Auditing Pension Assets and Obligations in the Financial Statements of the Sponsor

General Planning Considerations

Audited financial statements prepared by a pension plan

Audit procedures to consider when there is no reliance on the auditor’s report on the pension plan financial statements

This document provides general guidance to develop an efficient audit approach for pension1 assets and obligations in the financial statements of the Sponsor entity. It complements the detailed audit procedures found in the IFRS or PSAS TeamMate cabinets. It is not designed to be comprehensive and therefore does not replace the detailed audit procedures. It is also not designed to be accounting framework specific.

General Planning Considerations

Plan early—when auditing an entity that has a defined benefit plan, it is important to start work early during the planning phase to ensure a successful audit of pension assets and liabilities. The steps listed below should be performed before year-end.

The engagement leader is encouraged to discuss this guidance with the director, project leader and the team member assigned the pension section of the audit file.

TeamMate procedures—ensure the correct most up-to-date procedures are included in your audit file. There are many procedures in both the IFRS and PSAS cabinets. Some procedures are always applicable while others only apply in specific circumstances. It is important to carefully consider the applicability of each procedure in the context of the audit engagement.

A first important step to perform annually is to update our understanding of the plan’s terms to address the risk of undetected changes or amendments to the plan which can impact the accuracy of plan assets and obligations (for example, the plan is no longer available to all new employees but those employees are still being included in the census data provided to the actuary).

Pension Assets

Planning considerations

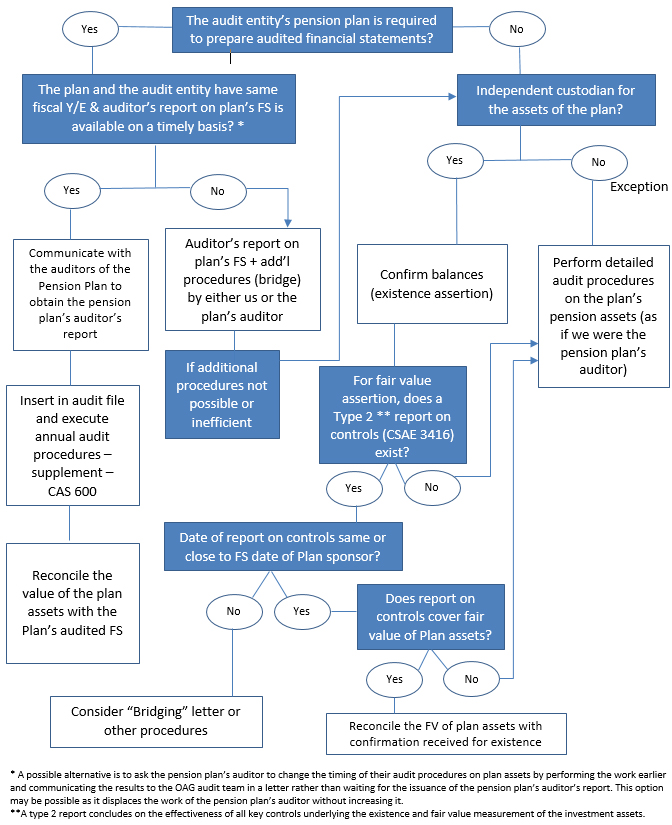

To assist in developing an audit strategy for plan assets that considers the specific circumstances of the audit entity audit teams are encouraged to use the decision tree in Appendix A.

To ensure the audit strategy is effective and efficient, the first step is to identify the key players for each pension asset held by the pension plan. Key players typically include the record keeper, the custodian, the investment manager and, in the case of pooled and mutual funds only, the transfer agent (see Appendix B for definitions of the key players).

Other factors to consider in gaining an understanding of the pension assets include:

- The nature of the plan assets, including level 1, 2, 3 fair value hierarchy classifications and which key player is managing these assets (i.e., custodian or fund administrator),

- Whether an auditor’s report on the pension plan financial statements is available. Consider the period it covers and if it will be available on time before/when communicating with the auditor of the pension plan financial statements.

