Annual Audit Manual

COPYRIGHT NOTICE — This document is intended for internal use. It cannot be distributed to or reproduced by third parties without prior written permission from the Copyright Coordinator for the Office of the Auditor General of Canada. This includes email, fax, mail and hand delivery, or use of any other method of distribution or reproduction. CPA Canada Handbook sections and excerpts are reproduced herein for your non-commercial use with the permission of The Chartered Professional Accountants of Canada (“CPA Canada”). These may not be modified, copied or distributed in any form as this would infringe CPA Canada’s copyright. Reproduced, with permission, from the CPA Canada Handbook, The Chartered Professional Accountants of Canada, Toronto, Canada.

7069.1 Testing Inventory Costs

Jun-2020

In This Section

Step 1: Gain an Understanding of the Process to Cost Inventory

Step 2: Plan and Perform Tests over Purchased Materials

Step 3: Plan and Perform Tests over Work-In-Progress and Finished Goods

OAG Guidance

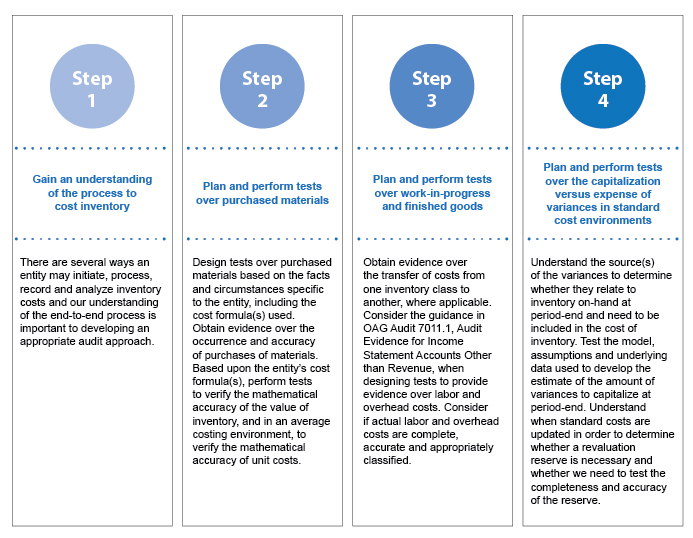

This subsection provides guidance on the approach to testing inventory costing and organizes the related procedures that we may perform into the following four steps:

When developing our approach to inventory costing, it is important to consider relevant requirements of the applicable financial reporting framework. Relevant considerations related to selecting an approach to testing inventory costing and approaches in different costing environments include the following:

-

Accounting methods and pricing conventions

-

Categories of inventory costs

-

Capturing and recording costs

-

Labor and overhead costs

-

Types of variances

-

Presentation and disclosure considerations

-

Standard cost environment

-

Weighted average cost environment

-

Testing the calculation of the inventory value

-

Considerations when different accounting methods or pricing conventions are used for different classes of inventory

-

Selecting an approach to test purchased materials

-

Defining the sampling unit when the population for testing is ending raw materials inventory

OAG Guidance

There are several ways that an entity may initiate, process, record and analyze inventory costs. Similarly, there are different methods we may use to test inventory costs.

In order to identify risks of material misstatement and develop an effective and efficient audit approach, we first obtain an understanding of the end-to-end process, considering how the entity accounts for and records inventory costs and how variances are captured and analyzed.

Prior to designing our tests over inventory costs, we complete our group audit scoping decisions to identify components where inventory will be within the scope of our audit. After we identify the components and the scope of work, we need to determine which inventory classes (e.g., raw materials, work-in-progress, finished goods) and types of inventory costs (i.e., materials, direct labor and overhead) will need to be tested.

We first determine which classes of inventory to test (e.g., raw materials, work-in-progress, finished goods). In order to plan procedures over work-in-progress and finished goods inventory, we also need to understand the costs capitalized into inventory in addition to the materials component (e.g., labor, depreciation expense, utilities expense) and whether we need to test all such components of inventory costs. Even when we have achieved significant coverage over total gross inventory by testing a given class of inventory or component of inventory costs, we still qualitatively and quantitatively evaluate the other classes of inventory or components of inventory costs as untested balances before concluding testing over the untested amounts is not necessary (the same as we do when evaluating any untested balance).

