Annual Audit Manual

COPYRIGHT NOTICE — This document is intended for internal use. It cannot be distributed to or reproduced by third parties without prior written permission from the Copyright Coordinator for the Office of the Auditor General of Canada. This includes email, fax, mail and hand delivery, or use of any other method of distribution or reproduction. CPA Canada Handbook sections and excerpts are reproduced herein for your non-commercial use with the permission of The Chartered Professional Accountants of Canada (“CPA Canada”). These may not be modified, copied or distributed in any form as this would infringe CPA Canada’s copyright. Reproduced, with permission, from the CPA Canada Handbook, The Chartered Professional Accountants of Canada, Toronto, Canada.

7062 Planning to attend physical inventory counting

Sep-2022

In This Section

Attending physical inventory counting

Planning attendance at physical inventory counting

Physical inventory observation staff considerations

Physical inventory observation documentation

Evaluate and observe management’s instructions and procedures for physical inventory counting

CAS Requirement

If inventory is material to the financial statements, the auditor shall obtain sufficient appropriate audit evidence regarding the existence and condition of inventory by:

- Attendance at physical inventory counting, unless impracticable (CAS 501.4(a))

CAS Guidance

Management ordinarily establishes procedures under which inventory is physically counted at least once a year to serve as a basis for the preparation of the financial statements and, if applicable, to ascertain the reliability of the entity’s perpetual inventory system (CAS 501.A1).

Attendance at physical inventory counting involves (CAS 501.A2):

- Inspecting the inventory to ascertain its existence and evaluate its condition, and performing test counts;

- Observing compliance with management’s instructions and the performance of procedures for recording and controlling the results of the physical inventory count; and

- Obtaining audit evidence as to the reliability of management’s count procedures.

These procedures may serve as a test of controls or substantive procedures depending on the auditor’s risk assessment, planned approach and the specific procedures carried out.

CAS Guidance

Matters relevant in planning attendance at physical inventory counting (or in designing and performing audit procedures pursuant to paragraphs 4-8 of this CAS) include, for example (CAS 501.A3):

- The risks of material misstatement related to inventory

- The nature of the internal control related to inventory

- Whether adequate procedures are expected to be established and proper instructions issued for physical inventory counting

- The timing of physical inventory counting

- Whether the entity maintains a perpetual inventory system

- The locations at which inventory is held, including the materiality of the inventory and the risks of material misstatement at different locations, in deciding at which locations attendance is appropriate. CAS 600 deals with the involvement of other auditors and accordingly may be relevant if such involvement is with regards to attendance of physical inventory counting at a remote location.

- Whether the assistance of an auditor’s expert is needed. CAS 620 deals with the use of an auditor’s expert to assist the auditor to obtain sufficient appropriate audit evidence.

OAG Guidance

For each of the examples listed in CAS 501.A3, consider the following:

- The risks of material misstatement related to inventory:

- Understand the nature and an approximation of the value, by inventory location or type.

- Understand the volume of the inventory, the identification of high value items, the method of accounting for inventory and the conditions giving rise to obsolescence.

- The nature of the internal control related to inventory:

- Review the business and accounting processes and related systems of internal control to identify any potential areas of difficulty.

- Understand cut-off procedures (i.e., related to in-transit goods, items received/shipped during the count and items in-transit between locations during the count).

- Whether adequate procedures are expected to be established and proper instructions issued for physical inventory counting:

- Review the instructions and consider whether they have been issued timely.

- Consider the competence of personnel assigned.

- The timing of physical inventory counting:

- Where the count is not performed at year-end, consider the reliability of records used in any roll-forward/roll-back of balances. See OAG Audit 7015 for roll-forward guidance.

- The locations at which inventory is held by the entity may consist of one or more facilities. We refer to locations where we observe the entity’s count as a count location. We need to:

- Understand the location of and method adopted by the entity for testing the existence of inventory at each location and for each type of inventory. For location selection, see "Selecting locations to visit" below.

- Inquire whether there are inventories owned by the entity in the custody of others or inventories owned by others on the entity’s premises. See OAG Audit 7068.

Note: There is no minimum coverage amount mandated by CASs or OAG Audit and use of accept-reject testing or audit sampling is not required. The selection of locations requires the exercise of professional judgment, and we need to assess the risk profile of the locations not observed to determine whether we have done sufficient work in respect of remaining inventory balance.

- Whether the assistance of an auditor’s expert is needed or a management’s expert is used:

- Consider whether specialist/expert help is necessary to determine quantities or test valuation of inventory due to the characteristics of the inventory or its storage. For example, a quarry may inventory a pile of stones that was excavated. The angle of repose and circumference of the pile needs to be measured to calculate the volume, which then needs to be used with a conversion factor to determine the weight of the entire pile. We would ordinarily consider using an expert to perform this for us. If an auditor’s external or management’s expert is used for this purpose document their work and perform audit procedures as appropriate. See OAG Audit 3090 for guidance on using auditor's experts.

