Annual Audit Manual

COPYRIGHT NOTICE — This document is intended for internal use. It cannot be distributed to or reproduced by third parties without prior written permission from the Copyright Coordinator for the Office of the Auditor General of Canada. This includes email, fax, mail and hand delivery, or use of any other method of distribution or reproduction. CPA Canada Handbook sections and excerpts are reproduced herein for your non-commercial use with the permission of The Chartered Professional Accountants of Canada (“CPA Canada”). These may not be modified, copied or distributed in any form as this would infringe CPA Canada’s copyright. Reproduced, with permission, from the CPA Canada Handbook, The Chartered Professional Accountants of Canada, Toronto, Canada.

1113 Documenting audit work

Oct-2019

In This Section

Available tools for documenting audit work

Using Smart Lite Audit Procedures—Frequently Asked Questions (FAQ)

Overview

This topic explains:

- The tools available for documenting the audit work

OAG Guidance

The following table briefly describes the tools available to auditors for documenting their audit work and responds to CASs requirements and OAG’s policies.

| Tool | Description |

|---|---|

|

Audit Working Paper Software |

Electronic toolset used to document our annual audit work. |

|

Audit Programs |

Comprehensive database of audit programs that can be used by auditors to plan and execute the audit as well as to report and communicate the results of the audits. It provides the basic audit file structure along with the audit programs and procedures common to all annual audits. The database includes various cabinets such as:

|

|

Audit Procedures |

Tasks performed by an auditor designed either to gather audit evidence as a basis for assessing and/or responding to risk, or to complete other audit procedures that are necessary to comply with CAS requirements and OAG policies. The performance of audit procedures collectively enables us to comply with CASs, draw conclusions, and support the audit opinion. For guidance on using Smart Lite audit procedures, see Using Smart Lite Audit Procedures—Frequently Asked Questions (FAQ). |

|

Templates |

Audit tools available through links in the related audit procedures or by navigating the Annual Audit INTRAnet site or the Audit Methodology icon on your desktop. Templates provide a standardized method that engagement teams can use to document audit work. |

|

Workpaper |

Excel or Word document used to record the detailed work done for an audit procedure, which is contained in the audit working paper software. Workpapers and Templates clearly reflect the procedures performed and the results of testing. |

|

Documents outside the Audit file |

All engagement documentation up to and including Protected B shall be retained in electronic format and stored in the audit working paper software. Refer to OAG Audit 1192 for a list of exceptions. When documents are kept outside the audit working paper software, teams shall include a reference in the audit working paper software noting the existence and physical location of any audit document retained in paper format in order to maintain a complete file. |

OAG Guidance

General information

- What is Smart Lite and what is its purpose?

- Is Smart Lite the same as Smart Documentation used in the PSAS and GNFPO procedures cabinets?

Features

- What are some of the key features of Smart Lite audit procedures?

- Why are many of the cells locked on the Library Procedures tab? What if I need to write more documentation but there’s no text box available?

- What is the difference between “or” and “checked those that apply” and why is there no “AND”?

- What happened to the procedure guidance that used to be located at the foot of the procedure?

- What is the impact of worksheet protection on my audit documentation?

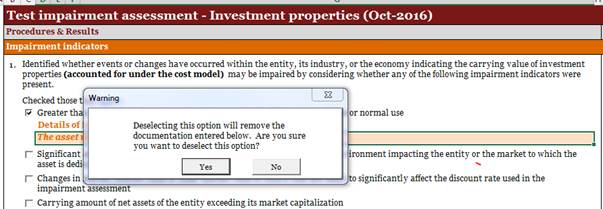

- Why do I sometimes receive a warning message when deselecting checkboxes?

Best practices

-

What are the recommended key working practices to make the most of the Smart Lite audit procedures?

-

When do I need to complete text boxes on the Library Procedures tab?

-

Why are other tabs in the Smart Lite audit procedures not protected?

Technical support

General information

1. What is Smart Lite and what is its purpose?

Smart Lite is a term created to name the next generation audit procedures designed to support a high quality efficient audit.

2. Is Smart Lite the same as Smart Documentation used in the PSAS and GNFPO procedures cabinets?

No. Smart Lite is the next generation of Smart Documentation. Key differences between the two formats include:

-

Smart Lite audit procedures are macro-enabled Excel files;

-

One column for procedures and results rather than one column for each;

-

Built-in warnings to ensure that incompatible checkboxes are not selected (for example, where “or” is used, only one selection can be made);

-

“AND” has been replaced by the use of bulleted lists;

-

Guidance has been moved from the bottom of the procedure to a separate tab making it easier to update the guidance without impacting the procedure;

-

Certain procedure steps appear only when applicable based on whether certain checkboxes are selected removing the need for auditors to fill out multiple procedure steps that do not apply to their audit entity; and

-

The procedures are locked-down to prevent modifications to the procedures and facilitate review.

