Annual Audit Manual

COPYRIGHT NOTICE — This document is intended for internal use. It cannot be distributed to or reproduced by third parties without prior written permission from the Copyright Coordinator for the Office of the Auditor General of Canada. This includes email, fax, mail and hand delivery, or use of any other method of distribution or reproduction. CPA Canada Handbook sections and excerpts are reproduced herein for your non-commercial use with the permission of The Chartered Professional Accountants of Canada (“CPA Canada”). These may not be modified, copied or distributed in any form as this would infringe CPA Canada’s copyright. Reproduced, with permission, from the CPA Canada Handbook, The Chartered Professional Accountants of Canada, Toronto, Canada.

5012.1 Overview

Sep-2022

In this Section

CAS Guidance

Risk assessment analytics

Analytical procedures help identify inconsistencies, unusual transactions or events, and amounts, ratios, and trends that indicate matters that may have audit implications. Unusual or unexpected relationships that are identified may assist the auditor in identifying risks of material misstatement, especially risks of material misstatement due to fraud (CAS 315.A27).

Analytical procedures performed as risk assessment procedures may therefore assist in identifying and assessing the risks of material misstatement by identifying aspects of the entity of which the auditor was unaware or understanding how inherent risk factors, such as change, affect susceptibility of assertions to misstatement (CAS 315.A28).

Obtaining an understanding of the entity and its environment, the applicable financial reporting framework and the entity’s system of internal control

The auditor’s understanding of the entity and its environment and the applicable financial reporting framework may also assist the auditor in developing initial expectations about the classes of transactions, account balances and disclosures that may be significant classes of transactions, account balances and disclosures. These expected significant classes of transactions, account balances and disclosures form the basis for the scope of the auditor’s understanding of the entity’s information system (CAS 315.A49).

OAG Guidance

OAG Audit 5012 provides guidance on performing risk assessment analytics and on how we utilize the preliminary understanding obtained from our risk assessment procedures to develop initial expectations about risks of material misstatement and the classes of transactions, account balances and disclosures that may be significant to direct elements of the further risk assessment procedures that we perform.

|

Why is this important?:

|

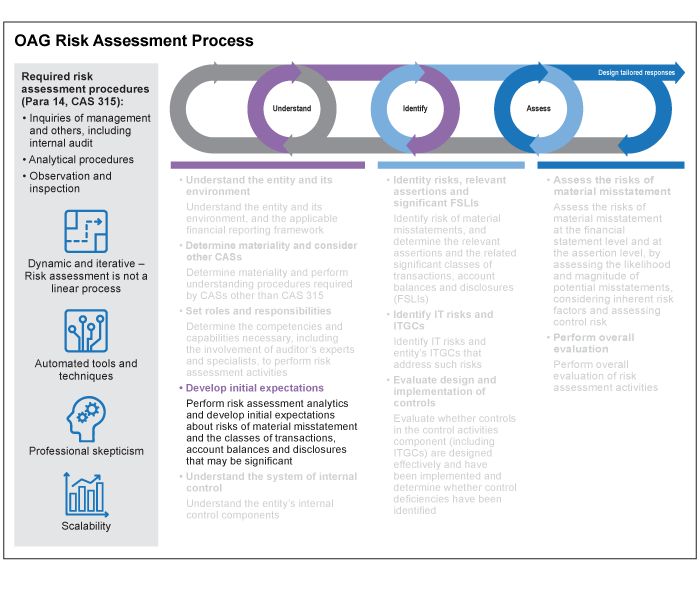

OAG’s Risk Assessment Process

Within OAG Audit 5012, we discuss in more detail the Develop initial expectations element of the OAG Risk Assessment Process illustrated below.