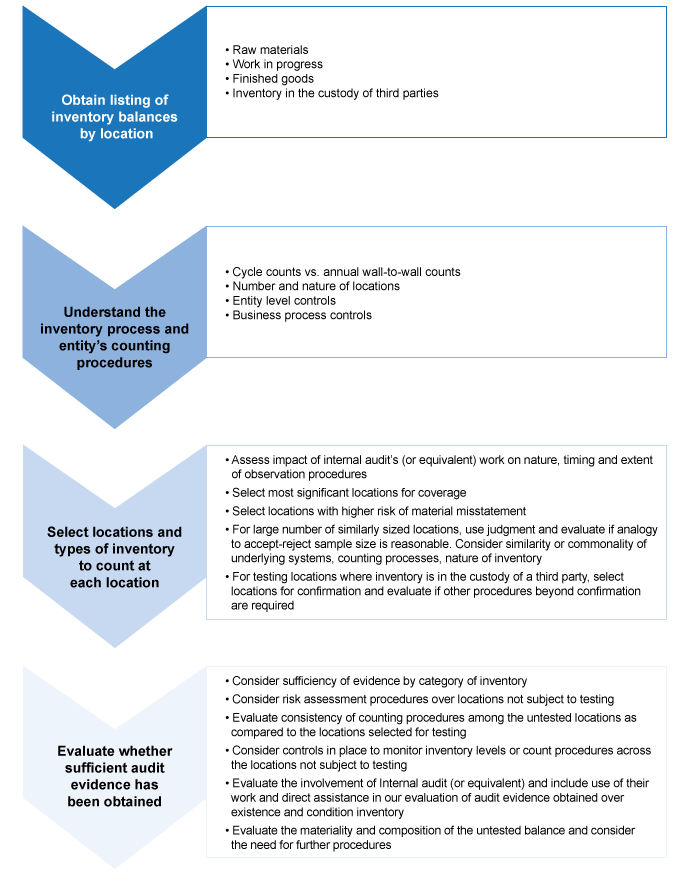

Selecting locations to visit

An effective starting point for selecting locations is to obtain a listing of inventory balances by location and inventory category (i.e., raw materials, work-in- progress, finished goods, etc.) that is reconciled to the general ledger. The listing includes inventory at all locations, including entity-owned warehouses, inventory in the custody of third parties, inventory in-transit and any other inventory the entity owns. This information assists us in gaining an understanding of the inventory balances, including the total amount of inventory, where the inventory is located and the nature of the inventory at each location (e.g., raw materials, work-in-progress, finished goods). The nature of the entity’s counting procedures (i.e., periodic cycle counts or annual wall-to-wall counts) and the types of facilities where the inventory is stored (i.e., entity-owned or third party) are important information when planning the specific procedures we will perform at the locations.

We first consider monetary coverage when selecting locations. We generally begin by selecting those locations that are most significant so that we can accumulate audit evidence to reduce the risk of misstatement in the untested balance. Next, we select those locations that have a higher risk of material misstatement. Factors to consider when evaluating the risk of material misstatement include the following:

- Risk assessment procedures performed to date

- Design and operating effectiveness of controls (where applicable)

- Significance/volatility of book to physical adjustments

- Significance/volatility of inventory loss/shrink (including fraud)

- Susceptibility of inventory to deterioration or obsolescence

- Experience level and knowledge of the individuals performing the counts

- History of misstatements resulting from counting errors

- Nature of inventory (e.g., hard-to-count, unusual measurement techniques)

As noted earlier in this topic, for an entity or component that has a large number of similarly sized locations, we apply professional judgment, and in applying this judgment, we may analogize to accept-reject sample sizes to determine the number of locations to visit. When determining the number of locations to visit in this situation, we consider not only the number of similarly sized locations but also the similarity or commonality among locations by considering factors such as:

- Underlying inventory systems

- Counting processes (i.e., cycle count vs wall-to-wall)

- Nature of inventory

- Type of location (e.g., manufacturing facility vs. sales facility vs. distribution center)

We would typically identify fewer locations when there is more commonality among the locations. For example, assume that 50% of an entity’s inventory is located in three distribution centers subject to annual counts at period-end and the remaining 50% of the inventory is located across 110 sales facilities subject to periodic cycle counts. The sales facilities hold similar inventory for sale to customers, use the same inventory management system and utilize the same cycle count program which is monitored centrally. In this situation, we may plan to observe inventory at the three distribution centers (which provide monetary coverage) as well as 10 of the sales facilities, assuming a low level of desired evidence based on the accept-reject sample size table in OAG Audit 7043.1.

