. Therefore, ordinarily, we would expect that there will be key audit matters (KAMs) to report in the Key Audit Matters section of the auditor’s report.

However, there may be some limited circumstances where the conclusion is reached that there are no KAMs. This may, for example, be the case for an entity that is dormant, has virtually no assets, liabilities or equity but is still a listed entity. In these limited circumstances, the communication with those charged with governance includes a description of why we have determined there are no KAMs.

If an audit of an entity where CAS 701 is applied resulted in a determination that there are no KAMs to be communicated, consider consulting with Audit Services.

CAS Requirement

The auditor shall communicate with those charged with governance (CAS 701.17):

(a) Those matters the auditor has determined to be the key audit matters; or

(b) If applicable, depending on the facts and circumstances of the entity and the audit, the auditor’s determination that there are no key audit matters to communicate in the auditor’s report.

CAS Guidance

CAS 260 requires the auditor to communicate with those charged with governance on a timely basis. The appropriate timing for communications about key audit matters will vary with the circumstances of the engagement. However, the auditor may communicate preliminary views about key audit matters when discussing the planned scope and timing of the audit, and may further discuss such matters when communicating about audit findings. Doing so may help to alleviate the practical challenges of attempting to have a robust two-way dialogue about key audit matters at the time the financial statements are being finalized for issuance (CAS 701.A60).

Communication with those charged with governance enables them to be made aware of the key audit matters that the auditor intends to communicate in the auditor’s report, and provides them with an opportunity to obtain further clarification where necessary. The auditor may consider it useful to provide those charged with governance with a draft of the auditor’s report to facilitate this discussion. Communication with those charged with governance recognizes their important role in overseeing the financial reporting process, and provides the opportunity for those charged with governance to understand the basis for the auditor’s decisions in relation to key audit matters and how these matters will be described in the auditor’s report. It also enables those charged with governance to consider whether new or enhanced disclosures may be useful in light of the fact that these matters will be communicated in the auditor’s report (CAS 701.A61).

The communication with those charged with governance required by paragraph 17(a) also addresses the extremely rare circumstances in which a matter determined to be a key audit matter is not communicated in the auditor’s report (see paragraphs 14 and A54) (CAS 701.A62).

The requirement in paragraph 17(b) to communicate with those charged with governance when the auditor has determined there are no key audit matters to communicate in the auditor’s report may provide an opportunity for the auditor to have further discussion with others who are familiar with the audit and the significant matters that may have arisen (including the engagement quality reviewer, where one has been appointed). These discussions may cause the auditor to re-evaluate the auditor’s determination that there are no key audit matters (CAS 701.A63).

OAG Guidance

See OAG Audit 2212 for guidance relating to communication to those charged with governance.

CAS Requirement

Prior to dating the auditor’s report, the engagement partner shall review the financial statements and the auditor’s report, including, if applicable, the description of the key audit matters and related audit documentation, to determine that the report to be issued will be appropriate in the circumstances (CAS 220.33).

The auditor shall include in the audit documentation (CAS 701.18):

(a) The matters that required significant auditor attention as determined in accordance with paragraph 9, and the rationale for the auditor’s determination as to whether or not each of these matters is a key audit matter in accordance with paragraph 10;

(b) Where applicable, the rationale for the auditor’s determination that there are no key audit matters to communicate in the auditor’s report or that the only key audit matters to communicate are those matters addressed by paragraph 15; and

(c) Where applicable, the rationale for the auditor’s determination not to communicate in the auditor’s report a matter determined to be a key audit matter.

CAS Guidance

Paragraph 8 of CAS 230 requires the auditor to prepare audit documentation that is sufficient to enable an experienced auditor, having no previous connection with the audit, to understand, among other things, significant professional judgments. In the context of key audit matters, these professional judgments include the determination, from the matters communicated with those charged with governance, of the matters that required significant auditor attention, as well as whether or not each of those matters is a key audit matter. The auditor’s judgments in this regard are likely to be supported by the documentation of the auditor’s communications with those charged with governance and the audit documentation relating to each individual matter (see paragraph A39), as well as certain other audit documentation of the significant matters arising during the audit (e.g., a completion memorandum). However, this CAS does not require the auditor to document why other matters communicated with those charged with governance were not matters that required significant auditor attention (CAS 701.A64).

OAG Guidance

When documenting information about key audit matters (KAMs) on our audit file, areas to consider include:

-

The matters we determined as KAMs and our judgments. The determination of KAMs involves judgment and our documentation reflects the matters we considered to require significant auditor attention and our rationale for determining which of those matters were of most significance in the audit. However, if we determine that some matters communicated with those charged with governance did not require significant auditor attention, we are not required to document our rationale for this determination (see CAS 701.A64).

-

In limited circumstances, that we have concluded that there are no KAMs to be communicated, the rationale for such determination for each matter communicated to those charged with governance is included in our documentation.

-

Whether audit procedures documented on our audit file are consistent with our description of those procedures in our audit report. Our documentation demonstrates a reconciliation of the description of how the KAMs were addressed in our audit report to the procedures we have documented within the audit file.

- Consider review and consultation requirements.

Use appropriate procedures to document the procedures performed and relevant considerations. This documentation guidance also applies to circumstances where we decide not to communicate a KAM.

Due to the judgment involved in determining KAMs, it is important that more experienced members of the engagement team are involved in review of the related documentation, as appropriate. Evidence of the engagement leader's review of the description of the KAMs included in the audit report and the related audit documentation is also included in the working papers. Where we are communicating key audit matters in our audit report, the engagement quality reviewer also reviews the significant judgments made in identifying key audit matters to be included in the audit report and reviews those key audit matters.