Annual Audit Manual

COPYRIGHT NOTICE — This document is intended for internal use. It cannot be distributed to or reproduced by third parties without prior written permission from the Copyright Coordinator for the Office of the Auditor General of Canada. This includes email, fax, mail and hand delivery, or use of any other method of distribution or reproduction. CPA Canada Handbook sections and excerpts are reproduced herein for your non-commercial use with the permission of The Chartered Professional Accountants of Canada (“CPA Canada”). These may not be modified, copied or distributed in any form as this would infringe CPA Canada’s copyright. Reproduced, with permission, from the CPA Canada Handbook, The Chartered Professional Accountants of Canada, Toronto, Canada.

5042 Determine relevant assertions and significant FSLIs

Sep-2022

In This Section

Mapping of CAS assertions to OAG assertions

Significant FSLIs and relevant assertions – examples

FSLIs not determined to be significant but that are material

CAS Guidance

In identifying and assessing the risks of material misstatement, the auditor may use the categories of assertions as described in paragraph A190(a)-(b) below or may express them differently provided all aspects described below have been covered. The auditor may choose to combine the assertions about classes of transactions and events, and related disclosures, with the assertions about account balances, and related disclosures (CAS 315.A189).

Assertions used by the auditor in considering the different types of potential misstatements that may occur may fall into the following categories (CAS 315.A190):

-

Assertions about classes of transactions and events, and related disclosures for the period under audit:

- Occurrence—transactions and events that have been recorded or disclosed, have occurred and such transactions and events pertain to the entity.

- Completeness—all transactions and events that should have been recorded have been recorded, and all related disclosures that should have been included in the financial statements have been included.

- Accuracy—amounts and other data relating to recorded transactions and events have been recorded appropriately, and related disclosures, have been appropriately measured and described.

- Cutoff—transactions and events have been recorded in the correct accounting period.

- Classification—transactions and events have been recorded in the proper accounts.

- Presentation—transactions and events are appropriately aggregated or disaggregated and clearly described, and related disclosures are relevant and understandable in the context of the requirements of the applicable financial reporting framework.

-

Assertions about account balances, and related disclosures, at the period end:

- Existence—assets, liabilities, and equity interests exist.

- Rights and obligations—the entity holds or controls the rights to assets, and liabilities are the obligations of the entity.

- Completeness—all assets, liabilities and equity interests that should have been recorded have been recorded, and all related disclosures that should have been included in the financial statements have been included.

- Accuracy, valuation and allocation—assets, liabilities, and equity interests have been included in the financial statements at appropriate amounts and any resulting valuation or allocation adjustments have been appropriately recorded, and related disclosures have been appropriately measured and described.

- Classification—assets, liabilities and equity interests have been recorded in the proper accounts.

- Presentation—assets, liabilities and equity interests are appropriately aggregated or disaggregated and clearly described, and related disclosures are relevant and understandable in the context of the requirements of the applicable financial reporting framework.

The assertions described in paragraph A190(a)-(b) above, adapted as appropriate, may also be used by the auditor in considering the different types of misstatements that may occur in disclosures not directly related to recorded classes of transactions, events or account balances (CAS 315.A191).

|

Example: An example of such a disclosure includes where the entity may be required by the applicable financial reporting framework to describe its exposure to risks arising from financial instruments, including how the risks arise; the objectives, policies and processes for managing the risks; and the methods used to measure the risks. |

Considerations Specific to Public Sector Entities

When making assertions about the financial statements of public sector entities, in addition to those assertions set out in paragraph A190(a)-(b), management may often assert that transactions and events have been carried out in accordance with law, regulation or other authority. Such assertions may fall within the scope of the financial statement audit (CAS 315.A192).

OAG Guidance

The following table shows how the assertions we use in OAG Audit map to the assertions identified in CAS 315. These OAG assertions were developed to simplify the use of financial statement assertions identified in CAS 315:

| CAS assertion | OAG assertion | Abbreviation |

|---|---|---|

| Accuracy | Accuracy | A |

| Completeness | Completeness | C |

| Cutoff | Cutoff | CO |

| Existence | Existence/occurrence | E/O |

| Occurrence | ||

| Classification | Presentation and disclosure | PD |

| Presentation | ||

| Rights and obligations | Rights and obligations | RO |

| Valuation and allocation | Valuation | V |

| Authorities | Authorities | AU |

Role of assertions

CAS Guidance

Assertions—Representations, explicit or otherwise, with respect to the recognition, measurement, presentation and disclosure of information in the financial statements which are inherent in management representing that the financial statements are prepared in accordance with the applicable financial reporting framework. Assertions are used by the auditor to consider the different types of potential misstatements that may occur when identifying, assessing and responding to the risks of material misstatement (CAS 315.12a).

In identifying and assessing the risks of material misstatement, the auditor uses assertions to consider the different types of potential misstatements that may occur. Assertions for which the auditor has identified related risks of material misstatement are relevant assertions (CAS 315.A188).

Categories of assertions are used by auditors to consider the different types of potential misstatements that may occur when identifying, assessing and responding to the risks of material misstatement. Examples of these categories of assertions are described in paragraph A190. The assertions differ from the written representations required by CAS 580, to confirm certain matters or support other audit evidence (CAS 315.A1).

OAG Guidance

Responding to assertion level risks

Our audit results in expressing an opinion on the financial statements taken as a whole. However, to reach our conclusions on the financial statements as a whole, we consider assertions which management makes regarding the various elements of financial statements and related disclosures when representing that the financial statements are in accordance with the applicable financial reporting framework. Therefore, our audit procedures are designed to respond to risks of material misstatement at the assertion level.

Financial statements can be viewed as an accumulation of a large number of transactions, account balances and disclosures, which have assertions associated with them. A line item on the financial statements can consist of several account balances or disclosure items, which aggregate several individual assertions. Many audit procedures are performed not on the financial statements as a whole or at the account balance or disclosure level, but rather, they are directed at individual assertions. This is done to allow us to design an audit response that is targeted directly at obtaining evidence relevant to the assertion-level risks of material misstatement.

Linking of risks to audit procedures via assertions

Relating identified risks of material misstatement to misstatements that might occur at the assertion level is necessary to properly link assessed risks to tests of controls and substantive audit procedures, most of which are directed at specific assertions. For example, observation of inventory counts provides strong, direct evidence about the existence of inventory and it may provide some evidence about the condition of the inventory and therefore provide some evidence addressing the valuation assertion (i.e., the provision for inventory obsolescence).

To establish a clear link between our assessment of the risk of material misstatement and further audit procedures, risk assessment procedures are performed at the assertion level. For example, if the risk of obsolescence is important in valuing inventory (i.e., the valuation assertion), the explicit use of the valuation assertion helps establish the linkage of the risks and the related audit procedures. It will be used when assessing the risk, documenting the controls and designing for the audit plan of further tests such as evaluating sales by product, or selecting specific items to test for valuation issues.