Our conclusion of whether we have done enough is impacted by the risk profile of the locations not selected for testing. In making this determination, we consider various factors, including:

- Risk assessment analytics performed over the locations not subject to testing.

- Other risk assessment procedures performed over locations not subject to testing (e.g., reviewing the results of internal audit’s work for testing inventory existence or reviewing the results of management’s counts, including counts performed by a third party count service).

- Entity level or transactional controls in place to monitor inventory levels or count procedures across the locations not subject to testing.

- Consistency of counting procedures among the untested locations as compared to the locations selected for testing.

- Nature of the inventory financial statement line item—the greater the risk associated with the inventory for that entity, the more evidence is needed related to that financial statement line item.

- Multiples of performance materiality represented by the untested balance—the greater the multiples, the greater pressure on the judgment of sufficiency of evidence.

- Composition of untested balance—the greater the concentration of the untested balance, including the number of locations not observed with balances greater than performance materiality, the greater the pressure on the judgment of sufficiency of evidence.

The following chart summarizes the relevant considerations noted above:

There is no minimum coverage amount mandated by the CASs or OAG Audit in relation to the amount of inventory to observe. Document the rationale for our judgments in selecting testing locations. Also, document our judgments in concluding that we have obtained sufficient audit evidence about whether the inventory exists and its condition.

Virtual inventory observations

It remains our preference to physically attend our clients’ inventory counts. However, physical attendance might not always be possible. In these cases, virtual inventory count observations might be appropriate. When deciding whether a virtual inventory count is appropriate, engagement teams must consider the associated risks and the practicality of designing a virtual inventory observation approach. The Virtual Inventory Observations Documentation template was designed to help engagement teams in assessing risks and practicality considerations and is strongly recommended to be used by all teams performing virtual inventory count observations:

Generally, observing an inventory count virtually is only appropriate when the following conditions are met:

-

we assess the risk of material misstatement of inventory quantities as normal (including any related fraud risks),

-

historically, inventory records have been accurate,

-

there are no known control deficiencies or any other significant changes to management’s process that could impact the quality of the inventory count observation such that our presence in person is required, and it is an existing client and the inventory is subject to the historical controls of the entity.

If a virtual inventory count is performed it is best practice that:

-

a dry run to test the connection is done by the client using the technology that will be used during the actual VIO to confirm continued access in all areas of the facility;

-

two members of the OAG are on the live feed when performing the virtual inventory count observation in case one member gets disconnected;

-

a more senior member of the team attends the virtual inventory count observation to apply their experience, professional skepticism, and deal with issues on a real-time basis;

-

two employees are present for each count team: one person counting and one person controlling the camera, to limit disruptions in the video feed; and

-

one or more competent entity employee(s) who is/are separate from the entity’s count teams are present during the virtual inventory count observation to execute our instructions, such as what to recount and where to go within the facility.

OAG Guidance

Due to the real-time nature of our physical inventory observation, understand, in advance of the start of the physical inventory, the nature of the inventory to be observed as well as the entity’s count procedures and controls. Consider the nature and extent of the audit procedures to perform in all key areas, e.g., number of test counts and how they will be spread across different types of inventory, testing the entity’s tag or count sheet control, the entity’s identification of obsolete inventory, how to handle difficult to count inventory, how to deal with count differences, what entity documentation to retain (e.g., we ordinarily maintain a copy of the tag or count sheet control listing and may retain copies of some or all inventory tags or count sheets, whether prepared manually or system generated), and when to call a more experienced person on the engagement team. The Physical Inventory Observation Checklist template is available to facilitate documentation of our observation.

Understand what to communicate within the team, whether they are on or off site, about those issues that might arise in the course of the observation. Issues may require immediate resolution with the engagement leader and/or team manager. For example, we generally discuss in advance what level of differences in test counts in different areas might not be considered significant vs. requiring recounting by the entity. As issues may arise during the inventory observation that require immediate resolution with the engagement leader and/or team manager, consider if appropriate plans have been made to communicate and resolve issues that may arise during the physical observation procedures with appropriate engagement team members.

Documentation of the resolution of such issues needs to be completed during the inventory observation or as soon thereafter as possible.

|

Audit Tip Use the opportunity to take a team member inexperienced in physical inventory observations to ‘shadow’ the physical inventory observation. Next time the team member will be skilled in performing the necessary procedures at a physical inventory observation. |

OAG Guidance

Proper documentation of work performed during our observation of the physical inventory is essential. For example, documented details of the last serial numbers of goods received and shipped and records of movements during the physical inventory counting may be used to subsequently test cut-off. After the inventory counting, follow up on the matters recorded in our workpapers at the time of the count, including apparent instances of obsolete or deteriorating inventory.