Features

3. What are some of the key features of Smart Lite audit procedures?

Smart Lite audit procedures include the following key features:

-

Enhanced procedure redesign—One column for both procedures and record of work done to minimize duplication;

-

Smarter checkboxes—Alerts are displayed to prevent incompatible selections;

-

Direct reference to relevant CASs for certain procedures—Certain procedures contain a “View/Hide Requirements” button which when clicked displays the relevant CAS requirements;

-

“Lock-down” of procedures—Procedures are protected on the Library Procedures tab so that they cannot be deleted or modified; and

-

Guidance is located in a separate tab making it easier to update without impacting the procedure.

4. Why are many of the cells locked on the Library Procedures tab? What if I need to write more documentation but there’s no text box available?

This locking feature was developed to enhance both the effectiveness of audit execution and the effectiveness and efficiency of documentation reviews. The locking of cells on the Library Procedures tab removes the need for reviewers to spend a lot of time re-checking the specific words next to check boxes, in case staff had modified the standard wording or, in some cases, crossed out parts of the responses.

In all cases where additional text is typically expected, there will be an available text box that is either displayed outright or appears based on a related checkbox selection. In the rare circumstances where additional documentation needs to be added and a text box is not available, you can also use the “+” symbol in the left margin to expand the section so that you can add additional documentation. [Note for reviewers: If the section is not expanded, there is nothing written in that section and you do not need to expand it]. It is expected that usage of these additional documentation boxes will be infrequent.

5. What is the difference between “or” and “checked those that apply” and why is there no “AND”?

“Or” means do one option or the other, but not both. “Checked those that apply” means that you need to perform at least one but not necessarily all of the possible procedure steps presented. Use your judgement to determine which procedure steps should be performed. The “AND” references were replaced by the use of bulleted lists. It is expected that you will perform each of the procedure steps in the bullets and then complete the related documentation for the entire group of bullets.

6. What happened to the procedure guidance that used to be located at the foot of the procedure?

In the Smart Lite audit procedures, this guidance (including links to OAG Audit and links to internal and external publications) is now located in a separate tab in front of the Library Procedures tab. In the future, the latest available guidance can be provided to users without impacting the procedure. In other words, a user can copy the new guidance tab into a rolled forward procedure without having to start from scratch.

7. What is the impact of worksheet protection on my audit documentation?

Despite the fact that Library Procedures are “locked-down” using worksheet protection, users of Smart Lite audit procedures are able to do the following to document the audit procedures performed:

- Make appropriate checkbox selections;

- Enter text into shaded text boxes;

- Use provided documentation templates;

- Add links to “Links” column;

- Utilize optional “+/- Additional documentation” sections; and

- Utilize the spell check button on the Library Procedures tab to check spelling.

8. Why do I sometimes receive a warning message when deselecting checkboxes?

If you deselect a checkbox selection that previously caused a section to expand, and text has been entered into that section, a warning message indicating that the entered text will be deleted will be displayed.

This confirmation is designed to help prevent audit teams from accidentally deleting documentation that they may wish to retain.

Best practices

9. What are the recommended key working practices to make the most of the Smart Lite audit procedures?

Concise, effective documentation can contribute significantly to a high quality efficient audit. Smart Lite audit procedures support engagement teams in executing and documenting their audit work by adhering to the following recommended key working practices:

-

Carefully read the procedures and instructions—Avoid using links where it may not be useful to a reviewer. Where links are commonly added, prompts to add a link are typically included in the procedures. Avoid simply carrying forward the same information from the previous period into the new Smart Lite format;

-

Understand the different types of checkbox options available—

-

“Checked those that apply” is used where more than one option may be applicable. At least one of these options will be selected or performed but it is not expected that all of the options will be applicable or performed. Use your judgment to determine how much work is enough; and

-

“or” at the end of an option indicates that only one checkbox is to be selected.

-

Perform each of the procedures in bulleted lists—Only check the box as completed when every bullet in the list has been completed;

-

On the Library Procedures tab, provide documentation in each displayed orange text box using the description above the box as a guide—if you see a shaded box, you should complete it—On other tabs, provide documentation in the tables unless it is clearly not applicable (in which case an explanation should be provided) or the instructions indicate that it may not be required;

-

Consider the need to use the “+/- Additional documentation” sections—Each procedure has an expandable section to add additional documentation when the preparer believes it is necessary. These optional sections are only expected to be used in limited circumstances and they only need to be expanded via the “+” if they are to be used; and

-

Perform additional procedures in expandable sections, if applicable—New sections and procedures will only appear when certain checkboxes are selected.

10. When do I need to complete text boxes on the Library Procedures tab?

The basic rule is this—If you see a text box, complete the text box.

Many of the text boxes on the Library Procedures tab only appear when triggered by your responses. If you see a text box, you should complete it, providing documentation consistent with the titles above it. This will help meet the “reperformance” documentation requirements of CAS 230. As a reviewer, you should never see an empty text box on the Library Procedures tab—they should always be completed when visible.