If we determine that an inventory class (e.g., raw materials, work-in-progress, finished goods) or component of inventory costs (i.e., materials, direct labor and fixed and variable production overhead) does not present a risk of material misstatement, we document our rationale for concluding that testing is not necessary. This decision is based upon qualitative and quantitative considerations as described in OAG Audit 7042, including the relationship of the untested balance to materiality, our understanding of the characteristics of the remaining population and our assessment of the risk of material misstatement.

It is common for manufacturing companies to maintain “spares” items, which are spare maintenance materials and parts kept on hand to allow for quick replacement or repair of production lines. These items are considered essential to the operations of the facility. It is appropriate to capitalize spares items because they have a service potential (e.g., when a part on a machine breaks down) and will provide future economic benefit to an entity. These items are generally classified as current (i.e., inventory) or non-current assets (i.e., property, plant and equipment) depending on an entity’s specific facts and the nature of the entity’s business. Regardless of the classification, we test the costing of spares items as part of either the property, plant and equipment process or the inventory process.

Understanding of the end-to-end process for inventory costing

When obtaining an understanding of the end-to-end process for inventory costing, we consider the following to develop an appropriately tailored audit approach:

-

The composition of work-in-progress and finished goods inventory (e.g., relative mix of materials, direct labor and fixed and variable production overhead)

-

All significant sources of inventory costs, including information that interfaces with the inventory costing system (e.g., purchases, depreciation, labor) and ways inventory costs may be adjusted or manipulated (e.g., unauthorized adjustment to inventory costs, unauthorized manipulation of capitalized or expensed costs)

-

The cost formula used by management to allocate costs to inventory and cost of sales (e.g., First-in, First-out or FIFO)

-

Techniques for the measurement of cost used by management to value inventory (e.g., standard costing, weighted average)

-

The process for capturing costs in inventory (e.g., process versus job costing), including the interaction with controls in other business processes and the process of capturing materials, direct labor and fixed and variable production overhead costs in inventory (e.g., how bills of materials are developed)

-

The process for how inventory costs are transferred between inventory classes (e.g., raw materials, work-in-progress and finished goods) and how inventory is recognized as expense in cost of sales at the appropriate amount

-

If standard costs are used, how standards are established, how often standards are updated and how they are updated (e.g., who has access and authority to update standard costs)

-

In standard cost environments, the types of variances that arise, how those variances are reflected in the general ledger and how management assesses whether variances are properly allocated between inventory and expense at the end of each reporting period

-

If standard costs are used, how management recognizes capitalized variances and/or revaluation reserves in the income statement

Our understanding of the end-to-end process for inventory costing includes an understanding of management’s process used to prepare the financial statements, including related disclosures. We need to consider the requirements of the applicable financial reporting framework when obtaining this understanding.

Planning Tests over Purchased Materials

OAG Guidance

We test the occurrence and accuracy of purchases included in raw materials inventory using targeted testing, non-statistical sampling or a combination of both. We separately obtain evidence that the inventory costing system is completely and accurately recording transfers between raw materials, work-in-progress and finished goods.

We would normally test purchases in other areas of the audit (e.g., testing purchasing controls, testing the proper classification of expenses, testing accounts payable). In these situations, we may develop a holistic testing strategy (i.e., design procedures to achieve several test objectives at the same time) rather than performing separate tests and making separate selections for each test. A holistic approach may be more efficient, if a selection of purchases tested in other areas of the audit can be leveraged for testing the cost of purchased materials (or vice versa).

We design our tests over purchased materials based on the engagement specific facts and circumstances. Typically, we cannot obtain a detailed listing of all purchases that remain in work-in-progress and finished goods inventory at period end. Therefore, when testing the accuracy and occurrence of purchases to third party documents (e.g., invoices), we typically choose to make our selections from:

-

Inventory purchases during a turnover period because this is an approximation of the period for which material purchase costs remain in period-end inventories (i.e., purchases remaining in raw materials, work-in-progress and finished goods), or

-

Ending raw materials inventory.

Testing inventory purchases during the turnover period provides evidence over the raw material purchases in work-in-progress and finished goods at period end. Factors we consider when determining which of these two approaches to apply for testing purchased materials include the materiality and relative size, nature and risk of misstatement (e.g., whether materials prices are stable) of raw material costs included in work-in-progress and finished goods as compared to raw materials inventory at period end.

For example, in situations where total raw materials inventory is significant and the proportion of raw materials inventory included in work-in-progress and/or finished goods inventory is large, we consider whether it is more appropriate to select inventory purchases during the turnover period for testing.