- Whether the pension plan’s fiscal year-end coincides with the audit entity year-end,

- If a CSAE 3416 type 2 report on controls at the fund administrator (or transfer agent in the case of pooled funds) exists and if so, whether the report will be available in time to perform our audit (refer to CAS 402). If the date of the report is not close to or the same as the audit entity fiscal year-end, consider requesting a bridging letter from the fund administrator (refer to CAS 402.17).

Depending on the specific circumstances of the audit entity, other planning activities in relation to plan assets may include:

- Prepare request for pension asset listing from the fund administrator (if different from the custodian).

- Prepare confirmation requests for the custodian.

- Calculate specific planning materiality for pension asset valuation testing (see more details on this topic further below).

There may be circumstances when the audit team must perform audit procedures to test the plan assets directly, as if we were the pension plan’s auditor (see decision tree in Appendix A). This may occur when there is no independent custodian and assets are managed directly by the pension plan’s/fund’s management and the audited financial statements of the plan are not available, or when the materiality used to audit the plan’s financial statements was much higher than that used to audit the sponsoring entity’s financial statements. In such circumstances:

- Prepare an audit plan for pension plan assets. Consider the proposed audit procedures provided in Appendix C, which are designed to address the existence and valuation assertions depending on the nature of the plan assets.

- Consider the need to involve valuation specialists. Teams should first contact the FI Specialist team before considering external experts. If required, the audit procedure “Plan involvement of auditor’s expert” within the “Reliance on work of others” program of the “AA Supplement” TeamStore cabinet should be added to the planning section in TeamMate.

- Identify and, if you plan to rely on them, test internal controls related to valuation.

Audited financial statements prepared by a pension plan

All registered pension plans are required to prepare audited financial statements. Relying on the audited financial statements of the plan is often the most efficient way to obtain the required level of assurance on plan assets. When relying on the auditor’s report on the pension plan financial statements, the audit team should insert in the audit file the appropriate audit procedures within the “CAS 600—Multi-Location” programs of the “AA Supplement” TeamStore cabinet.

Non-registered plans are not required to prepare audited financial statements. If the non-registered plans are significant, the audit team must consider other audit procedures as described further below.

The audit team must determine whether the pension plan’s fiscal year-end coincides with the audit entity year-end and if the auditor’s report on the plan’s financial statements will be available in time.

- When the plan’s year-end does not coincide with that of the audit entity, the audit team should consider additional procedures to audit the bridge period.

- When the auditor’s report of the plan financial statements is not released in time to be useful to the audit team, an option may be to discuss with the plan auditors and management of the audit entity the possibility for the plan auditor to change the timing of (i.e., expedite) the audit procedures performed on the plan assets and communicate the results of that work earlier in a letter to the OAG audit team rather than wait for the issuance of the pension plan’s auditor’s report.

Audit procedures to consider when there is no reliance on the auditor’s report on the pension plan financial statements

Existence assertion

It is NOT sufficient to simply tie the asset figure to the actuary report (See FAQ #1 in Appendix D). It is also not necessary to obtain a confirmation from the investment manager since they typically do not hold custody of the assets. Be careful as sometimes the custodian and the pension administrator may be two arms of the same company (for example, call to confirm that the confirmation received is from the custodian arm of CIBC Mellon and not the pension administrator) and sometimes the assets may be held by brokers. Obtain a confirmation (by investment type) from each custodian. Trace the confirmed amount to the pension asset statements and/or reconciliation obtained directly from the fund administrator/trustee. Agree the amounts to the pension asset per the client’s disclosure or general ledger.

Refer to Appendix C, for proposed audit procedures designed to address the existence assertion depending on the type of investments held by the pension plan.