Significant FSLIs

CAS Requirement

The auditor shall determine the relevant assertions and the related significant classes of transactions, account balances and disclosures (CAS 315.29).

CAS Guidance

Paragraph 18 requires the auditor to design and perform substantive procedures for each material class of transactions, account balance, and disclosure. For significant classes of transactions, account balances and disclosures, substantive procedures may have already been performed because paragraph 6 requires the auditor to design and perform further audit procedures that are responsive to the assessed risks of material misstatement at the assertion level. Accordingly, substantive procedures are required to be designed and performed in accordance with paragraph 18 (CAS 330.A43):

- When the further audit procedures for significant classes of transactions, account balances or disclosures, designed and performed in accordance with paragraph 6, did not include substantive procedures; or

- For each class of transactions, account balance or disclosure that is not a significant class of transactions, account balance or disclosure, but that has been identified as material in accordance with CAS 315.

This requirement reflects the facts that: (a) the auditor’s assessment of risk is judgmental and so may not identify all risks of material misstatement; and (b) there are inherent limitations to controls, including management override.

Not all assertions within a material class of transactions, account balance or disclosure are required to be tested. Rather, in designing the substantive procedures to be performed, the auditor’s consideration of the assertion(s) in which, if a misstatement were to occur, there is a reasonable possibility of the misstatement being material, may assist in identifying the appropriate nature, timing and extent of the procedures to be performed (CAS 330.A44).

OAG Guidance

Significant FSLIs

CAS 315 defines significant classes of transactions, account balances or disclosures as those for which there are one or more relevant assertions. Assertions are considered relevant when they have an identified risk of material misstatement (CAS 315.12). When we identify a reasonable possibility of material misstatement at the assertion level for an FSLI, it is considered a “significant FSLI”. For further guidance on relevant assertions, refer to the block ‘Relevant assertions’ below.

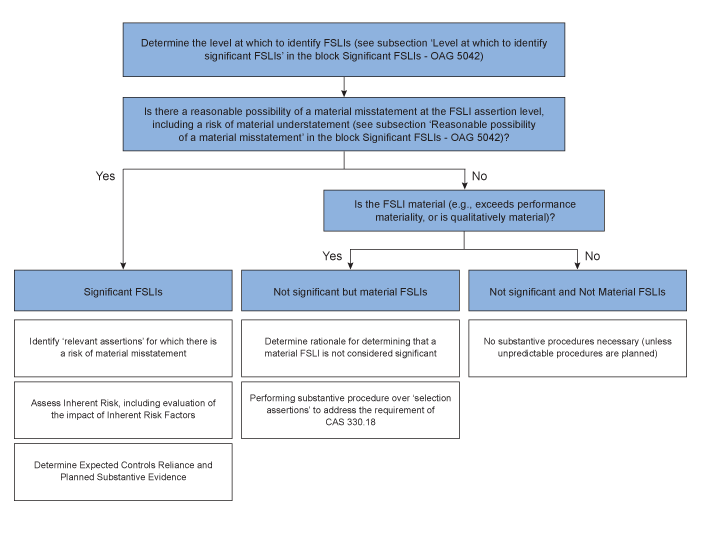

Our identification of significant FSLIs and relevant assertions assists us in determining the procedures needed to address the risks of material misstatement (i.e., controls and substantive tests). If we determine that an FSLI is not considered a significant FSLI, we would not need to perform further audit procedures over the FSLI, unless the FSLI is material. If an FSLI is not determined to be significant but it is material (i.e., there is no reasonable possibility of material misstatement for the FSLI and therefore no relevant assertions are identified, but it is quantitatively material), CAS 330.18 requires us to perform substantive procedures solely because the requirement of CAS 330 to perform substantive procedures for material FSLIs applies irrespective of the results of our risk assessment. For further guidance on our procedures over material but not significant FSLIs, refer to the block “FSLIs not determined to be significant but that are material” below. The following table briefly summarizes the FSLI categories we would identify as part of our risk assessment and scoping:

| FSLI Category | FSLI Characteristics |

|---|---|

| Significant |

|

| Not significant but material |

|

| Not significant and not material |

|

*- FSLIs that exceed performance materiality are generally considered for testing. In some cases, we may determine an FSLI to be qualitatively material, even if it does not exceed performance materiality. Refer to OAG Audit 2103 for guidance. If an FSLI that does not exceed performance materiality is determined to be qualitatively material, typically these qualitative considerations would also give rise to a risk of material misstatement, in which case the FSLI would be considered significant.

The following chart briefly summarizes the process of identifying significant FSLIs. The purpose of providing this chart is only to illustrate at a high level the logical flow and steps in the process. This chart does not aim to illustrate all relevant considerations that need to be taken into account in making important judgments; refer to the detailed guidance provided further in this subsection for the relevant factors to consider:

In accordance with CAS 200.A16, a risk of material misstatement exists when there is a reasonable possibility of a misstatement occurring (i.e., its likelihood) and being material if it were to occur (i.e., its magnitude). If there is a reasonable possibility the FSLI could contain a misstatement that, individually or when aggregated with other misstatements, has a material effect on the financial statements, considering the risks of both overstatement and understatement, it would be considered a significant FSLI. The determination of whether an FSLI is significant is based on our assessment of inherent risk, without regard to the effect of controls. A sufficient understanding of the FSLI and related business process is necessary to determine whether there is a reasonable possibility of a material misstatement related to the FSLI. Further guidance on ’reasonable possibility’ of misstatement is provided later in this subsection.

Level at which to identify significant FSLIs

There is no formal CAS definition of account balances, classes of transactions or disclosures. However, we generally interpret this phrase as including amounts that are separately disclosed in the financial statements (account balances presented on the balance sheet, classes of transactions presented on the income statement, and disclosures in the notes) and refer to classes of transactions, account balances and disclosures as ’FSLIs’ (see OAG Audit 5041).

Consideration needs to be given if an amount presented or disclosed comprises more than one FSLI. For example, if an entity only presents a single revenue amount, but this comprises domestic and export revenue, both of which have differing risks of material misstatement (i.e., we have identified a risk of material misstatement at the assertion level related to each of them), then these are considered as separate FSLIs.

If the entity disaggregates revenue into a number of different trial balance lines, then we may conclude this is one significant FSLI. However, there may be situations where each trial balance line for revenue would be identified as a separate significant FSLI.

We also consider if further disaggregation of a line item presented in an entity’s financial statements may help us more efficiently and effectively target our risk assessment and develop appropriate audit responses.