See below for a table of the considerations for selecting an approach to test the cost of purchased materials:

| Population | ||||

|---|---|---|---|---|

| Ending Raw Materials Inventory | Inventory Purchases During the Turnover Period | Inventory Purchases During the Full Audit Period | ||

| Pricing Convention | Actual |

|

|

|

| Standard |

|

|

|

|

| Weighted Average |

|

|

|

|

Testing Purchased Materials During a Period of Time

OAG Guidance

When testing purchased materials during a period of time, we typically define the population subject to testing as inventory purchases during the turnover period because this is an approximation of the period for which material purchase costs remain in period-end inventories. We first recalculate the turnover period using cost of sales divided by average inventory (account balances subject to testing during our audit). For example, if we determine that inventory turns consistently four times per year, a purchased material remains on-hand for approximately three months (i.e., it takes three months for a purchase to go through the production process – from raw materials to work-in-progress to finished goods and to be sold which serves as an approximation of the length of time materials remain in inventories). In this example, we test the completeness and accuracy of purchases in the last three months of the period.

We may also define the population subject to testing as inventory purchases during the full audit period. However, it is typically more efficient to test inventory purchases during the period that approximates period-end inventory. Additionally, the procedures we perform over purchases, coupled with other procedures such as tests of accruals as of period end and overall conclusion analytics, typically can provide evidence over the completeness and accuracy of cost of sales without additional tests of inventory purchases during the full audit period.

Testing Purchased Materials in Ending Raw Materials Inventory

OAG Guidance

This approach is often used in situations where purchased materials are goods for resale (i.e., no work-in-progress or finished goods) and may also be used in situations where we determine that this form of direct substantive audit evidence over the accuracy of raw materials included in work-in-progress and finished goods is not needed.

Testing inventory purchases in ending purchased/raw materials inventory provides direct evidence over raw material purchases in raw materials inventory at period-end (i.e., may not provide direct evidence over the materials component of work-in-progress and finished goods inventory at period end).

Additionally, in a standard cost environment, we also consider the materiality of the purchase price variances resulting from purchases of raw materials included in work-in-progress and finished goods as of period end in determining which approach to use to test purchased materials.

In a standard cost environment, management’s variance capitalization analysis includes purchase price variances resulting from all inventory purchases on-hand at period end, including those in raw materials, work-in-progress and finished goods. When we select our sample of purchased materials from ending raw materials inventory only, the invoices associated with raw material purchases in work-in-progress and finished goods are not subject to direct testing, and consequently, the completeness and accuracy of the related purchase price variances are also not directly tested. Therefore, as the risk of material misstatement associated with the completeness and accuracy of purchase price variances resulting from purchases in work-in-progress and finished goods at period-end increases, we consider whether it is more appropriate to select inventory purchases during the turnover period for testing.

Testing the Materials Component of Work-In-Progress and Finished Goods

OAG Guidance

We design our tests over the materials component of work-in-progress and finished goods inventory based on the facts and circumstances specific to our audit. Gaining an understanding of what costing method is used to cost each inventory class, how costs are captured in each inventory class and how materials costs are transferred between inventory classes (i.e., from raw materials to work-in-progress to finished goods) is important to developing an appropriate audit approach for testing the cost of raw materials included in work-in-progress and finished goods inventories.

The cost of raw materials transferred to work-in-progress and, ultimately, finished goods may be transferred using the same cost method as the method used to initially measure raw materials purchase costs, or they may follow a different costing process. The systems and costing processes used often differ among entities. In situations where inventory classes are costed using different methods or pricing conventions, we test raw materials under each method separately.

We may choose to subject only raw materials to testing to underlying invoices (i.e., the materials component of work-in-progress and/or finished goods is excluded from the population of purchases tested to invoices). Alternatively, based on the considerations discussed in the section Planning Tests over Purchased Materials above, it may be appropriate to test the materials component of work-in-progress and finished goods by including it in the population of purchases selected for testing to underlying invoices (i.e., test purchases in the turnover period). In both scenarios, the evidence we obtain supports the initial purchase cost of raw materials. Therefore, regardless of the approach we use to select purchases for testing, we design a separate test to obtain evidence over the transfer of costs from one inventory class to another, where applicable (e.g., from raw materials to work-in- progress and from work-in-progress to finished goods).