Valuation assertion

Materiality consideration

It may be appropriate to use a higher performance materiality than the performance materiality determined for the sponsor to test the valuation of pension assets. The rationale for using a higher performance materiality is that materiality is generally calculated based on net income before tax, revenue or expenses and not on comprehensive income since the effects of OCI generally add variability that is not material to users (for IFRS entities) or not on unamortized actuarial gains or losses since the variability in these balances is generally not material to users (for PSAS entities). Therefore, an error in the fair value of plan assets would affect OCI and comprehensive income (or unamortized actuarial gains/losses in the case of a PSAS entity) to a higher degree but not be considered material to users. Rather, an error in the fair value of plan assets would have an indirect, rather than a dollar for dollar impact, on the sponsor entity’s net income before tax for IFRS entities (or annual surplus/deficit for PSAS entities). This is due to the fact that the periodic plan cost reflected in net income is typically impacted only to the extent of the change in the expected return on plan assets assumption (e.g., assuming an expected rate of return of 8 percent, a $150 million error in the fair value of plan assets would approximate a $12 million error in net income). Therefore, if OCI for IFRS entities (or unamortized actuarial gains or losses under PSAS) is not included in the benchmark to calculate materiality, then an alternative performance materiality may be used. In calculating the different performance materiality, teams would primarily consider the potential impact on net income before tax for IFRS entities (or annual surplus/deficit for PSAS entities) but still consider comprehensive income/loss, plan assets, funded status and shareholder equity for IFRS entities (or net assets for PSAS entities).

The starting point is to figure out the amount of error in plan assets that would result in a material error in net income before tax for IFRS entities (or annual surplus/deficit for PSAS entities) (i.e., performance materiality divided by expected return on plan assets). Then consider how this amount relates to FSLIs that would be affected by errors in plan assets.

Designing audit tests

Keeping the specific materiality level discussed above in mind, design tests to address the valuation of these pension assets. Refer to Appendix C for proposed audit procedures designed to address the valuation assertion depending on the type of investments held by the pension plan. Normally, teams would want to obtain low to moderate level of comfort to address the normal risk in this area, considering pension assets in the context of the sponsor’s financial statements as a whole. Typical procedures to achieve this level of comfort include:

- Obtain an understanding of the nature of investments included in the investment portfolio to design an appropriate testing strategy. Some considerations include:

- Review the investment portfolio and the fair value hierarchy disclosures to identify the amount of securities in each of the levels. Ensure sufficient and appropriate procedures are performed to assess the reliability of this report and the related classifications. The larger pension administrators have set policies on how investments are allocated, and it may be performed automatically by the system, so the controls over this may be covered in the service organization report. The investment manager should also have a process in place for reviewing the classifications.

- Review the nature of the investments classified as level 2 to understand whether these are made up of debt securities, derivatives or pooled and/or mutual funds. Derivatives in particular, depending on the nature and significance, may require the involvement of valuation specialists where they are based on pricing models (for example, interest or credit default swaps). Teams should contact the FI Specialist team before considering external experts. For mutual or pooled funds where there is no publicly available price see FAQs #2, #3 and #3a in Appendix D.

- Obtain an understanding of the nature of the investments classified as level 3 and of how they are valued. Depending on the significance, and in particular for private equity funds, consider involving a valuation specialist. Teams should contact the FI Specialist team before considering external experts. Also see FAQs #2, #3 and #3a in Appendix D.

- In certain circumstances a CSAE 3416 type 22 service organization report may be available. If this is the case, obtain the report and complete the audit procedure “Understand and plan nature and extent use of service organizations” within the “Reliance on work of others” program of the “AA Supplement” TeamStore cabinet—some key considerations:

- Obtain the most recent report. Most of the larger pension administrators (CIBC Mellon, RBC Dexia) have these done every six months.

- Ensure the report covers valuation and document the controls you are relying on in your audit file.

- Request a bridging letter from the pension administrator from the date of the report to the audit entity year-end date.

- If the bridging letter cannot be obtained and the gap is significant, consider extending substantive testing procedures by performing targeted testing and/or non-statistical sampling to achieve a moderate or high level of assurance.