In some cases, the disaggregated accounts or transactions comprising a single line presented in the entity’s financial statements may have sufficiently differing risks such that we would need to evaluate each line item separately. For example, an entity may include intangible assets as a single line item within its balance sheet, but the account includes both definite-lived intangible assets and indefinite-lived intangible assets. We may determine amortizing intangible assets is a significant FSLI with relevant assertions given newly acquired assets during the year as a result of a business combination. However, we may be able to conclude indefinite-lived intangible assets is not a significant FSLI (i.e., has no relevant assertions) if no indefinite-lived intangible assets were acquired in the current year business combination and the risk of a triggering event that could lead to a material impairment is not reasonably possible. Note that if the indefinite-lived intangible assets balance is material, CAS 330.18 would still require us to perform substantive procedures over this material but not significant FSLI. For guidance on our procedures regarding not significant but material FSLIs, refer to the block “FSLIs not determined to be significant but that are material” below.

There is a risk that we may inappropriately conclude an FSLI is not a significant FSLI if our identification of FSLIs is done at too disaggregated of a level. For example, an entity may present other assets as a single line item on its balance sheet. This other assets balance may comprise several different asset balances, each of which is individually below performance materiality, but which are material when aggregated and presented on the balance sheet. Consequently, when making our judgments as to whether disaggregated line items are separate FSLIs, we consider aggregation risk. For liability accounts, this includes the risk related to completeness. When we identify FSLIs at a disaggregated level, as compared to the balances presented on the face of the financial statements, we consider a lower quantitative threshold (e.g., percentage of performance materiality) when concluding if an FSLI is a significant FSLI to allow for aggregation risk.

For further guidance on sub-account scoping, refer to OAG Audit 4024.

Relevant factors when identifying significant FSLIs

To identify significant FSLIs and the relevant assertions that give rise to the reasonably possible risks of misstatement, we evaluate both qualitative and quantitative factors and apply professional judgment. Our documentation reflects the qualitative considerations and rationale for significant judgments made, as appropriate in the engagement circumstances. We would not need to specifically document our evaluation of each of the factors below in all cases, but may consider doing so to support our risk assessment conclusions.

The following are some factors that may be relevant to our identification of risks of material misstatement and determining if the FSLI is significant, although there may be additional factors to consider depending on the engagement facts and circumstances:

- Size and composition of the account

- Susceptibility to misstatement due to errors or fraud

- Volume of activity, complexity, and homogeneity of the individual transactions processed through the account or reflected in the disclosure

- Nature of the account, class of transactions, or disclosure

- Accounting and reporting complexities associated with the account or disclosure

- Exposure to losses in the account

- Possibility of significant contingent liabilities arising from the activities reflected in the account or disclosure

- Existence of related party transactions in the account

- Changes from the prior period in account or disclosure characteristics (i.e., whether the nature and characteristics of the account are consistent with the prior period and no changes affect our evaluation of the possibility of a material misstatement in the account)

- Preliminary understanding of the complexity, uncertainty and subjectivity associated with the FSLI

- If forecasts are important to the estimate, the length of the forecast period and degree of uncertainty regarding trends affecting the forecast

We may determine an FSLI to be qualitatively significant because it is affected by inherent risks of fraud or error that have a reasonable possibility of resulting in a material misstatement, either on an individual or aggregate basis, even when the FSLI is not quantitatively material. This may be the case for a liability account where there is a reasonable possibility that the FSLI could be understated by a material amount and therefore the completeness assertion is relevant. Other FSLIs may be qualitatively significant based on the expectations of a reasonable user of the financial statements or when we are incorporating an element of unpredictability into our audit procedures at the FSLI assertion level (e.g., when we substantively test accuracy of immaterial PP&E additions at certain locations that were not otherwise included in-scope).

It is important that we consider the nature of the FSLI when determining if an FSLI is significant. This is because our judgment around the likelihood of an FSLI being significant is impacted by the factors such as level of complexity, degree of uncertainty associated with the FSLI and other relevant factors listed above. For example, in certain industries, property, plant and equipment is often an FSLI with a low level of complexity, has activity that is predictable, and in many cases, is not considered a key performance indicator by the entity’s stakeholders. By contrast, revenue is often an FSLI with varying degrees of complexity, including a presumed risk of fraud in revenue recognition, and is usually a key performance indicator for the entity’s stakeholders. Similarly, the inventory FSLI at a manufacturing entity likely has a significant level of activity and those activities directly contribute to the entity’s primary revenue stream and gross margins. In these examples, revenue and inventory would more likely be considered significant FSLIs absent any quantitative or qualitative factors to the contrary.

When concluding an FSLI is not significant or an assertion is not a relevant assertion, it is important to consider if other areas of the audit, including other FSLIs, could be impacted by the conclusion. Examples include, but are not limited to, income taxes, including deferred taxes, pension disclosures, and the statement of cash flows. This impact on other areas of the audit could influence our conclusion regarding whether or not an FSLI is significant and/or could influence the audit work we plan to perform in such other areas. For example, often the substantive work we perform over accounts payable provides audit evidence over the completeness, accuracy, and occurrence of operating expenses and therefore influences how much additional testing is needed over those expense accounts. In this case if we identify both accounts payable and operating expenses as significant FSLIs we may be able to leverage the audit work performed over accounts payable as part of the audit procedures over operating expenses.

The more an FSLI exceeds performance materiality, the greater the likelihood it would be considered significant. FSLIs that exceed performance materiality will generally present at least a normal level risk of material misstatement for one or more assertions and therefore would be considered a significant FSLI. However, an FSLI that exceeds performance materiality is not necessarily identified as significant if we do not identify a risk of material misstatement at the FSLI assertion level (i.e., there is no reasonable possibility of a material misstatement). Conversely, engagement circumstances may also lead us to consider an FSLI less than performance materiality to be significant (e.g., the FSLI balance may be below performance materiality but the FSLI includes a risk of material understatement).

We need to exercise caution when determining that a material FSLIs is not significant. In fact, we may not identify any ’not significant but material FSLIs’ on an engagement and it would not be common to identify multiple not significant FSLIs that are material. If we believe it may be appropriate to categorize multiple material FSLIs as ’not significant’ we need to carefully consider whether the likelihood of a material misstatement for all financial statement assertions is truly not even reasonably possible, including the completeness assertion. Identifying multiple FSLIs as not significant even though they are material, increases the risk that undetected misstatements in several FSLIs may, in the aggregate, be material to the financial statements as a whole.

Consider consulting Audit Services if we believe it may be appropriate to categorize multiple material FSLIs as ’not significant’ or in situations when the process of scoping and identifying significant FSLIs is particularly complex or difficult.