Testing the Labor and Overhead Components of Work-In-Progress and Finished Goods

OAG Guidance

General considerations

In addition to testing the materials component of inventory, we also test the direct labor and fixed and variable production overhead components of inventory. Testing the direct labor and overhead components of inventory includes:

-

Testing the completeness and accuracy of the actual expense incurred during the period;

-

Testing whether the related costs are coded to the appropriate department code or cost center; and

-

Testing whether the costs included in the department codes or cost centers are appropriately capitalized versus expensed.

Additionally, we test how direct labor and overhead costs are captured into ending inventory (and in a standard cost environment, how the related variances are calculated and accumulated) to determine the appropriateness of labor and fixed and variable production overhead included in ending inventory.

With the exception of testing capitalized labor in job costing environments (where we typically select jobs for testing and then test the labor component of each job selected), testing the completeness and accuracy of direct labor and overhead costs is typically achieved through obtaining evidence over actual costs incurred during the period and testing whether those costs are properly allocated to inventory. Consider guidance in OAG Audit 7011.1 when designing tests to provide evidence over direct labor and overhead costs, including payroll, depreciation and other overhead expenses.

For example, the labor costs that will ultimately be charged to inventory are initially recorded via the payroll process. We design our substantive payroll tests to test total actual payroll expense incurred during the period. To provide evidence over inventory costs, we also test whether employee payroll expenses are coded to the appropriate job (e.g., in a job costing environment) and/or department code or cost center (e.g., in a process costing environment) based on the respective employee’s job responsibilities. In situations where we choose to test payroll expense using non-statistical sampling, we test the expense for each employee selected was coded to the appropriate cost center. When we choose to test payroll expense using a substantive analytic, we also test that employee’s payroll expense during the period is coded to the appropriate cost center. We may do this by performing a disaggregated substantive analytic over payroll expense at the cost center level, which would include developing an expectation for payroll expense for each cost center. Alternatively, we may perform a separate accept-reject test over the coding of employee payroll expense during the period to determine whether it is coded to the appropriate cost center. For example, we may select payroll expense for the operations shift supervisor for the second pay period in June. In this example, we test whether the payroll expense for the selected pay period was recorded to a cost of inventory cost center which is appropriate based on the job title of the employee and the description of the cost center.

We also design tests over property, plant and equipment to determine whether depreciation expense is complete and accurate. Similar to how we test payroll expense, we extend this testing to provide evidence over inventory costs by testing whether depreciation is coded to the appropriate department code or cost center. We either extend our detailed substantive testing of depreciation expense to determine whether depreciation is coded to the appropriate cost center, or if substantive analytics are used to test depreciation expense, we perform a separate accept-reject test to check that coding is appropriate during the period.

The design of the testing for items selected (i.e., targeted tests or non-statistical sampling) to test the completeness and accuracy of labor and fixed and variable production overhead costs incurred during the period will typically include procedures to test whether the costs are coded to the appropriate cost center. For example, if twelve employees are selected for payroll expense testing using non-statistical sampling, it is not necessary to select additional items to determine whether those same expenses are coded to the appropriate job code or cost center as long as the coding of those expenses is made part of the test.

For general overhead costs other than labor and depreciation (e.g., rent, maintenance, utilities), we extend our testing over the proper classification and presentation on the income statement to determine whether these costs are coded to the appropriate job and/or department code or cost center based on the nature of the cost (i.e., included in the cost of inventory or expensed). For example, if we select an expenditure for electricity of a manufacturing plant, we would test whether the expenditure was coded to an appropriate production cost center from which costs are ultimately capitalized to inventory.

Labor and fixed and variable production overhead costs

Labor and fixed and variable production overhead costs evaluated for capitalization into inventory are recorded via the payroll (i.e., direct and indirect labor), property, plant and equipment (i.e., depreciation) and purchasing (i.e., general expenses) business processes. It is important we develop a testing strategy in a manner that is “holistic” (i.e., focused on the collective achievement of audit objectives across multiple business processes) rather than “separated” (i.e., focused on the testing of individual account balances). A holistic approach may also be more efficient, as a selection of disbursements tested for other areas of the audit may be leveraged for testing the labor and fixed and variable production overhead components of work-in-progress and finished goods (or vice versa). For example, we may extend our non-statistical sample selected for payroll testing to test whether employees’ time is charged to the appropriate cost centers based on the nature of work performed by the employee rather than performing a separate accept-reject test to test the proper classification of payroll costs to cost centers. Similarly, we may extend our non-statistical sample used to test the accuracy of depreciation expense to also test whether depreciation expense is coded to appropriate cost centers based on the nature of the asset rather than performing a separate accept-reject test to test the proper classification of depreciation expense to cost centers.

