Annual Audit Manual

COPYRIGHT NOTICE — This document is intended for internal use. It cannot be distributed to or reproduced by third parties without prior written permission from the Copyright Coordinator for the Office of the Auditor General of Canada. This includes email, fax, mail and hand delivery, or use of any other method of distribution or reproduction. CPA Canada Handbook sections and excerpts are reproduced herein for your non-commercial use with the permission of The Chartered Professional Accountants of Canada (“CPA Canada”). These may not be modified, copied or distributed in any form as this would infringe CPA Canada’s copyright. Reproduced, with permission, from the CPA Canada Handbook, The Chartered Professional Accountants of Canada, Toronto, Canada.

3093 Determining the procedures to perform when using auditor’s experts

Dec-2023

In This Section

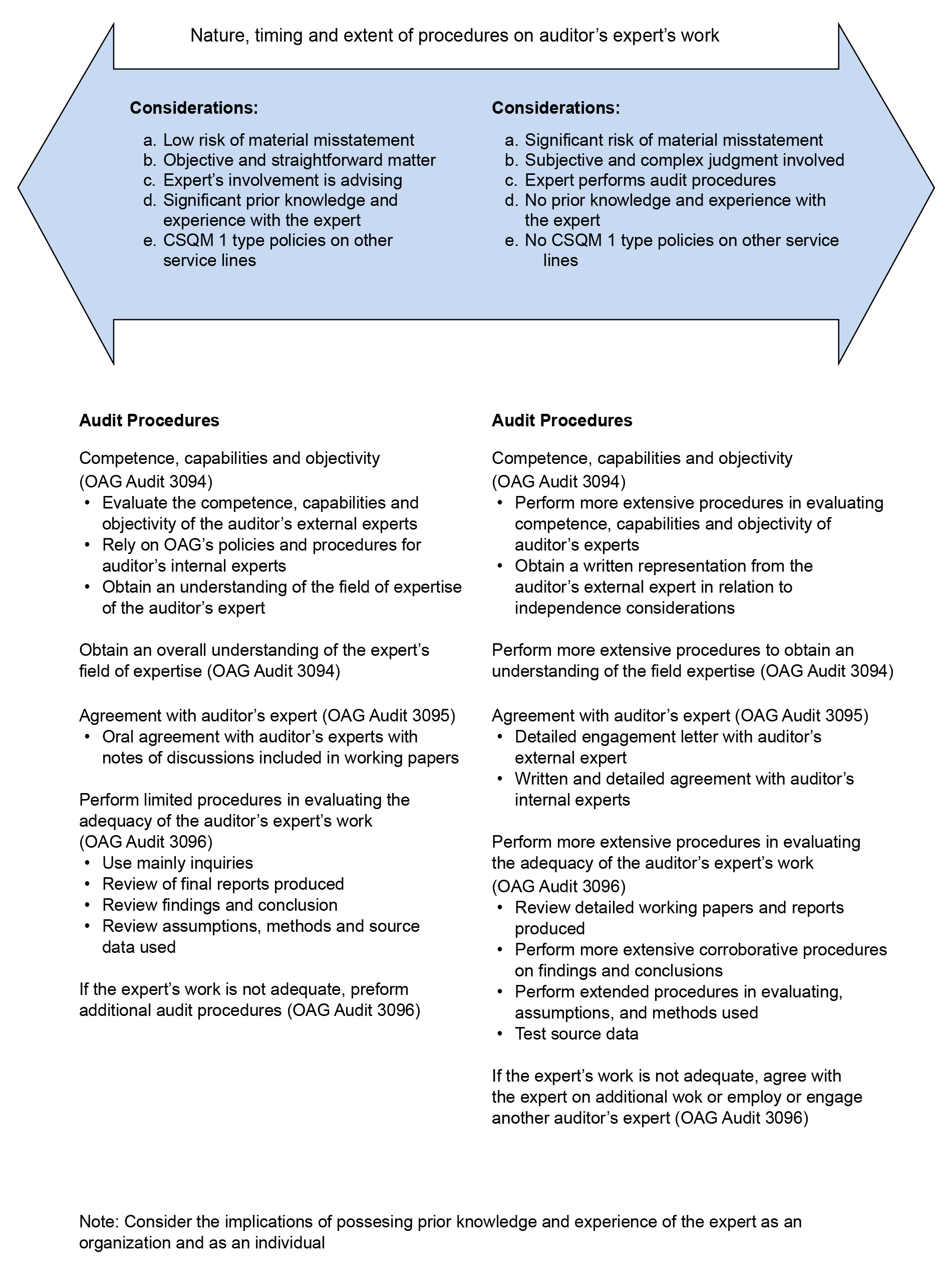

Nature, timing, and extent of audit procedures

Individual versus organization

CAS Requirement

The nature, timing and extent of the auditor’s procedures with respect to the requirements in paragraphs 9-13 of this CAS will vary depending on the circumstances. In determining the nature, timing and extent of those procedures, the auditor shall consider matters including (CAS 620.8)

(a) the nature of the matter to which that expert’s work relates,

(b) the risks of material misstatement in the matter to which that expert’s work relates,

(c) the significance of that expert’s work in the context of the audit,

(d) the auditor’s knowledge of and experience with previous work performed by that expert, and

(e) whether that expert is subject to the auditor’s firm’s system of quality management.