Reasonable possibility of a material misstatement

As explained earlier in this block, a risk of material misstatement exists when there is a reasonable possibility of a misstatement occurring (i.e., its likelihood) and being material if it were to occur (i.e., its magnitude).

CAS 315 does not provide a definition or guidance as to what would be considered a ’reasonably possible’ risk. However, there are a number of references to ’reasonably possible’ in the professional accounting standards that can be used to inform our judgment when assessing the likelihood of a misstatement. For example, IAS 37.16, Provisions Contingent Liabilities and Contingent Assets, which does not directly define ’reasonably possible’, does make a distinction between the probable, possible and remote possibility that a present obligation exists, in effect establishing a view that likelihood may range from a remote possibility to probable. In deliberating CAS 315 the AASB explicitly supported a view that, in some cases, a risk of material misstatement with more than remote likelihood of occurring may not be reasonably possible.

There is no explicit quantitative probability threshold we apply when determining that a material misstatement is reasonably possible. However, we generally recognize that ’reasonably possible’ would mean more than a remote chance of a material misstatement occurring, and therefore a material misstatement with only a remote risk of occurring would not be considered ’reasonably possible’. This would not mean, however, that any risk for which we judge the likelihood of occurrence to be higher than remote would always be considered reasonably possible. In other words, if based on evaluation of relevant factors, we consider the likelihood of a risk occurring to be only slightly higher than remote, we apply judgment and might reach a conclusion that the likelihood of a material misstatement occurring for such a risk is not reasonably possible.

When evaluating the likelihood of a potential misstatement occurring, we consider the same quantitative and qualitative risk factors that formed the basis for our identification of significant FSLIs and relevant assertions. Our assessment of the likelihood of a potential misstatement considers whether such a misstatement individually or in combination with others, could result in a material misstatement to the financial statements. The list of factors reflected on the likelihood graphic below does not include the previously listed factors related to size of the account, composition, volume and homogeneity of transactions because they do not, in all cases, increase or decrease the likelihood of a misstatement occurring:

| Nature of transactions is normal/recurring | Nature of transactions is unusual/non-recurring or new |

|---|---|

| Transactions with low complexity | Transactions with high complexity |

| Less susceptible to misstatement due to error or fraud | More susceptible to misstatement due to error or fraud |

| Accounting or reporting complexity is low | Accounting or reporting complexity is high |

| Does not give rise to risk of losses | Gives rise to risk of losses |

| Does not give rise to risk of contingent liabilities | Gives rise to risk of contingent liabilities |

| No related party transactions present | Related party transactions present |

| No changes from the prior period in the characteristics of the transactions | Changes from the prior period in the characteristics of the transactions |

Accounting estimates

When identifying and assessing risks at the assertion level, we are focused on the risk of material misstatement. Assessing the risk of material misstatement associated with an accounting estimate (and the development of further audit procedures to address that risk) is therefore performed in respect of FSLIs that represent a risk of material misstatement and are considered significant FSLIs. Estimates relating to FSLIs that are not considered significant would not be subject to the specific requirements of CAS 540. We would not, for example, perform CAS 540 risk assessment and execution procedures on the allowance for doubtful debts for an accounts receivable FSLI that is not, itself, considered to be a significant FSLI (i.e., the valuation assertion for the accounts receivable FSLI was determined not to be relevant as a result of our risk assessment procedures).

Inventory

As CAS 501.4 requires us to attend physical inventory counting if inventory is material, we would need to perform appropriate procedures over the physical inventory observations even when an inventory FSLI is determined not to be significant.

Documentation

We document the identified significant FSLIs and relevant assertions, based on the evaluation of the factors explained above and our assessment of the misstatement likelihood and magnitude. We are not required to separately document our evaluation of the misstatement likelihood, however we may document the rationale if the basis for our conclusion is not already evident. Examples of identifying significant FSLIs and their relevant assertions are provided in the block “Significant FSLIs and relevant assertions—examples” below.

For significant FSLIs we document our evaluation of the impact of inherent risk factors on the level of inherent risk, expected controls reliance and planned substantive evidence. Refer to the block “FSLIs not determined to be significant but that are material” below for further guidance related to FSLIs that are determined to be not significant but material.

CAS Guidance

Determining relevant assertions and the significant classes of transactions, account balances and disclosures provides the basis for the scope of the auditor’s understanding of the entity’s information system required to be obtained in accordance with paragraph 25(a). This understanding may further assist the auditor in identifying and assessing risks of material misstatement (CAS 315.A202).

The auditor may use automated techniques to assist in the identification of significant classes of transactions, account balances and disclosures (CAS 315.A203).

|

Example:

|

Significant disclosures include both quantitative and qualitative disclosures for which there is one or more relevant assertions. Examples of disclosures that have qualitative aspects and that may have relevant assertions and may therefore be considered significant by the auditor include disclosures about (CAS 315.A204):

- Liquidity and debt covenants of an entity in financial distress.

- Events or circumstances that have led to the recognition of an impairment loss.

- Key sources of estimation uncertainty, including assumptions about the future.

- The nature of a change in accounting policy, and other relevant disclosures required by the applicable financial reporting framework, where, for example, new financial reporting requirements are expected to have a significant impact on the financial position and financial performance of the entity.

- Share-based payment arrangements, including information about how any amounts recognized were determined, and other relevant disclosures.

- Related parties, and related party transactions.

- Sensitivity analysis, including the effects of changes in assumptions used in the entity’s valuation techniques intended to enable users to understand the underlying measurement uncertainty of a recorded or disclosed amount.

OAG Guidance

Assertions are considered relevant when they have an identified risk of material misstatement (CAS 315.12). To identify relevant assertions, determine the most likely ways that the given class of transactions, account balance and disclosure could be misstated by considering the nature of the transactions, the volume and complexity of transactions, and other relevant factors. For example, the gross balance of accounts receivable could be misstated if:

- one or more individual receivables did not exist at the balance sheet date (existence), or

- the entity failed to record a receivable that did exist at the balance sheet date (completeness), or

- a long-term receivable was presented as a current asset (presentation and disclosure), or

- a long-term receivable was not accurately reported, for example, by inappropriately discounting the receivable (valuation).

When assessing the identified risks at the assertion level, evaluate whether they relate more pervasively to the financial statements as a whole and potentially affect many assertions, in which case we may determine that there is a risk of material misstatement at the financial statement level, which would need to be assessed and addressed, as appropriate.

When determining if an assertion is relevant, we need to consider if there is a reasonable possibility of material misstatement associated with this assertion. For guidance on what constitutes a reasonable possibility, refer to the block “Significant FSLIs” above.

For certain FSLIs, an assertion may inherently not be relevant, for example the valuation assertion is not an assertion that is relevant to payroll expense. Some assertions may not be relevant given the particular circumstances of the entity, for example, valuation of cash balances held in accounts at well-established, regulated banks where all transactions are conducted in the entity’s functional currency.