As discussed in OAG Audit 7011.1, all labor and fixed and variable overhead accounts are subjected to risk assessment analytics and overall conclusion analytics, at least at the financial statement level. Additionally, some accounts are optionally and discretionarily subject to further risk assessment analytics (e.g., scanning expense account activity for missing or unusual entries, analyzing common ratios) and/or substantive analytics (e.g., depreciation expense, payroll expense). As a result, when determining the sufficiency of audit work over cost of sales, we may determine it is necessary to perform risk assessment or substantive analytics over cost of inventories categories in addition to general risk assessment analytics, overall conclusion analytics and classification testing. For example, we may perform targeted risk assessment analytics over certain cost of inventories categories (e.g., rent expense, utilities expense) in addition to performing a test over the proper classification of these operating expenses in order to determine whether additional testing is necessary over cost of sales.

Alternatively, if considered more effective and efficient, rather than performing the procedures described above, we may design separate tests to determine whether actual direct labor and fixed and variable production overhead costs are appropriately classified. Specifically, we perform additional procedures for testing expenses incurred during the period in accordance with OAG Audit 7011.1 to provide evidence as to whether these expenses were coded to the appropriate department code or cost center (where applicable) based on the nature of the expense. We then design a test to determine whether costs accumulated in the department code or cost center are appropriately included in the cost of inventory or expensed during the period.

Testing that Department Codes/Cost Centers are Appropriately Included in the Inventory Cost or Expensed

OAG Guidance

Our testing of the underlying labor and fixed and variable production overhead transactions includes testing whether the related costs are being coded to the appropriate department code or cost center. We design separate tests to determine whether the department code or cost center is appropriately included in the inventory cost or expensed during the period. We may do this by obtaining a listing of all department codes and a mapping of these codes to financial statement line items. We then select cost centers using accept-reject testing to test whether they are appropriately mapped to be capitalized into inventory versus expensed by determining the nature of the activities in the cost center and whether those activities are cost of inventories. Our determination of the nature of the costs accumulated in the cost center is based on our testing of the proper classification of the underlying labor and fixed and variable production overhead transactions (as described in the section Testing the Labor and Overhead Components of Work-In-Progress and Finished Goods above) and inquiries performed with management.

Alternatively, we may choose to design a holistic test and extend our testing of the underlying labor and overhead transactions to test whether costs included in the related department code or cost center are appropriately treated as cost of inventories or expense. The design of a holistic test in this area may reduce the number of separate tests we perform. However, when we select from a population to test the proper coding of costs to department codes/cost centers, a portion of our sample may relate to disbursements not directly included in labor and fixed and variable production overhead costs. In this situation, we evaluate the sufficiency of evidence to determine whether costs included in the related department codes or cost centers are appropriately treated as cost of inventories or expense.

Testing Management’s Variance Capitalization Analysis

OAG Guidance

In addition to testing the materials component of inventory, we also test the direct labor and fixed and variable production overhead components of inventory. Testing the direct labor and overhead components of inventory includes:

Each reporting period, management analyzes variances between actual costs and standard costs to determine whether any of the variances (or portions thereof) generated during the period relate to inventory on-hand at period end and need to be capitalized in ending inventory.

When testing variances, we understand the source(s) of the variances to determine whether they relate to inventory on‑hand at period end and are cost of inventories.

In some instances, variances are captured using specific identification, in which case variances are tracked and analyzed against the specific product to which they relate. More commonly, variances, which arise from applying either more or less costs than were actually incurred to inventory, are a residual expense (or credit) in the general ledger. At period end, management determines the portion of the variances, if any, to allocate to inventory based on an assumption about inventory turnover which provides an estimate of what portion of the costs were incurred in the production of inventory that remains on hand at the period-end. In this situation, the amount of variances to capitalize at period end is an accounting estimate.

In line with CAS 540, we use one or a combination of the following approaches to test an estimate:

- Developing our own point estimate or range to evaluate management’s estimate

- Testing how management made the estimate

- Obtaining audit evidence from events occurring up to the date of the auditor’s report

Obtaining evidence from events occurring up to the date of the auditor’s report is not typically used as an approach to test capitalized variances given the nature of the estimate, as subsequent sale of the inventory does not provide evidence as to whether the original costs included in inventory, even if ultimately recoverable, were accurate.