When the entity operates a perpetual inventory system which is used to determine the period end balance, evaluate, through the performance of additional procedures, whether the reasons for any significant differences between the physical count and the perpetual inventory records are understood and the records are properly adjusted.

The Physical Inventory Observation Checklist template is available to facilitate documentation of our observation.

CAS Requirement

If inventory is material to the financial statements, the auditor shall obtain sufficient appropriate audit evidence regarding the existence and condition of inventory by:

(a) Attendance at physical inventory counting, unless impracticable, to:

(i). Evaluate management’s instructions and procedures for recording and controlling the results of the entity’s physical inventory counting (CAS 501.4(a)(i))

(ii). Observe the performance of management’s count procedures (CAS 501.4(a)(ii))

CAS Guidance

Matters relevant in evaluating management’s instructions and procedures for recording and controlling the physical inventory counting include whether they address, for example (CAS 501.A4):

- The application of appropriate controls, for example, collection of used physical inventory count records, accounting for unused physical inventory count records, and count and re-count procedures.

- The accurate identification of the stage of completion of work in progress, of slow moving, obsolete or damaged items and of inventory owned by a third party, for example, on consignment.

- The procedures used to estimate physical quantities, where applicable, such as may be needed in estimating the physical quantity of a coal pile.

- Control over the movement of inventory between areas and the shipping and receipt of inventory before and after the cutoff date.

Observing the performance of management’s count procedures, for example those relating to control over the movement of inventory before, during and after the count, assists the auditor in obtaining audit evidence that management’s instructions and count procedures are adequately designed and implemented. In addition, the auditor may obtain copies of cutoff information, such as details of the movement of inventory, to assist the auditor in performing audit procedures over the accounting for such movements at a later date (CAS 501.A5).

OAG Guidance

Our attendance at inventory counts serves as a test of controls and/or a substantive procedure over inventory depending on our risk assessment and planned approach. During the observation, we inspect the condition of the inventory, observe management’s controls over performing, recording and controlling the inventory count, and observe the safeguarding of inventory, especially in the case of high dollar value items that are susceptible to theft. Our observation also serves as a fraud procedure to test that fictitious inventory quantities are not recorded. The audit evidence we obtain from observing inventory counts comes not only from our test counts but also from other audit procedures we perform during our observation.

We need to obtain entity information, including management instructions sufficiently in advance of the inventory observation to allow for time to review and communicate to management if amendments are deemed necessary.

As part of our review of the instructions, we obtain an understanding of the methods the entity will use to quantify inventory during the count (e.g., count, weight, meter readings, state of completion of work-in-progress). To the extent the count teams will use scales or meter readings, we understand (and test at the observation) how the scales/meters will be calibrated. We also identify items that may require complex measurement (such as estimating a bulk coal pile) and where applicable, management’s process for converting recorded quantities to quantities recorded in the general ledger. Gaining this understanding will help us determine any specialized skills we may need and the extent of work to perform during the observation.

In some situations, the entity may establish a threshold to tolerate estimation differences identified during the count. When planning for the observation, we assess the appropriateness of management’s thresholds for determining whether amounts recorded in the perpetual inventory records will be adjusted to the physical count. One way to do this is to evaluate the materiality of the potential inaccuracy and determine whether such inaccuracy would or could be material. If we conclude the established threshold is not appropriate, we discuss this with management, determine if there is a control implication and understand the extent to which the threshold will be adjusted prior to the count.

Entities may engage third party count services to perform count procedures on behalf of management. Use of a third party count service does not change our responsibility to assess the count team and perform test counts.

Relevant matters include

- whether the instructions are reviewed and approved by a responsible official and are effectively communicated to persons participating in the count;

- how will counters determine or record the stage of completion of work in progress inventory;

- whether there are specific instructions on how to follow up on identified differences (i.e., recounting procedures);

- whether established procedures are adequate to control the use of inventory tags or count sheets by the count teams (e.g., by using pre-numbered tags or count sheets and accounting for all such tags or count sheets, including used, unused, and voided), and consider the segregation of duties between persons responsible for tag or count sheet control, counting inventory, and inputting completed inventory tags or count sheets to inventory records;

- whether information needed for proper identification of the inventory and subsequent tracing of the test counts to the inventory listings exists in useable form; and

- whether inventory count teams include:

- persons able to identify the nature and quality of the items;

- persons from departments that have no responsibility for the custody, movement, or recording of the inventory;

- if both of the above are not present, it may be necessary to revise the extent of work performed to determine that a complete and accurate count is achieved and that slow-moving, obsolete, and damaged inventory is appropriately identified. This may include asking the entity to recount the inventory and then performing additional test counts.