- The audit team should evaluate if it has sufficient assurance through the review of the confirmations received and the review of the service organization report above.

If the audit team needs more comfort or the CSAE 3416 report is not available, consider the following supplementary audit procedures.

- Consider what controls the client has in place and whether these can be relied on, and perform controls testing if necessary. For example, management may review third-party valuations of pension assets quarterly. Remember, the testing performed by management must be in sufficient detail to detect a material error if we want to place reliance on it as a key control to reduce the amount of substantive testing required.

- Once you have an understanding of the types of securities and the internal controls to be relied on, determine an appropriate substantive testing strategy which may include a combination of target and non-statistical sampling methods to gain comfort over the valuation of investments (see Appendix C for proposed audit procedures on investments). Be careful to consider both the significance of the various types of investments as well as the risks of misstatement. For example, if the total of the complex derivatives classified as level 2 and level 3 securities totaled just less than the revised performance materiality it may not be appropriate to completely exclude them from the testing population.

TeamMate tips:

- Ensure the following audit procedures are in the audit file: “Test fair value of plan assets” and “Confirm securities held by custodians and other parties.”

- If you plan to obtain a service organization report, also bring in the “Understand and plan nature and extent of use of service organizations” audit procedure within the “Reliance on work of others” program of the “AA Supplement” TeamStore cabinet and follow the related guidance included in the OAG Annual Audit Manual (OAG Audit 6040).

Pension Benefit Obligations

In January 2011, the CICA (now known as CPA Canada) issued jointly with the Canadian Institute of Actuaries (CIA) a guide: Audits of financial statements that contain amounts that have been determined using actuarial calculations (follow link here). This guide is a good source of additional non-authoritative guidance and we encourage audit teams to consult it.

Planning considerations

The use of actuarial calculations in determining the liabilities of an employee future benefit plan, defined benefit employee future benefit costs, etc. adds complexity, which may increase the risk of material misstatement when these amounts are material to the financial statements as a whole. Because of the complexity and specialized nature of these amounts, they are ordinarily determined by or with the assistance of an actuary; however, in some cases, management may elect not to use an actuary.

- First, the team determines if management uses an actuary and if so, which FSLI it relates to. If management uses an actuary, the team should assess the information to be used as audit evidence using CAS 500.08.

- Then the team determines if it plans to rely on management’s expert or if it will hire its own expert.

- If the team plans to rely on management’s expert, the audit procedure “Plan use of management’s expert’s work” should be added to the Planning Activities section of the audit file. Also ensure the communications with management’s expert are in accordance with CAS 500.

- If the team plans to rely on its own expert, the audit procedure “Plan involvement of auditor’s expert” within the “Reliance on work of others” program of the “AA Supplement” TeamStore cabinet should be added to the planning section of TeamMate.

- Prepare reliance letter to inform the actuary that we plan to rely on his/her work. Consider the use of the Template Actuarial Reliance Confirmation.

Obtain knowledge on all significant assumptions that have an impact on the pension benefit obligation, understand how they are determined and identify the one we plan to test.

Plan census data testing (refer below for more details).

Auditing the benefit obligations

Ensure the most recent “Pension, post-retirement and other benefits” (IFRS library) or “Other liabilities—pension, post-retirement and other benefits” (PSAS library) audit procedures are brought into the audit file and execute them. Some of these procedures are discussed below.

Insert the TeamMate procedure “Plan use of management’s expert’s work” within the “Reliance on work of others” program of the “AA Supplement” TeamStore cabinet in TeamMate and document the professional qualifications of the actuaries that performed the work. Consider whether they are from a reputable firm, and whether they are fellows of the Canadian Institute of Actuaries, the Society of Actuaries or associates thereof. This information should be in the actuary’s report.

Census data used by the actuary

The reliability of the data used by the actuary must be tested. The main data used by actuaries is the sponsor’s census data (information about the population of active, vested and retired employees participating in the pension).