In some cases, it may be appropriate to develop our own point estimate or range to evaluate the completeness and accuracy of capitalized variances at period-end. When using this approach, we test the completeness and accuracy of variances incurred throughout the period and recorded in the general ledger through our tests of purchased materials, direct labor and fixed and variable production overhead. We then develop our own point estimate of the portion of variances that relate to inventory on-hand at period end based on inventory turnover or some other plausible source that we have validated through substantive procedures, and compare this to the variance capitalized by management.

In some cases, it may likely be more efficient to test management’s process for analyzing and capitalizing variances, particularly where we also test management’s controls over accounting estimates. This includes testing the model, assumptions and underlying data used in the estimate.

Test Model Used to Analyze Variances for Capitalization

OAG Guidance

The model used to analyze variances differs based on facts and circumstances of each entity, including the systems used to capture and report variances. For example, some entities may capture and analyze variances by product line. Others may capture and analyze variances by variance type (e.g., purchase price, direct labor, variable overhead) or department (e.g., payroll or depreciation expenses coded to specific departments). We verify all sources of variances are included in management’s variance capitalization analysis. We test the appropriateness of the selection of the model (i.e., the level of disaggregation, whether the model is based on appropriate assumptions such as inventory turnover, whether all sources of variances are included, etc.) based on the related risk of misstatement from both a qualitative and quantitative perspective. We determine whether the model is appropriate to analyze variances, and we test the mathematical accuracy of the model.

Test Assumptions Used to Determine the Portion of Variances to Capitalize at Year End

OAG Guidance

Often, management analyzes variances using an inventory turnover assumption to estimate the amount of variances that relate to inventory on-hand at year end. To determine the appropriate amount of variances to capitalize, management estimates the period of time it takes to produce and sell inventory using inventory turnover as an approximation. In many cases, this period of time can be approximated by inventory cost of sales turnover (i.e., cost of sales divided by average inventory) because production typically approximates sales during a period. However, in situations where there are significant changes in the inventory balance during the period as a result of production either significantly exceeding sales or sales significantly exceeding production, the inventory turnover calculation may need to be adjusted to properly estimate the production period. For example, the turnover assumption may be calculated as the cost of goods manufactured divided by average inventory.

To demonstrate the typical approach to capitalization of variances, assume an entity’s inventory turns 12 times per year. In this case, management’s year end variance analysis may determine that all variances incurred in the last month of the year are attributable to inventory that is on-hand at year end. As part of testing management’s analysis, we test the one month turnover assumption, typically by recalculating it as cost of sales divided by average inventory. In this example, we test the reliability of the data used in our recalculation (i.e., agree the inputs to data that was subject to testing elsewhere in the audit).

When the turnover assumption is calculated at a disaggregated level, we tailor our testing of the assumption accordingly. One approach to designing a test to assess the appropriateness of a disaggregated turnover assumption is to test the assumption by understanding management’s process for calculating the disaggregated turnover (including consideration of how management considers the reliability of the data used in the calculation) and then test management’s process.

We also assess whether the level of disaggregation at which the analysis of the assumption is performed is appropriate, giving consideration to the potential impact of a change in the disaggregation of the assumption to the overall estimate. For example, when analyzing direct labor and overhead variances, the turnover assumption used by management is intended to approximate the amount of production time to bring work-in-progress and finished goods inventory to their state of completion. Typically, work-in-progress and finished goods inventory has a different turnover than the overall inventory average, because the turnover rate calculated using an average of overall inventory includes the time that raw materials remain on-hand (i.e., the full production process – purchasing raw materials through the sale of finished goods). Accordingly, it may be appropriate for management to use a separate turnover assumption for material variances than for direct labor and overhead variances.

A separate analysis may also be necessary for variances associated with goods received but not invoiced since the related variance is typically not recorded until the invoice is received. This analysis would consider whether ending inventory costs require adjustment to reflect the difference between the anticipated invoice price and standard cost of the inventory. Recent invoice data for similar products (i.e., most recent invoice for the same product) or invoices received after period-end may provide evidence of the anticipated invoice price.

Test Underlying Data Used in Management’s Variance Capitalization Analysis

OAG Guidance

The underlying data used when estimating the portion of variances to capitalize into ending inventory are the calculated variances in the general ledger. We test the completeness and accuracy of this data (i.e. variances) used by management in its variance capitalization analysis. When designed appropriately, our tests of purchased materials, direct labor and fixed and variable production overhead provide evidence over the completeness and accuracy of the underlying data used by management in its variance analysis.