11. I decided not to use some of the tabs in the Smart Lite audit procedure since I would rather use my own schedule/format. Will this cause any issues?

Many of these tabs have been designed to address applicable CAS requirements. If substitute documentation is prepared, you will need to make sure that all aspects of the CASs, including documentation requirements, are fully addressed. This, of course, creates some risk that the tabs were designed to mitigate. For this reason, it is highly recommended that engagement teams use the existing Smart Lite tabs for documenting work performed.

If you opt to not use the testing tabs available in the Smart Lite audit procedures, you should remember that if you delete the testing tab, in order to access them again in future periods (assuming you roll forward workpapers), you will need to obtain a new procedure document in order to obtain an unmodified version of the audit procedure.

12. Why are other tabs in the Smart Lite audit procedures not protected?

Worksheet protection is not used on the other tabs as there may be a need to add or modify columns in tables based on engagement circumstances.

However, due to the fact that specific CAS requirements are addressed on these tabs, it is recommended that none of the columns are deleted. Any columns considered not applicable to an engagement should be retained and marked as not being applicable.

13. A new Leadsheet Automation Tool was introduced in September 2016. How does the use of this tool impact the IFRS Cabinet?

Audit teams now have a choice of using a Leadsheet Automation Tool to automatically generate leadsheets from the entity’s trial balance. For audit teams that use this tool, it is recommended that all leadsheets be kept within one document, rather than migrating the individual leadsheets elsewhere in the audit file.

The new IFRS Cabinet includes a Smart Lite Lead Schedule procedure that is duplicated for use within each FSLI. The following options are available to audit teams that choose to use the new Leadsheet Automation Tool:

-

Use the Leadsheet Automation Tool to generate all leadsheets and save the file in a global folder in the audit file. Prepare the Lead Schedule procedure once, save it in the same folder that contains the leadsheets, and include a hyperlink to the leadsheets generated by the Leadsheet Automation Tool (this is the preferred approach as this will allow auditors to easily update all the leadsheets at once).

-

Use the Leadsheet Automation Tool to generate all leadsheets, save the file in a global folder in the audit file and export each individual leadsheet to the corresponding FSLI folder in the audit file (this is not the preferred approach as every time leadsheets will be updated, they will need to be exported again to the corresponding FSLI folder in the audit file). Prepare the Lead Schedule procedure for each FSLI with links to the separate leadsheet. The separate leadsheet could be inserted in the procedure document as a new tab or maintained separate from the procedure as indicated in option (a) above.

Technical support

14. I noticed that the filenames of the procedures do not match the procedure titles and seem to be abbreviated versions. What is the reason for using an abbreviated title as the filename?

The filenames for audit procedures are restricted due to a limitation when working in Windows. The actual maximum Windows filename path length is around 250 characters. If filenames are too long, problems can arise if the document is exported and then stored several layers deep in a file structure. If this happens, you would need to copy the file to a location that results in a path + filename that is less than the maximum character limit.

In order to minimize such issues when exporting audit documents to your computer, we have restricted the IFRS procedure filenames to a maximum of 60 characters which results in using an abbreviated form of the procedure title.

15. I noticed that there are hidden rows and columns in the Library Procedures tab. Can I unhide these rows and columns to see all of the procedure steps?

While the protected state of the Library Procedures will not prevent auditors from unhiding rows and columns, we do not recommend this practice as it alters the view of the procedure such that checkboxes may no longer appear in their proper places, removes the benefits of using the Smart Lite procedure format and can cause the procedure to no longer function as intended.

To rehide rows that have been inadvertently unhidden, simply check and uncheck the checkboxes that resulted in unhiding new procedure steps and/or click on the orange +/- signs to rehide all the appropriate rows and return the document to its original state.

16. What if I need to customize a procedure for my audit entity? How can I do this if the Library Procedures tab is locked?

If a Smart Lite procedure document needs to be customized, this can be done in one of two ways:

-

A new tab can be added to the Smart Lite procedure to explain the customization, or;

-

The customized procedures can be added directly in the procedure section of the audit working paper software.

17. I rolled forward an engagement that used the Smart Lite audit procedures and in my rolled forward database my work paper checkbox selections from the previous period remain as checked. Is this correct?

Yes, this is necessary to allow the roll forward of all other elements of the prior period audit documentation. Of course, each check box will need to be carefully reviewed by both preparers and reviewers because the procedures performed may vary with each audit.

Related Guidance:

The following sections address various topics regarding documentation and may be consulted together with this section:

OAG Audit 1111—Nature, purpose, and extent of audit documentation

OAG Audit 1112—Entity documentation and electronic (including email) audit evidence

OAG Audit 1192—Confidentiality, safe custody, integrity, accessibility, and retrievability of engagement documentation