Annual Audit Manual

COPYRIGHT NOTICE — This document is intended for internal use. It cannot be distributed to or reproduced by third parties without prior written permission from the Copyright Coordinator for the Office of the Auditor General of Canada. This includes email, fax, mail and hand delivery, or use of any other method of distribution or reproduction. CPA Canada Handbook sections and excerpts are reproduced herein for your non-commercial use with the permission of The Chartered Professional Accountants of Canada (“CPA Canada”). These may not be modified, copied or distributed in any form as this would infringe CPA Canada’s copyright. Reproduced, with permission, from the CPA Canada Handbook, The Chartered Professional Accountants of Canada, Toronto, Canada.

1022 Departures from CAS objectives and CAS requirements

Apr-2018

In This Section

Assessing and responding to departures from CAS requirements

Determining the need for additional audit procedures

Failure to achieve a CAS objective

Documenting departures from CAS requirements or failure to achieve a CAS objective

Considerations for group audits

Overview

This topic explains:

-

How to assess and respond to departures from CAS requirements

-

Determining the need to perform additional procedures to achieve compliance with one or more CAS requirements or objectives

-

How to evaluate our response in the event of failure to achieve a CAS objective

-

What to document in the event of a departure from a CAS requirement or failure to achieve a CAS objective

-

Considerations for group audits

Assessing and responding to departures from CAS requirements

CAS Requirement

In exceptional circumstances, the auditor may judge it necessary to depart from a relevant requirement in a CAS. In such circumstances, the auditor shall perform alternative audit procedures to achieve the aim of that requirement. The need for the auditor to depart from a relevant requirement is expected to arise only where the requirement is for a specific procedure to be performed and, in the specific circumstances of the audit, that procedure would be ineffective in achieving the aim of the requirement (CAS 200.23).

CAS Guidance

The requirements of the CASs are designed to enable the auditor to achieve the objectives specified in the CASs, and thereby the overall objectives of the auditor. Accordingly, other than in exceptional circumstances, the CASs call for compliance with each requirement that is relevant in the circumstances of the audit (CAS 230.A18).

OAG Guidance

Departure from a stated requirement of a CAS is expected to be extremely rare. Requirements are to be complied with unless the requirement is not relevant or conditional, as explained in OAG Audit 1021. Departure from a required procedure is not optional on the grounds of efficiency if performance of the procedure, as stated in the CAS, would achieve the aim of the relevant CAS requirement. Depart from a required procedure only if performance of that procedure will not achieve the aim of the CAS requirement. In such situations determine additional audit procedures to achieve the aim of the relevant requirement.

Taking into consideration the guidance in OAG Audit 1021, in the event that engagement teams assess that compliance with a relevant requirement is not practicable and therefore departure from a relevant requirement is considered necessary, follow the guidance in Determining the need for additional audit procedures below. This explains the process to be applied when developing alternative audit procedures to address CAS requirements and/or objectives, when consultation is appropriate or required and the related documentation requirements for such situations.

See also Documenting departures from CAS requirements or failure to achieve a CAS objective below for guidance on documenting departures from CAS requirements.

Determining the need for additional audit procedures

CAS Guidance

The requirements of the CASs are designed to enable the auditor to achieve the objectives specified in the CASs, and thereby the overall objectives of the auditor. The proper application of the requirements of the CASs by the auditor is therefore expected to provide a sufficient basis for the auditor's achievement of the objectives. However, because the circumstances of audit engagements vary widely and all such circumstances cannot be anticipated in the CASs, the auditor is responsible for determining the audit procedures necessary to fulfill the requirements of the CASs and to achieve the objectives. In the circumstances of an engagement, there may be particular matters that require the auditor to perform audit procedures in addition to those required by the CASs to meet the objectives specified in the CASs (CAS 200.A77).

The auditor is required to use the objectives to evaluate whether sufficient appropriate audit evidence has been obtained in the context of the overall objectives of the auditor. If as a result the auditor concludes that the audit evidence is not sufficient and appropriate, then the auditor may follow one or more of the following approaches to meeting the requirement of paragraph 21(b), (CAS 200.A78):

-

Evaluate whether further relevant audit evidence has been, or will be, obtained as a result of complying with other CASs.

-

Extend the work performed in applying one or more requirements.

-

Perform other procedures judged by the auditor to be necessary in the circumstances.

Where none of the above is expected to be practical or possible in the circumstances, the auditor will not be able to obtain sufficient appropriate audit evidence and is required by the CASs to determine the effect on the auditor's report or on the auditor's ability to complete the engagement.

OAG Guidance

Taking into consideration the guidance in OAG Audit 1021 on the role of CAS objectives in the audit process and our related assessment of whether such objectives have been addressed through performance of planned audit procedures, the assessment of the need for additional audit procedures is a matter requiring professional judgment and requires discussion amongst the engagement team, including the engagement leader. Where engagement quality reviewer has been appointed, the engagement leader also discusses the need for additional audit procedures and situations where engagement team concludes that a CAS requirement or objective cannot be met with the engagement quality reviewer.