Before planning and designing the tests to be performed, it is important to first obtain an understanding of the key data fields that have an impact on the pension benefit obligation through discussions with the actuary because specific data fields can be more or less important depending on the nature and specific circumstances of the pension plan.

Census data for retired plan members may often be managed differently from the data of active employees. It is important to understand who manages retirees’ data as this may impact the nature of the audit procedures selected by the audit team. For example, data and transactions for retirees such as benefit payments are often managed by a service organization. In this case, enquire whether a CSAE 3416 report is produced by the service organization. The audit team could also consider performing additional analytical procedures by reviewing movements in retiree data year-over-year. The risk of significant errors in retiree data is usually lower given the more stable nature of this part of the plan member population.

To test the accuracy of the data, select a sample of employees from the payroll records and trace them to the census data file, checking details such as date of birth, gender, date of hire, salary, etc. To test the completeness of the data, do a similar test by selecting a sample from the census data file and testing back to payroll records. This is typically accept-reject testing. The sample size should be determined based on the risk assessment and the level of assurance needed (see OAG Audit 7043 for more guidance on accept-reject testing). For a pension obligation covering more than 200 individuals and a low level of assurance is required, the sample size would be 16 each way when no exception is tolerated. The team should also consider the need to consult with the OAG internal statistics specialist when determining test sample sizes and/or when interpreting what is considered a test item. For example, if four data fields are being tested for each employee selected from the census database, the test items may be the four data fields and not the employee. This distinction is important to properly assess the acceptable number of errors permitted by the test.

Actuarial assumptions

Assess the appropriateness of the actuarial assumptions. Identify the actuarial assumptions, such as discount rate, expected return on assets, salary increases, medical cost increases.

- Consider guidance in the two “Actuarial Awareness for Auditors” Standards Interpretations available on the INTRAnet dealing with:

- The discount rate assumption (including the Fiera Capital yield curve endorsed by the Canadian Institute of Actuaries)—issued quarterly; and

- Other actuarial assumptions—issued annually.

- The audit procedure also lists other tests to perform related to assumptions, for example, comparing assumptions with prior year estimates, with actuals (such as past salary increases).

- It may also be appropriate to compare the discount rate or other assumptions used by the actuary with those used by other audit entities in our portfolio to assess reasonableness. However, be careful because the term of the pension obligation has a direct impact on the selection of the discount rate and when performing benchmark analysis, it is important to ensure discount rates being compared are covering similar periods.

The auditor should also consider if the entity is consistent in the way it determines actuarial assumptions. If the entity changes the way it determines an assumptions, for example using the Fiera Capital yield curve one year and another method next year, the audit team should consider if the change should be treated as a change in accounting estimates.

Methodology

Assess the appropriateness of the methodology used to calculate the actuarial obligation—is it in line with the applicable financial reporting requirements? This information should be listed in the actuary’s report. Be careful as actuarial reports may conclude that their methodology complies with generally accepted accounting standards (GAAP). Such a statement should not be used as audit evidence as it is the responsibility of management to make this assessment and our responsibility to audit such a statement using appropriate, sufficient independent audit evidence.

An entity may request an actuary to carry out a detailed actuarial valuation of a pension obligation before the end of the reporting period. In such a scenario, the entity is still responsible to update the results of the valuation for any material transactions or other material changes in circumstances (including changes in market prices and interest rates) up to the end of the reporting period.

Conclusion

The audit procedures discussed in this guide are not new and have been part of our audit procedures for some time. Defined benefit pension plan accounting is however a very complex area that is typically not well understood and for which audit procedures are often inconsistently executed. In particular, there is sometimes too much reliance placed on actuarial letters.

Do not hesitate to consult with AAPT regarding specific circumstances.

Appendix A

Decision Tree—Auditing Pension Plan Assets

The purpose of this decision tree is to assist in developing the most efficient audit approach for pension plan assets (in the case of a funded plan) depending on the various possible scenarios.

