Annual Audit Manual

COPYRIGHT NOTICE — This document is intended for internal use. It cannot be distributed to or reproduced by third parties without prior written permission from the Copyright Coordinator for the Office of the Auditor General of Canada. This includes email, fax, mail and hand delivery, or use of any other method of distribution or reproduction. CPA Canada Handbook sections and excerpts are reproduced herein for your non-commercial use with the permission of The Chartered Professional Accountants of Canada (“CPA Canada”). These may not be modified, copied or distributed in any form as this would infringe CPA Canada’s copyright. Reproduced, with permission, from the CPA Canada Handbook, The Chartered Professional Accountants of Canada, Toronto, Canada.

2335 Determining the type of work to be performed on the financial information of components

Jun-2020

In This Section

Different types of work that can be performed on components

Factors affecting the type of work

Components that are not significant components

Group consisting only of components not considered significant components

Components subject to audit by statute, regulation or other reason

Overview

This section discusses:

- Different types of work that can be performed on components

- Factors affecting the type of work

CAS Requirement

The auditor is required to design and implement appropriate responses to address the assessed risks of material misstatement of the financial statements. The group engagement team shall determine the type of work to be performed by the group engagement team, or the component auditors on its behalf, on the financial information of the components (see paragraphs 26-29). The group engagement team shall also determine the nature, timing and extent of its involvement in the work of the component auditors (see paragraphs 30-31). (CAS 600.24)

OAG Guidance

The group or component auditor performs one of the following (which are described in “Explanation of the Different Types of Work To be Performed at Components”):

- An audit of the financial information of the component using component materiality.

- An audit of one or more account balances, classes of transactions or disclosures.

- Specified procedures relating to the likely significant risks of material misstatement of the group financial statements.

- A review of the financial information of a non-significant component using component materiality.