We may also determine that an assertion is not relevant because there is no reasonable possibility of material misstatement for that assertion. Consider the following examples:

Example 1: Revenue Cut‑Off

Based on an understanding of customer sales arrangements, including contractual shipping terms shipping method and historical order fulfillment time and prior audit experience, the engagement team determined the at-risk period for the revenue cut-off testing to be one week before and after the period end.

Total revenue during the at-risk period is less than performance materiality, and therefore the engagement team determined that the risk of a material misstatement arising from a cut-off error associated with these transactions would be remote based on the magnitude of potential misstatement and therefore concluded that cut-off does not present a reasonable possibility of material misstatement (i.e., cut‑off is not a relevant assertion).

In this case, after testing the completeness and accuracy of the sales register during the at-risk period to check that the aggregate value of revenue transactions is less than performance materiality, and performing risk assessment procedures to identify any significant or unusual sales transactions during the at-risk period, we might conclude there is only a remote risk of material misstatement for such period and no additional substantive procedures are necessary. In this example, an integral aspect of this evaluation is an assessment of the at‑risk period for the cut‑off.

Example 2: Revenue Cut‑Off

Entity XYZ’s performance obligation is satisfied and revenue recognition occurs at the time that the customer’s order is shipped from entity XYZ’s warehouse. Based upon the engagement team’s understanding of the revenue business process obtained during a walkthrough performed as part of the current period audit and review of the revenue testing performed in the prior year audit, the engagement team is aware that the status in the system is changed to ’shipped’ by warehouse personnel once the shipments are picked up by the carrier. The carrier pick up normally occurs on the same day the customer order is assembled by XYZ warehouse personnel for shipment.

The engagement team considered the following in their risk assessment:

- Average daily sales are $22.5M. Results of risk assessment procedures have supported the engagement team’s understanding that daily sales are consistent throughout the period.

- Based upon the average revenue transaction size of $100K, average number of shipments to customers are 225 per day.

- It would take an over or understatement of the number of shipments in excess of approximately 400 shipments (performance materiality of $40M divided by the average revenue transaction size of $100K) to cause a material misstatement of revenue due to an error in cut‑off.

Assume that the engagement team has concluded that there is no risk of material misstatement due to fraud with respect to cut-off and is therefore only considering the risk of error (further details of the fraud risk assessment and documentation are not provided for the purposes of this example).

Based on these facts, it would take an additional 400 erroneous shipments to generate a material error, which is not considered reasonably possible considering the average volume of 225 shipments per day and considering the at-risk period is only one day. Additionally, in order for revenue to be recognized without an actual product shipment, warehouse personnel would have to take action to erroneously reflect over 400 unshipped orders as “shipped” in the system during the at-risk period, which is also considered to have low likelihood of occurring. The engagement team updated their risk assessment procedures as of year end, including understanding of the revenue business process. Also, no unusual or unexpected relationships relevant to risk assessment for revenue cut-off were identified as a result of risk assessment analytics.

Given these considerations, the engagement team concluded there is no reasonable possibility of the risk of material misstatement associated with the Cut‑off assertion.

Throughout the audit, it is important to document judgments in support of our risk assessment procedures and conclusions. We are not necessarily required to document the rationale for our conclusion that an assertion is not relevant for a significant FSLI. Instead, we document the rationale if the basis for our conclusion is not already evident. When determined necessary, we document the rationale in sufficient detail to enable an experienced auditor, having no previous connection with the engagement, to understand the conclusions reached.

OAG Guidance

These examples illustrate a broad range of factors considered by the engagement team in determining the significant FSLIs and relevant assertions. The considerations illustrated do not reflect the documentation that engagement teams are expected to include in their workpapers. For example, even though each example identifies factors that do not contribute to the significant FSLI conclusion, it would not typically be necessary to document such factors.

Spare parts

| Scenario A—Spare parts is determined not to be significant but is a material FSLI | |

|

Background and preliminary risk assessment

Preliminary Conclusion The engagement team has concluded there is no reasonable possibility that the spare parts account could contain a material misstatement, and therefore, the spare parts FSLI is not identified as a significant FSLI. Although spare parts is not a significant FSLI it is quantitatively material and therefore, as required by CAS 330.18, the engagement team will still need to perform substantive procedures over this FSLI. For an example of substantive procedures that could be performed over selected assertions for this FSLI, as required by CAS 330.18, refer to the block “FSLIs not determined to be significant but that are material” below. Note that we would, in any event, also need to perform appropriate physical inventory observation procedures for this material FSLI, as CAS 501.4 requires us to attend physical inventory counting, if inventory is material. The engagement team also considered the potential impact on other areas in the audit. As an example, in the prior year, PP&E additions that included parts used from spare parts were agreed to spare parts records that were subject to substantive testing. Given that the spare parts account is not determined to be a significant FSLIs, testing over spare parts will be less extensive in the current year The engagement team will obtain source documents (e.g., invoice, PO) for all PP&E additions selected for testing, including audit evidence supporting transfers to the PP&E project from spare parts. |

|

| Scenario B - Spare parts is a significant FSLI | |

|

Consider the fact pattern above, with the following relevant changes:

Conclusion Given any of these alternative fact patterns, the engagement team may conclude there is a reasonable possibility of material misstatement within the spare parts account, and accordingly spare parts would be identified as a significant FSLI. In this case, controls (if applicable) and substantive testing would be performed to address the relevant assertions. |

|

Accounts receivable—Valuation

| Scenario A—Valuation is not a relevant assertion |

|

Background and preliminary risk assessment

Updating risk assessment procedures and other considerations The engagement team will update their risk assessment procedures as of year end, including:

The engagement team will also perform sufficient controls testing (if we plan to test controls) and substantive testing over the assertions that are relevant for accounts receivable (e.g., Accuracy, Existence/Occurrence). Preliminary Conclusion The engagement team has concluded that there is no reasonable possibility that Valuation of accounts receivable could contain a material misstatement, and therefore, Valuation is not a relevant assertion for this client’s $90 million accounts receivable balance, and therefore, no controls testing or substantive testing will be performed over the allowance for doubtful accounts (see the block “Significant FSLIs” above for relevant guidance). Given the facts and circumstances of this example, the engagement team documented judgments related to the determination that valuation is not a relevant assertion (including the risk assessment procedures performed and the quantitative and qualitative factors considered). |

| Scenario B—Valuation is a relevant assertion |

|

Consider the fact pattern above, with the following relevant changes:

Conclusion Given any of these alternative fact patterns, the engagement team may conclude there is a reasonable possibility of material misstatement within the allowance for doubtful accounts, and therefore, valuation would be a relevant assertion for accounts receivable. In this case, controls (if applicable) and substantive testing would be performed to address this assertion. |