Appendix B

Glossary of terms

|

Key Players |

Definition |

|

Actuary |

Third party responsible for performing actuarial valuations that determine the pension obligation, required level of annual contributions and calculation of certain benefits. An actuary is usually only applicable to a defined benefit pension plan. |

|

Usually the company whose employees are members of the pension plan. The Administrator is often responsible for funding the pension plan. A pension plan can have multiple sponsors (in this case the sponsor is not always the administrator). It should be noted that certain Administrator functions are often outsourced to third parties which does not result in the outsourced third party as the ultimate administrator. |

|

|

Custodian |

A financial institution that has the legal responsibility for the safekeeping of the pension plan’s investments. |

|

Counterparty |

The other party that participates in a financial transaction. |

|

Investment Manager |

An investment manager is a person or organization that makes investment decisions on behalf of the pension plan, in accordance with the investment objectives and parameters defined by the pension plan. An investment manager may be responsible for all activities associated with the management of the pension plan’s portfolio, from buying and selling securities on a day-to-day basis to portfolio monitoring, settlement of transactions, performance measurement, etc. These transactions, however, are transacted by the custodian, not the investment manager. |

|

Record Keeper |

This is the entity that maintains the accounting records for the pension plan. This function is normally handled by a third party service provider (see definition below) and can also act as the pension plan’s custodian (see ‘Custodian’) and/or transfer agent (see ‘Transfer Agent’), an arrangement which is common for small plans. However, the Record Keeper may not necessarily perform all administrative activities. This will depend on how the administrator/sponsor chooses to set up the pension plan. |

|

Regulator |

The regulator is the public authority for each province (can also be a national regulator) that is responsible for exercising autonomous authority over pension plans, including audit requirements. Most pension legislations across Canada has similar requirements; and although specific references may be made only to the federal legislation, there are very likely similar requirements in the provincial standards. |

|

Service Provider |

A third party that performs an array of services for the pension plan which can include being the Record Keeper, custodian, actuary, and transfer agent or investment manager. |

|

Transfer Agent |

A transfer agent for pooled and mutual funds maintains the records of investors, account balances and transactions, cancels and issues certificates, processes investor mailings and deals with any associated problems (i.e. lost or stolen certificates). The transfer agent function may be performed in-house or may be a trust company, bank or similar financial institution assigned by the pooled funds. |

|

Other Terms |

Definition |

|

Defined Benefit (DB) |

Defined Benefit (DB) Pension Plans: a DB plan provides members with a pre-determined level of benefits based on the years of service and salary earned. The employer bears the risk of market performance since the pension plan must hold sufficient funds to meet the pension obligations to members in the future. Defined Contribution (DC) Pension Plans: a DC plan provides the members with a predetermined level of contributions (driven by a formula stipulated in the pension trust agreement). The member is then provided with investment options. The member will be entitled to all vested contributions and accumulated earnings when they retire and as such, the amount of pension to be received will not be known until actual retirement. The contributions and accumulated earnings for each employee are segregated in a separate account by the Record Keeper. Members receive regular statements indicating the activity and performance of their individual account. Risk of market performance is borne by plan members. Hybrid Pension Plans: a Hybrid plan is a pension plan that contains a defined benefit component and a defined contribution component. |

|

Pension Fund financial |

Pension fund financial statements include only the assets and current liabilities of the pension plan. They specifically exclude the recognition and disclosure of actuary-determined pension obligations. This distinction relates to defined benefit plans only. Since Pension fund financial statements do not disclose the pension obligations, these are special purpose financial statements and are usually prepared for filing with the regulator (see ‘Regulator’ above) with an appropriate audit opinion under CAS 800. Pension plan financial statements include assets, current liabilities and disclosure and recording of the actuary-determined pension obligations. The difference between pension plan and pension fund financial statements is important because application of Part IV of the Handbook (incorporating s.4600) requires the preparation of pension plan financial statements. |