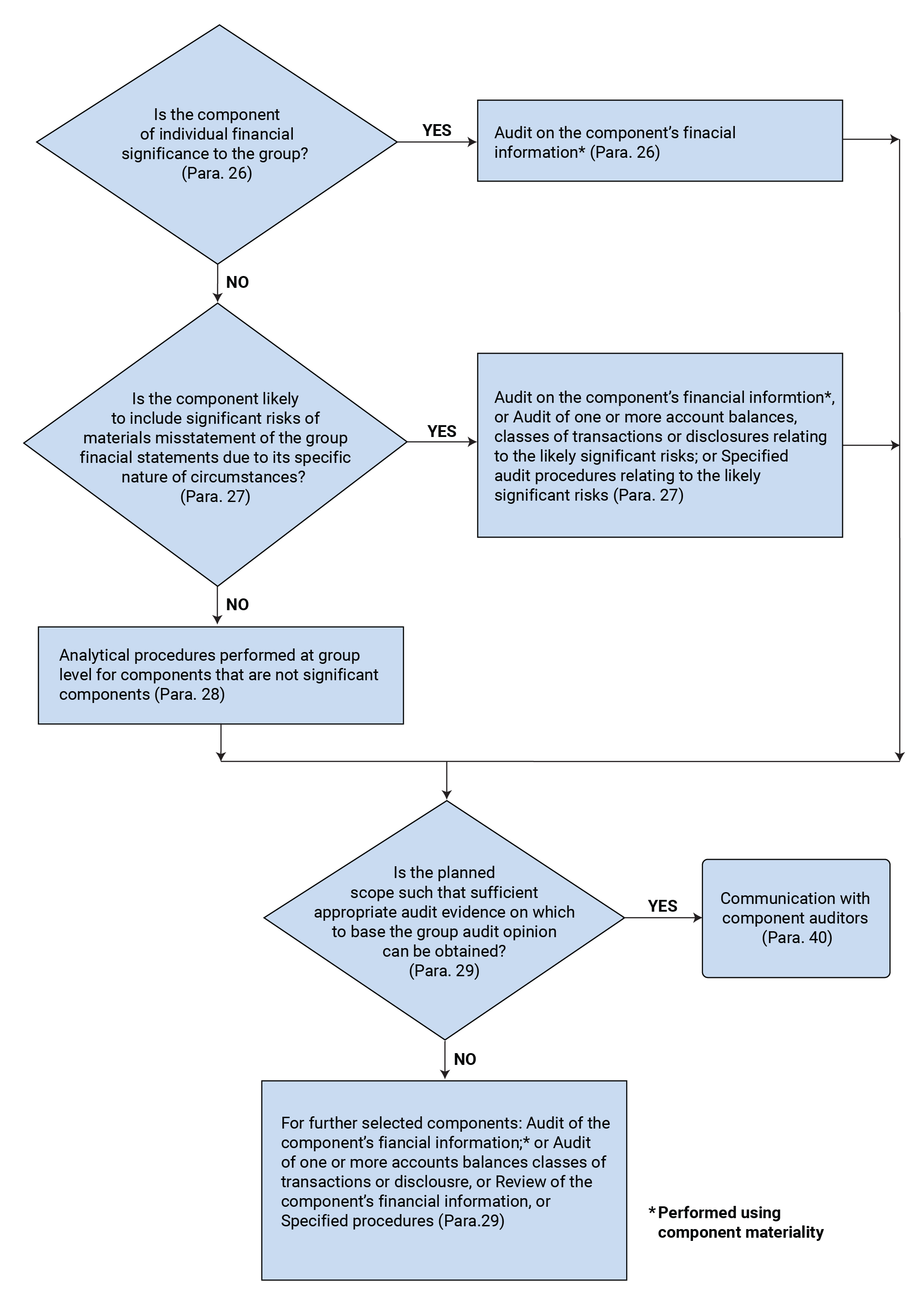

An overview of group audit scoping decisions is set forth in the scoping decisions flowchart in this section.

For additional guidance on determining the nature, timing, and extent of the group engagement team’s involvement in the work of the component auditors, see OAG Audit 2324.

CAS Requirement

If the nature, timing and extent of the work to be performed on the consolidation process or the financial information of the components are based on an expectation that group-wide controls are operating effectively, or if substantive procedures alone cannot provide sufficient appropriate audit evidence at the assertion level, the group engagement team shall test, or request a component auditor to test, the operating effectiveness of those controls. (CAS 600.25)

CAS Guidance

The group engagement team’s determination of the type of work to be performed on the financial information of a component and its involvement in the work of the component auditor is affected by (CAS 600.A47)

(a) the significance of the component,

(b) the identified significant risks of material misstatement of the group financial statements,

(c) the group engagement team’s evaluation of the design of group-wide controls and determination whether they have been implemented, and

(d) the group engagement team’s understanding of the component auditor.

OAG Guidance

For additional guidance on the group engagement team’s evaluation of the design and implementation of group-wide controls, see OAG Audit 5031).

Sharing evidence is discussed further in Shared Service Centres OAG Audit 2380.

For further guidance on scoping of components for journal entry testing, refer to OAG Audit 5509.

CAS Requirement

For a component that is significant due to its individual financial significance to the group, the group engagement team, or a component auditor on its behalf, shall perform an audit of the financial information of the component using component materiality. (CAS 600.26)

For a component that is significant because it is likely to include significant risks of material misstatement of the group financial statements due to its specific nature or circumstances, the group engagement team, or a component auditor on its behalf, shall perform one or more of the following (CAS 600.27):

(a) An audit of the financial information of the component using component materiality.

(b) An audit of one or more account balances, classes of transactions or disclosures relating to the likely significant risks of material misstatement of the group financial statements.

(c) Specified audit procedures relating to the likely significant risks of material misstatement of the group financial statements.