Cash

| Background and preliminary risk assessment | |

| The entity’s financial statements include a Cash and cash equivalents FSLI balance of $13.8 million. Overall materiality is $8 million, and performance materiality is $6 million. The following trial balance shows the accounts for the Cash and cash equivalents FSLI balance: | |

| (in $000s) | |

| Current account xx1768—ABC Bank | 9,100 |

| Payroll account xx4569—ABC Bank | 1,700 |

| Deposits at cal—XYZ Bank | 3,000 |

| Cash and cash equivalents - total | 13,800 |

|

With respect to this FSLI we considered the following:

Conclusion Based on the factors above, we determine Cash and cash equivalents to be a significant FSLI. We determined the following relevant assertions: Accuracy; Completeness; Cut-off; Existence/Occurrence; Rights & Obligations; Presentation & Disclosure. For this significant FSLI we will identify risks of material misstatement at the assertion level and assess the level of inherent risk as normal, elevated, or significant. |

|

Prepaid Expenses

|

Back ground and preliminary risk assessment The entity’s financial statements include a Prepaid expenses FSLI balance of $9 million. Overall materiality is $8 million, and performance materiality is $6 million. With respect to this FSLI we considered the following:

Given that the balance largely comprises a fixed number of annual insurance premiums and monthly rent prepayments pursuant to the terms of insurance policies and formal leases, respectively, for which there has been virtually no change in the current period, there is not a reasonable possibility of a material misstatement related to the Completeness, Accuracy, Cut-Off, and Valuation assertions.

Conclusion After consideration of the factors above and the related risk assessment procedures performed, we conclude that prepaid expenses is a not significant but material FSLI (i.e., no assertions for which there is a risk of material misstatement, but the account balance exceeds performance materiality). Although there are no assertions for which we assessed there to be a reasonable possibility (i.e., more than remote likelihood) of a material misstatement occurring, CAS 330 requires that we perform substantive procedures for all material FSLIs. To fulfill this requirement, we will select assertions where we have concluded, if a misstatement were to occur in the Prepaid expenses FSLI, it could be material and we will direct any substantive procedures to these selected assertions. Based on our understanding of the Prepaid expenses FSLI, including the factors noted above, the selected assertions for this FSLI for which we plan to obtain substantive audit evidence are Existence/Occurrence and Accuracy. The rationale for not selecting other assertions for testing is as follows:

We will consider the evidence we obtain from our procedures over other significant FSLIs, including cash and accounts payable. We will also perform targeted testing of the two largest items on the prepaid expenses listing to address the risk that they may not exist or are inaccurately calculated. The testing comprises tracing to the supporting documentation (e.g., prepaid invoice, proof of payment) and recalculating the prepaid balance. This testing will cover 30% of the period end balance. Although the untested balance is above performance materiality, we likely would not perform additional testing for this FSLI if our testing is completed without noting exceptions. |

Salaries/Payroll Expenses

|

Background and preliminary risk assessment The entity’s financial statements include a Salaries/payroll expenses FSLI of $30 million. Overall materiality is $8 million, and performance materiality is $6 million. With respect to this FSLI we considered the following:

Conclusion Given the above factors, we determine the Salaries/payroll expenses FSLI to be a significant FSLI. We determined the following relevant assertions: Accuracy; Completeness; Existence/ Occurrence; Cut-off; Presentation & Disclosure. For this significant FSLI we will identify risks of material misstatement at the assertion level and assess the level of inherent risk as normal, elevated, or significant. |

CAS Requirement

For material classes of transactions, account balances or disclosures that have not been determined to be significant classes of transactions, account balances or disclosures, the auditor shall evaluate whether the auditor’s determination remains appropriate (CAS 315.36).

CAS Guidance

As explained in CAS 320, materiality and audit risk are considered when identifying and assessing the risks of material misstatement in classes of transactions, account balances and disclosures. The auditor’s determination of materiality is a matter of professional judgment, and is affected by the auditor’s perception of the financial information needs of users of the financial statements. For the purpose of this CAS and paragraph 18 of CAS 330, classes of transactions, account balances or disclosures are material if omitting, misstating or obscuring information about them could reasonably be expected to influence the economic decisions of users taken on the basis of the financial statements as a whole (CAS 315.A233).

There may be classes of transactions, account balances or disclosures that are material but have not been determined to be significant classes of transactions, account balances or disclosures (i.e., there are no relevant assertions identified) (CAS 315.A234).

|

Example: The entity may have a disclosure about executive compensation for which the auditor has not identified a risk of material misstatement. However, the auditor may determine that this disclosure is material based on the considerations in paragraph A233. |

Audit procedures to address classes of transactions, account balances or disclosures that are material but are not determined to be significant are addressed in CAS 330. When a class of transactions, account balance or disclosure is determined to be significant as required by paragraph 29, the class of transactions, account balance or disclosure is also a material class of transactions, account balance or disclosure for the purposes of paragraph 18 of CAS 330 (CAS 315.A235).

Not all assertions within a material class of transactions, account balance or disclosure are required to be tested. Rather, in designing the substantive procedures to be performed, the auditor’s consideration of the assertion(s) in which, if a misstatement were to occur, there is a reasonable possibility of the misstatement being material, may assist in identifying the appropriate nature, timing and extent of the procedures to be performed (CAS 330.A44).

OAG Guidance

As part of the OAG Risk Assessment Process, we form initial expectations about FSLIs that may be significant as part of our initial risk assessment procedures (OAG Audit 5013), we then identify significant FSLIs and relevant assertions that represent a risk of material misstatement.

As explained in the block “Significant FSLIs” above, an FSLI may be material but not determined to be significant, i.e., there is no risk of material misstatement and no relevant assertions associated with the FSLI even though it is considered material (e.g., they are above performance materiality or are considered material based on evaluation of the qualitative factors). Refer to the block "Significant FSLIs and relevant assertions – examples" for an illustrative example of an FSLI that is not determined to be significant but is material.

The more an FSLI exceeds performance materiality, the greater the likelihood it would be considered significant. Often FSLIs that exceed performance materiality will present at least a normal level risk of material misstatement for one or more assertions and therefore would be considered a significant FSLI. We need to exercise caution when determining that a material FSLIs is not significant, as we typically plan to obtain less controls and substantive audit evidence for FSLIs that are not determined to be significant. Therefore, if we inappropriately determine that a material FSLIs is not significant, this may lead to an ineffective testing strategy. In fact, we may not identify any ’not significant but material FSLIs’ on an engagement and it would not be common to identify multiple not significant FSLIs that are material. If we believe it may be appropriate to categorize multiple material FSLIs as ’not significant’ we need to carefully consider whether the likelihood of a material misstatement for all financial statement assertions is truly not even reasonably possible, including the completeness assertion. Identifying multiple FSLIs as not significant even though they are material, increases the risk that undetected misstatements in several FSLIs may, in the aggregate, be material to the financial statements as a whole.