CAS Guidance

The nature, timing and extent of audit procedures with respect to the requirements in paragraphs 9-13 of this CAS will vary depending on the circumstances. For example, the following factors may suggest the need for different or more extensive procedures than would otherwise be the case (CAS 620.A10):

-

The work of the auditor’s expert relates to a significant matter that involves subjective and complex judgments.

-

The auditor has not previously used the work of the auditor’s expert, and has no prior knowledge of that expert’s competence, capabilities and objectivity.

-

The auditor’s expert is performing procedures that are integral to the audit, rather than being consulted to provide advice on an individual matter.

-

The expert is an auditor’s external expert and is not, therefore, subject to the firm’s system of quality management.

OAG Guidance

After considering the circumstances of each engagement, the nature, timing, and extent of procedures to be performed on auditor’s expert’s work may be viewed along a continuum as follows:

CAS Guidance

It is necessary to apply judgment when considering how the requirements of this CAS are affected by the fact that an auditor’s expert may be either an individual or an organization. For example, when evaluating the competence, capabilities and objectivity of an auditor’s expert, it may be that the expert is an organization the auditor has previously used, but the auditor has no prior experience of the individual expert assigned by the organization for the particular engagement; or it may be the reverse, that is, the auditor may be familiar with the work of an individual expert but not with the organization that expert has joined. In either case, both the personal attributes of the individual and the managerial attributes of the organization (such as systems of quality control the organization implements) may be relevant to the auditor’s evaluation. (CAS 620.A3)

Refer to OAG Audit 3062 for guidance when using the Office’s internal specialists.

CAS Guidance

An auditor’s internal expert may be a partner or staff (i.e., personnel), including temporary staff, of the auditor’s firm and, therefore, subject to the system of quality management of that firm in accordance with CSQM 1 or requirements that are at least as demanding. An auditor’s internal expert may also be a partner or staff, including temporary staff, of a network firm, and is subject to the firm’s policies or procedures for network requirements and network services in accordance with CSQM 1. In some instances, the auditor’s internal expert of a network firm may be subject to common quality management policies or procedures as the auditor’s firm, given that they are part of the same network. (CAS 620.A11)

CSQM 1 requires the firm to address the use of resources from a service provider, which includes the use of an external expert. An auditor’s external expert is not a member of the engagement team and may not be subject to the firm’s policies or procedures under its system of quality management. Furthermore, the firm’s policies or procedures for relevant ethical requirements may include policies or procedures that apply to the auditor’s external expert. In some cases, relevant ethical requirements or law or regulation may require that an auditor’s external expert be (CAS 620.A12):

-

Treated as a member of the engagement team (.i.e, the external expert may be subject to relevant ethical requirements, including those related to independence); or

-

Subject to other professional requirements.

As described in CAS 220, quality management at the engagement level is supported by the firm’s system of quality management and informed by the specific nature and circumstances of the audit engagement. For example, the auditor may be able to depend on the firm’s related policies or procedures in respect of (CAS 620.A13):

-

Competence and capabilities, through recruitment and training programs.

-

Objectivity. Auditor’s internal experts are subject to relevant ethical requirements, including those relating to independence.

-

The auditor’s evaluation of the adequacy of the auditor’s expert’s work. For example, the firm’s training programs may provide auditor’s internal experts with an appropriate understanding of the interrelationship of their expertise with the audit process. Reliance on such training may affect the nature, timing and extent of the auditor’s procedures to evaluate the adequacy of the auditor’s expert’s work.

-

Adherence to regulatory and legal requirements, through monitoring processes.

-

Agreement with the auditor’s expert.

Matters that the auditor may take into account when determining whether to depend on the firm’s policies or procedures are described in CAS 220. Depending on the firm’s policies or procedures does not reduce the auditor’s responsibility to meet the requirements of this CAS.

OAG Guidance

The nature, timing and extent of procedures to be performed by the engagement teams on auditor’s internal experts are affected by whether the Office has implemented quality management policies and procedures in accordance with CSQM 1 requirements. If such policies and procedures are in place, we can rely on OAG’s system of quality management and therefore, generally, engagement teams will not need to perform additional procedures when evaluating their competence, capabilities and objectivity.

OAG Guidance

Consider the auditor’s expert’s involvement in team and client meetings. It is generally expected that auditor’s internal experts will be involved in such meetings, as appropriate. If involving auditor’s external experts in meetings, consider confidentiality issues. If appropriate, hold meetings with such experts separate from wider team or client meetings so that discussion is specific to the expert’s work.

|

Team planning meetings |

Share knowledge of risk areas and entity-specific issues in the area of expertise. Assist with development of audit plan. Assist with identification of risks of material misstatement. Provide insight to determine the extent and requirements of auditor’s expert’s involvement in the audit. |

|

Taking stock meeting |

Discuss progress of work. Discuss results of work performed, conclusions reached, and audit findings. Identify any changes in the audit plan resulting from initial work. Assist with identifying issues to communicate to management and to those charged with governance. |

|

Debriefing meeting |

Provide feedback on the effectiveness and efficiency of the auditor’s expert’s involvement and on communication with the core assurance team. |

|

Meeting(s) with the entity and management’s experts (if relevant) |

Discuss risk issues identified so far, and assist in identifying and discussing any additional concerns raised by the entity. |

| Meeting | Auditor’s experts contribution |

|---|