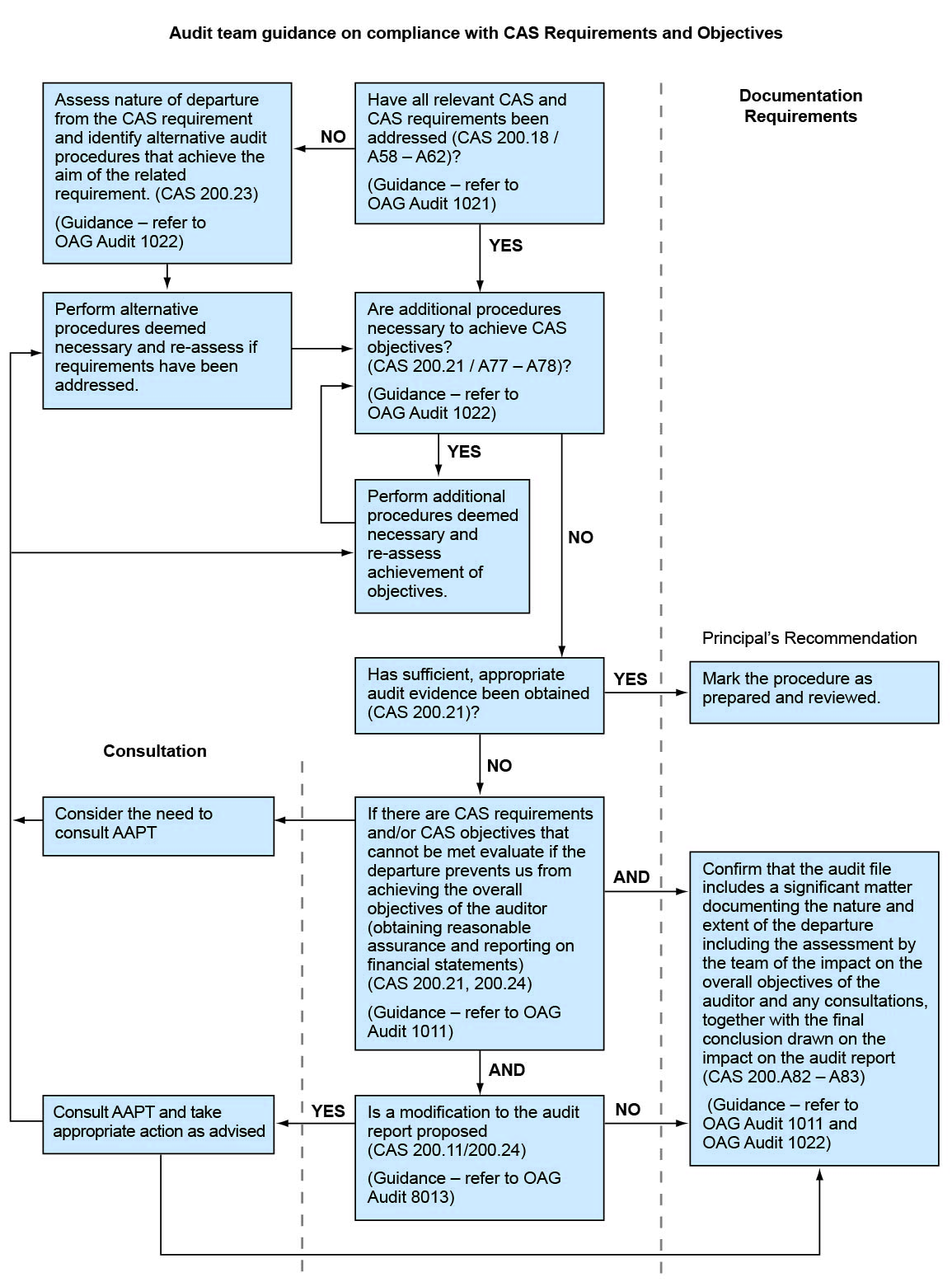

Consultation with Audit Services may also be required in situations where engagement teams conclude that a CAS requirement or objective cannot be met. The following flowchart provides guidance on determining when consultation is appropriate and sets out the related documentation requirements in such situations:

In addition to the guidance included in the above flowchart, see Documenting departures from CAS requirements or failure to achieve a CAS objective below for further guidance on consultations and documenting departures from CAS requirements.

Related Guidance:

See OAG Audit 1051 for further guidance on sufficient appropriate audit evidence.

Failure to achieve a CAS objective

CAS Requirement

If an objective in a relevant CAS cannot be achieved, the auditor shall evaluate whether this prevents the auditor from achieving the overall objectives of the auditor and thereby requires the auditor, in accordance with the CASs, to modify the auditor's opinion or withdraw from the engagement (where withdrawal is possible under applicable law or regulation). Failure to achieve an objective represents a significant matter requiring documentation in accordance with CAS 230 (CAS 200.24).