It is important that senior members of the engagement team are involved in making these risk assessment judgments. Consider consulting Audit Services if we believe it may be appropriate to categorize multiple material FSLIs as ’not significant’ or in situations when the process of scoping and identifying significant FSLIs is particularly complex or difficult. Evaluating whether our determination that a material FSLI is not a significant FSLI remains appropriate, is part of our overall evaluation discussed in OAG Audit 5044.

Even though there are no ’relevant assertions’ associated with an FSLI that is not determined to be significant but that is material (i.e., there is no risk of material misstatement at the assertion level), CAS 330.18 requires us to perform substantive procedures for any quantitatively or qualitatively material FSLIs, irrespective of the assessed risks of material misstatement. This requirement is a recognition that any risk assessment is judgmental, is based only on information obtained and considered by the auditor and therefore may not identify all risks of material misstatement. The requirement for the audit response to be substantive procedures is based on a recognition that there are inherent limitations to any entity’s system of internal controls, including the risk of management override.

When we intend to leverage substantive procedures performed over a balance sheet FSLI to provide audit evidence over a related income statement FSLI (e.g., we intend to leverage substantive procedures performed over prepaid expenses to obtain some or all of the audit evidence needed to address the presentation and disclosure and accuracy assertions for the administrative expenses FSLI), and the related balance sheet FSLI is determined to be not significant (e.g., prepaid expenses are material but are determined not to be a significant FSLI), we need to consider whether the nature and extent of substantive procedures we had intended to leverage will provide sufficient evidence to respond to the risks of material misstatement identified for the applicable income statement FSLI. If we determine that further evidence is necessary, we need to plan and perform further procedures over the income statement FSLI.

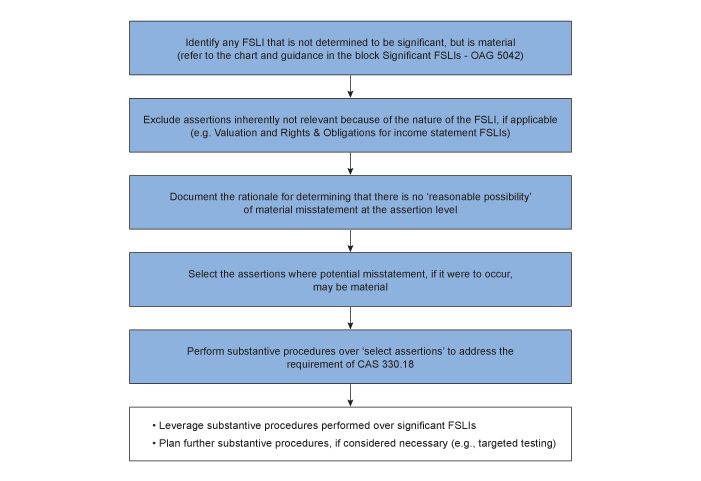

The following chart summarizes the process followed when selecting assertions and planning substantive procedures to address FSLIs that are not determined to be significant but are material. This chart does not aim to illustrate all relevant considerations that need to be taken into account in making the underlying judgments. For the relevant factors to consider when making these judgments, refer to the detailed guidance and examples provided further in this block:

Selecting assertions to test

CAS 330.A44 explains that we are not required to test all assertions associated with a material FSLI. For significant FSLIs (i.e., those for which we identify relevant assertions because there is a reasonably possible risk of material misstatement), we direct our testing to the relevant assertions. For an FSLI that we do not determine to be significant (i.e., those for which we identified no relevant assertions), we identify the assertions for which we will perform substantive procedures by identifying one or more assertions for which a misstatement, if it were to occur, could be material. For certain FSLIs, there are assertions that we do not consider for selection because they may inherently not be relevant because of the nature of the FSLI (e.g., Valuation of payroll expense or Rights and Obligations for cost of sales).

If we believe that a potential misstatement at the assertion level could be material, if such a misstatement were to occur, we would typically select that assertion for purposes of planning our required substantive procedures for that material FSLI. In contrast, if we believe that a potential misstatement at the assertion level could not be material, if such a misstatement were to occur, we typically would not select that assertion for purposes of planning our required substantive procedures for that material FSLI. For example, if we determine that property, plant and equipment (PP&E) is not a significant FSLI but it is a material FSLI and the entity’s PP&E additions and disposals before and after period end are clearly immaterial, we would likely not select the Completeness or Cut-off assertions for testing. Similarly, if our risk assessment procedures identified no impairment indicators and our risk assessment analytics did not indicate any unusual trends in the depreciation expense, we likely would not select the Valuation assertion for substantive testing. This might leave the Accuracy and Existence assertions as the PP&E assertions, for which we conclude that a misstatement could be material if it were to occur and therefore we would likely select the Accuracy and Existence assertions and plan substantive procedures to address them.

We document the rationale for selecting assertions to test for FSLIs that are not considered significant but are material unless it is otherwise evident from our risk assessment documentation. When we decide it is appropriate to document the rationale for our selection of assertions over which to perform substantive procedures, we do so in sufficient detail to enable an experienced auditor, having no previous connection with the engagement, to understand the conclusions reached.

Nature and extent of substantive procedures for an FSLI that is not determined to be significant but is material

The nature and extent of the substantive procedures we perform over an FSLI that is not determined to be significant but that is material would be a matter of professional judgment, including consideration of the nature and composition of the FSLI, size of the FSLI and our evaluation of the likelihood and magnitude of potential misstatements associated with the FSLI.

The nature and/or extent of substantive procedures we perform for an FSLI that is not determined to be significant but is material, would generally be less than the substantive procedures we might perform had the FSLI been determined to be a significant FSLI. The aggregate level of evidence planned from substantive procedures would not necessarily need to achieve a low level of evidence for such an FSLI not considered significant but that is material.

We first consider whether substantive procedures planned to address risks of material misstatement for significant FSLIs may also provide substantive evidence that addresses the selected assertion(s) for the FSLI not determined to be significant but that is material. If so, we evaluate whether leveraging this substantive testing will provide sufficient appropriate substantive evidence or whether further audit procedures may need to be planned. For example, substantive procedures performed over cost of sales and procedures performed during our attendance of the physical inventory observation may provide sufficient evidence over the selected assertions of existence, cutoff and completeness for a raw materials FSLI that we concluded was not significant but for which the balance exceeded performance materiality.