CAS Guidance

The group engagement team may identify a component as a significant component because that component is likely to include significant risks of material misstatement of the group financial statements due to its specific nature or circumstances. In that case, the group engagement team may be able to identify the account balances, classes of transactions or disclosures affected by the likely significant risks. Where this is the case, the group engagement team may decide to perform, or request a component auditor to perform, an audit of only those account balances, classes of transactions or disclosures. For example, in the situation described in paragraph A6, the work on the financial information of the component may be limited to an audit of the account balances, classes of transactions and disclosures affected by the foreign exchange trading of that component. Where the group engagement team requests a component auditor to perform an audit of one or more specific account balances, classes of transactions or disclosures, the communication of the group engagement team (see paragraph 40) takes account of the fact that many financial statement items are interrelated. (CAS 600.A48)

The group engagement team may design audit procedures that respond to a likely significant risk of material misstatement of the group financial statements. For example, in the case of a likely significant risk of inventory obsolescence, the group engagement team may perform, or request a component auditor to perform, specified audit procedures on the valuation of inventory at a component that holds a large volume of potentially obsolete inventory, but that is not otherwise significant. (CAS 600.A49)

OAG Guidance

The different components types are discussed in OAG Audit 2323.

For guidance on the requirements from the component auditor, refer to OAG Audit 2336.

CAS Requirement

For components that are not significant components, the group engagement team shall perform analytical procedures at group level. (CAS 600.28)

If the group engagement team does not consider that sufficient appropriate audit evidence on which to base the group audit opinion will be obtained from (CAS 600.29):

(a) the work performed on the financial information of significant components,

(b) the work performed on group-wide controls and the consolidation process, and

(c) the analytical procedures performed at group level,

the group engagement team shall select components that are not significant components and shall perform, or request a component auditor to perform, one or more of the following on the financial information of the individual components selected:

- An audit of the financial information of the component using component materiality.

- An audit of one or more account balances, classes of transactions or disclosures.

- A review of the financial information of the component using component materiality.

- Specified procedures.

The group engagement team shall vary the selection of components over a period of time.

CAS Guidance

Depending on the circumstances of the engagement, the financial information of the components may be aggregated at various levels for purposes of the analytical procedures. The results of the analytical procedures corroborate the group engagement team’s conclusions that there are no significant risks of material misstatement of the aggregated financial information of components that are not significant components. (CAS 600.A50)

The group engagement team’s decision as to how many components to select in accordance with paragraph 29, which components to select, and the type of work to be performed on the financial information of the individual components selected may be affected by factors such as the following (CAS 600.A51):

-

The extent of audit evidence expected to be obtained on the financial information of the significant components.

-

Whether the component has been newly formed or acquired.

-

Whether significant changes have taken place in the component.

-

Whether the internal audit function has performed work at the component and any effect of that work on the group audit.

-

Whether the components apply common systems and processes.

-

The operating effectiveness of group-wide controls.

-

Abnormal fluctuations identified by analytical procedures performed at group level.

-

The individual financial significance of, or the risk posed by, the component in comparison with other components within this category.

-

Whether the component is subject to audit required by statute, regulation or for another reason.

Including an element of unpredictability in selecting components in this category may increase the likelihood of identifying material misstatement of the components’ financial information. The selection of components is often varied on a cyclical basis.

A review of the financial information of a component may be performed in accordance with International Standard on Review Engagements (ISRE) 2400 or ISRE 2410, adapted as necessary in the circumstances. The group engagement team may also specify additional procedures to supplement this work. (CAS 600.A52)

OAG Guidance

Consistent with the CAS requirements, when assessing the sufficiency of evidence to be obtained, we first assess the evidence to be obtained from:

- the work performed on the financial information of significant components,

- the work performed on group-wide controls and the consolidation process, and

- the analytical procedures performed at group level.

Our audit work on significant components is a key part of the evidence to be obtained; however, whether or not it will be sufficient to be a substantive portion of the audit work will depend on the structure of the group.

The sufficiency of audit evidence in a group audit considers both quantitative and qualitative factors and requires a significant degree of auditor judgement. In a group audit it is not the intent that the quantitative assessment of sufficiency is to be based on a financial statement line item assessment of untested balances compared with overall group performance materiality, nor is there an expectation or requirement to perform incremental procedures on all balances within non-significant components that are above overall materiality.