CAS Guidance

Whether an objective has been achieved is a matter for the auditor's professional judgment. That judgment takes account of the results of audit procedures performed in complying with the requirements of the CASs, and the auditor's evaluation of whether sufficient appropriate audit evidence has been obtained and whether more needs to be done in the particular circumstances of the audit to achieve the objectives stated in the CASs. Accordingly, circumstances that may give rise to a failure to achieve an objective include those that (CAS 200.A82):

-

prevent the auditor from complying with the relevant requirements of a CAS; and

-

result in its not being practicable or possible for the auditor to carry out the additional audit procedures or obtain further audit evidence as determined necessary from the use of the objectives in accordance with paragraph 21, for example due to a limitation in the available audit evidence.

OAG Guidance

Follow the guidance included in the flowchart included at Determining the need for additional audit procedures with respect to consultations and the documentation guidance at Documenting departures from CAS requirements or failure to achieve a CAS objective with respect to documenting the failure to achieve a CAS objective. In addition, assess whether the failure to achieve the objective prevents achievement of the overall objectives of the auditor as prescribed by CAS 200.21 and consider the implications for the audit opinion. Refer to OAG Audit 3081, on required consultations, where a qualified or modified audit opinion is being considered.

Related Guidance:

See OAG Audit 8013 for guidance on modifications to the audit opinion.

Documenting departures from CAS requirements or failure to achieve a CAS objective

CAS Requirement

If, in exceptional circumstances, the auditor judges it necessary to depart from a relevant requirement in a CAS, the auditor shall document how the alternative audit procedures performed achieve the aim of that requirement, and the reasons for the departure (CAS 230.12).

CAS Guidance

CAS 230 establishes documentation requirements in those exceptional circumstances where the auditor departs from a relevant requirement. The CASs do not call for compliance with a requirement that is not relevant in the circumstances of the audit (CAS 200.A81).

The documentation requirement applies only to requirements that are relevant in the circumstances. A requirement is not relevant only in the cases where (CAS 230.A19):

(a) the entire CAS is not relevant (for example, if an entity does not have an internal audit function, nothing in CAS 610); or

(b) the requirement is conditional and the condition does not exist (for example, the requirement to modify the auditor's opinion where there is an inability to obtain sufficient appropriate audit evidence, and there is no such inability).

Audit documentation that meets the requirements of CAS 230 and the specific documentation requirements of other relevant CASs provides evidence of the auditor's basis for a conclusion about the achievement of the overall objectives of the auditor. While it is unnecessary for the auditor to document separately (as in a checklist, for example) that individual objectives have been achieved, the documentation of a failure to achieve an objective assists the auditor's evaluation of whether such a failure has prevented the auditor from achieving the overall objectives of the auditor (CAS 200.A83).

OAG Guidance

In the event of a departure from a relevant requirement, document such a departure as a significant matter. In situations where additional audit procedures were required to achieve a CAS objective and such procedures were easily identified and achieved without the need to exercise any significant professional judgment (see OAG Audit 1042) such situations would ordinarily not require to be documented as a significant matter, provided that our procedures step clearly disclose the alternative procedures performed and conclusions reached. Where significant professional judgment is required in determining alternative audit procedures to achieve the aim of a CAS requirement or objective, document such instances as a significant matter (see OAG Audit 1143).

Document the failure to achieve a CAS Objective in accordance with OAG Audit 1143 on documenting significant matters.

In most circumstances failure to comply with a CAS objective will have resulted from a specific issue that may already have been documented as a significant matter within the audit file e.g., a limitation on scope over a material FSLI. Where this is the case, review the documented content of the significant matter and update as necessary to address the requirements, namely that an assessment of whether the overall objectives of the auditor can be met and the implications for the audit opinion has been documented.

Related Guidance:

See Assessing and responding to departures from CAS requirements for guidance on assessing and responding to departures from CAS requirements and Failure to achieve a CAS Objective for guidance in relation to failures to achieve a CAS Objective.

Considerations for group audits

OAG Guidance

On group audits the following considerations are relevant for Group and Component audit teams in applying the OAG guidance on complying with, and documenting departures from, the CASs:

-

On a group engagement, the component auditor complies with all CAS requirements and objectives and OAG policies if they report statutorily. This includes making appropriate consultations where there is a departure from a CAS requirement or failure to achieve a CAS objective and reporting the results of such consultations to the group engagement team.

-

On a group engagement where the component auditor performs an audit or other work in accordance with CASs, if there is no local report the component auditor complies with all CAS requirements and objectives that are relevant based on the scope of work specified by the group engagement team in the interoffice instructions and reports to the group engagement team all situations where a significant matter is required, including any assessed departure from a CAS requirement or failure to achieve a CAS objective. It is the responsibility of the group team to make appropriate consultations to assess the impact of any such reported matters on the group audit report. The component auditor may consult locally, if deemed appropriate to do so, prior to reporting to the group engagement team.

-

In certain situations some requirements may be performed by the group engagement team on behalf of the component. For example, procedures relating to tax accounts or litigations, claims and assessments may be performed at the group level. It is the responsibility of the component auditor to determine that sufficient appropriate audit procedures, in respect of the component financial information, have been performed, either at the component or group level, to enable them to report to the group engagement team compliance with all CAS requirements and objectives applicable to the component financial information.

Related Guidance:

Refer to OAG Audit 2336 for further guidance on Responsibilities of the Component Auditor in Different Types of Work to be Performed on the Financial Information of Components.