If leveraged procedures do not provide sufficient appropriate evidence, we perform further substantive procedures for the FSLIs not considered significant but that are material. Such procedures may include substantive analytics or tests of details. Note that it would generally not be necessary to perform audit sampling to address selected assertions for an FSLI not considered significant, as it would likely not represent an efficient testing strategy. Instead, it may be that selecting items for targeted testing based on a monetary value threshold will provide sufficient evidence.

Note that CAS 501.4 requires us to attend physical inventory counting if inventory is material. Therefore, even when we consider an inventory FSLI to be not significant but that is material, we would need to perform appropriate procedures over the physical inventory observations.

Examples

Consider the following illustrative examples of substantive procedures that we might perform for an FSLI we do not consider significant but is material. This example is provided solely for illustrative purposes and may not reflect the only judgments or testing strategy, depending on engagement-specific facts and circumstances. Also note that these examples do not illustrate the rationale for concluding that the FSLIs are not significant and solely focus on selecting assertions and planning a testing strategy, after reaching a determination that the FSLI is not significant but is material. Refer to the blocks "Significant FSLIs" and "Relevant assertions for guidance".

Example 1—Spare Parts

Background

Refer to the detailed scenario circumstances previously provided in the block “Significant FSLIs and relevant assertions – examples” above.

Selected Assertions

- Based on the understanding of the purchases and payables business process and supplier contracts, and given that purchases and issuances before and after the period end are clearly immaterial, the engagement team determined that no substantive procedures are planned for Cut-off, Completeness and Rights & Obligations ( i.e., these assertions will not be selected for testing).

- Given the nature of the spare parts balance, which primarily comprises items that are frequently used and not subject to notable risk of obsolescence because technological changes to plant equipment in this industry is slow and there have been virtually no write-offs due to obsolescence, the engagement team determined that no substantive procedures are planned for Valuation (i.e., this assertion will not be selected for testing).

- Based on the procedures performed in the course of expense classification testing, which includes plant repair and maintenance expense, and given that there is no separate disclosure of spare parts in the financial statements, the engagement team determined that no substantive procedures are planned for Presentation & Disclosure (i.e., this assertion will not be selected for testing).

- Because the spare parts balance exceeds performance materiality, the engagement team concludes that an error related to the Accuracy or Existence/Occurrence assertion, if it were to occur, could be material. Therefore, the engagement team will plan substantive procedures to address the Accuracy and Existence/Occurrence assertions.

Planned Substantive Procedures

The following substantive procedures are planned to address the selected assertions:

- The engagement team determines that procedures performed during the physical inventory observation which included the spare parts, provide sufficient substantive audit evidence over Existence/Occurrence. Note that we need to perform physical inventory observation procedures for the material spare parts FSLI in line with the requirements of CAS 501.

- The engagement team plans to perform a targeted test of the 10 largest items included in the spare parts balance as of the end of the reporting period to verify the Accuracy of the spare parts cost by tracing to supporting documentation of the parts purchases that comprise the aggregate quantity. The number of items to test was determined based on the engagement team’s professional judgment and is considered to provide sufficient substantive evidence over Accuracy of the spare parts balance. The total amount of tested spare parts is $5 million (and the total spare parts balance is $150 million).

Example 2— Property, Plant and Equipment

Background

Overall materiality is $100 million, performance materiality is $75 million. As of the end of the reporting period, the gross and net book values of PP&E are $350 million and $200 million, respectively. Total additions for the reporting period are $50 million, and disposals are $5 million. Annual depreciation expense is approximately $40 million. All PP&E items are depreciated on a straight line basis.

The engagement team performed the following risk assessment procedures:

- Obtained a roll-forward of the PP&E account and agreed i) beginning and ending amounts to the trial balance, and ii) activity to account detail (standard reports).

- Obtained a detailed schedule of depreciation expense and agreed the total to the rollforward. Performed risk assessment analytics, comparing the total annual recorded annual depreciation expense to the team’s expectation of annual depreciation expense. The engagement team’s expectation of annual depreciation expense was based on the average PP&E balances and their associated weighted average useful lives.

- Obtained a detailed listing of the additions and agreed the total to the rollforward.

- Validated through review of the rollforward, there were no other transactions included in the year end general ledger balance.

- Reviewed the operating results and noted no significant changes or declines in the business that could be indicative of a triggering event.

- Inquired of management and read board minutes to validate no other expected changes in the account and the related disclosure, including no changes to the entity’s capitalization policies, and to validate there were no indicators of a risk of obsolescence or any possible triggering events. The engagement team also inquired to validate with management that there were no changes in the entity’s process to prepare the disclosure.

- Obtained and scanned the repairs and maintenance expense subledger detail to identify unusual activity, such as individually large items or large fluctuations in the volume of repairs and maintenance activity.

- Based on the procedures noted above, the PP&E FSLI was determined not to be a significant FSLI but the balance is material.

- These considerations and judgments were appropriately documented by the engagement team in the audit file.

Selected Assertions

- Based on the understanding of the PP&E business process and contractual arrangements with vendors, and given that additions and disposals before and after the period end are immaterial, the engagement team determined that no substantive procedures are planned for Cutoff, Completeness and Rights & Obligations ( i.e., these assertions will not be selected for testing).

- Based on the risk assessment procedures described above, given that no impairment indicators were identified, and the fact that depreciation expense is not material, the engagement team determined that no substantive procedures are planned for Valuation (i.e., this assertion will not be selected for testing).

- Based on an understanding of the business process, risk assessment analytics and work performed during prior year audits, the engagement team determined that no substantive procedures are planned for Existence (i.e., this assertion will not be selected for testing).

- Given that there is a separate PP&E footnote included in the financial statements that includes information known to be of interest to the entity’s lenders, the engagement team determined it would plan substantive procedures to address the Presentation & Disclosure assertion (i.e., an error in the disclosure, if it were to occur, could be qualitatively material to the entity’s lenders).

- Because the PP&E balance exceeds performance materiality, the engagement team concludes that an error related to the Accuracy assertion, if it were to occur, could be material. Therefore, the engagement team will plan substantive procedures to address the Accuracy assertion.

Planned Substantive Procedures

The following substantive procedures are planned to address the selected assertions:

- The engagement team plans to perform a targeted test of the 5 largest PP&E additions made during the reporting period to verify the Accuracy of the related fixed asset items. The number of items to test was determined based on the engagement team’s professional judgment and is considered to provide sufficient substantive evidence over the Accuracy assertion. The total acquisition cost of tested PP&E additions totals $5 million.

- Substantive procedures (e.g., check for mathematical accuracy, check agreement to subledger totals and check for consistency and internal cross-referencing) will be performed over the PP&E disclosure (consistent with guidance provided in OAG Audit 9030) to address Presentation & Disclosure.