When sufficient appropriate audit evidence can be obtained through the work performed on the financial information of significant components; the work performed on group-wide controls and the consolidation process; and the analytical procedures performed at group level, then neither an audit of one or more of the non-significant components; an audit of one or more of account balances within the non-significant components; a review of one or more of the non-significant components; nor incremental specified procedures would be required. However, engagement teams may consider performing work at non-significant components, in order to address fraud risk and to add an aspect of unpredictability into procedures.

In many circumstances, the analytical procedures over components that are not significant components may be performed as part of the group engagement team’s risk assessment analytics at the consolidated financial statement level, including disaggregated revenue analytics. The objective of performing analytical procedures over components that are not significant components is consistent with the objective of risk assessment analytics, which is to obtain an understanding of the business and its environment and to help assess the risk of material misstatement in order to determine the nature, timing, and extent of further audit procedures.

When using risk assessment analytics to meet this requirement and no additional risks are identified that require a change in audit strategy, the group engagement team may document as part of the results that no risks were identified at the components that are not significant components that would lead the group engagement team to perform, or to ask a component auditor to perform, any additional procedures on the financial information of one or more of these components. If the results of the risk assessment analytics indicate there may be a risk of material misstatement at one or more of these components, the group engagement team need to document the nature, timing and extent of procedures that will be performed to address the identified risk.

The results of the components that are not significant components would then also be considered when performing the overall conclusion analytics at the consolidated level.

We consider the factors below, along with any others relevant in the specific engagement circumstances, in evaluating whether sufficient appropriate evidence will be obtained from planned procedures:

|

Evaluate whether sufficient appropriate evidence is planned. Consideration of need to plan additional procedures at components that are not significant |

|

Impact of factors below on decision to plan testing at components that are not significant in concluding on sufficiency of audit evidence for the group

|

|

Group Structure |

|

|

Group wide controls/control environment |

|

|

Results of risk assessment analytics |

|

|

Other considerations |

|

CAS Guidance

As explained in paragraph A13, a group may consist only of components that are not significant components. In these circumstances, the group engagement team can obtain sufficient appropriate audit evidence on which to base the group audit opinion by determining the type of work to be performed on the financial information of the components in accordance with paragraph 29. It is unlikely that the group engagement team will obtain sufficient appropriate audit evidence on which to base the group audit opinion if the group engagement team, or a component auditor, only tests group-wide controls and performs analytical procedures on the financial information of the components. (CAS 600.A53)

OAG Guidance

The provisions of CAS 600.A13 are discussed in OAG Audit 2321.

The group engagement team needs to select components that are not significant components and perform, or request a component auditor to perform, one or more of the four types of work included in CAS 600.29, as discussed in “Components that are Not Significant Components.”

The group engagement team’s decision as to how many and which components to select and the type of work to be performed on the financial information of the individual components selected may be affected by factors included in the previous section “Components that are Not Significant Components.”

Rotation of Scope Options—Financial Statement Only

Rotation of scope options over a number of years is useful and is to be considered to support the financial statement opinion only when there are a number of components, none of which is individually significant, but in total they are material to the entity as a whole.

CAS Guidance

A component auditor may be required by statute, regulation or for another reason, to express an audit opinion on the financial statements of a component. The group engagement team may decide to use the audit evidence on which the audit opinion on the financial statements of the component is based to provide audit evidence for the group audit, but the requirements of this CAS nevertheless apply. (CAS 600.3)

Factors that may affect the group engagement team’s decision whether to use an audit required by statute, regulation or for another reason to provide audit evidence for the group audit include the following (CAS 600.A1):

- Differences in the financial reporting framework applied in preparing the financial statements of the component and that applied in preparing the group financial statements.

- Differences in the auditing and other standards applied by the component auditor and those applied in the audit of the group financial statements.

- Whether the audit of the financial statements of the component will be completed in time to meet the group reporting timetable.

OAG Guidance

The requirements of CAS 600 that apply when using the audit evidence on which the audit opinion on the financial statements of the component is based are primarily those related to understanding the component auditor, materiality, scoping, and communications.

CAS Guidance

The diagram shows how the significance of the component affects the group engagement team’s determination of the type of work to be performed on the financial information of the component. (CAS 600.A47)

.png)