|

Hedge Fund |

An aggressively managed portfolio of investments that uses advanced investment strategies such as leveraged, long, short and derivative positions in both domestic and international markets with the goal of generating high returns. Legally, hedge funds are most often set up as private investment partnerships that are open to a limited number of investors and require a very large initial minimum investment. Investments in hedge funds can be less liquid due to redemption frequency or initial lock-up periods. |

|

Master Trust |

A master trust is a pool of assets that are set up to allow several pension plans of the same sponsors to invest in them. These are similar to a private pooled fund. Master trusts are usually created when a sponsor has multiple pension plans and wishes to reduce the administrative cost and effort by managing one larger pool as opposed to several smaller pools. |

|

Mutual Fund |

An investment vehicle that is made up of a pool of funds collected from many investors for the purpose of investing in securities such as stocks, bonds, money market instruments and similar assets. Mutual funds are operated by money managers, who invest the fund’s capital and attempt to produce capital gains and income for the fund’s investors. A mutual fund’s portfolio is structured and maintained to match the investment objectives stated in its prospectus. Within the fund, there are usually two main classes of shares that investors may enter into: Class I shares: typically only solicit institutional investors, e.g. Managers of retirement plans, banks, insurance companies, retirement plans and hedge funds. These funds can take almost any form but their defining trait is their clients. Class O shares: typically only solicit individual investors through investment dealers and in open market transactions. These are usually retail funds which are registered with a Securities and Exchange Commission. They carry lower initial investments and management expense ratios than institutional funds and are restricted in the amount of self-exposed overall risk. |

|

Pooled Fund |

Funds from many individual investors that are aggregated for the purposes of investment, as in the case of a mutual fund or pension plan. Investors in pooled fund investments benefit from economies of scale, which allow for lower trading costs per dollar of investment, diversification and professional money management. |

|

Segregated Fund |

An investment that is essentially a receivable balance with a life insurance company that is secured and indexed to a group of assets held by that insurance company, usually mutual or pooled funds. |

|

Standard of Investment Policies and Procedures |

A document issued by the sponsor and required by the Regulator which specifies investment strategies and investment limitations. |

Appendix C

Proposed Audit Procedures for Investments Held by a Pension Plan

The following procedures are relevant when the audit team must test the plan assets directly, as if it were the pension plan’s auditor.

Investments—Existence

|

Types of investments |

Audit approach |

|

Marketable securities |

|

|

Pooled, mutual and hedge funds |

|

|

Segregated funds |

|

|

Derivatives |

|

|

Real estate |

|

|

Private placements |

|

Investments—Valuation

|

Types of investments |

Audit approach |

|

Marketable securities |

|

|

Pooled, mutual and hedge funds |

|

|

Segregated funds |

|

|

Derivatives |

|

|

Real estate |

|

|

Private placements |

|

Appendix D

Frequently Asked Questions

1. Why isn’t sufficient audit evidence for existence of plan assets gained by tying amounts to the actuary report?

Because the actuary is management’s expert, evidence produced by the actuary needs to be corroborated and verified to external sources. Although the actuary uses asset information in his/her calculations, we cannot be certain that the actuary is using the correct figures unless we obtain such evidence directly from the trustee. Actuaries may just be using the information on pension assets that they received from management, without independently verifying the information. In the same way, we independently test census data and estimates used by the actuary.

2. My entity’s pension invests in private equity funds. These funds are only audited once annually and the audit report is not typically available until well after the audited sponsor financial statements are required to be done. What valuation testing do you suggest?

This situation can be difficult to address. As indicated above, consider materiality first. However, you cannot simply pass on testing these investments if they are less than performance materiality without considering the potential for a material understatement, since the value of these investments is typically based on estimates.

The key substantive procedures to test the value of private equity funds to achieve a moderate level of assurance (with no controls reliance) are:

- Obtain prior year audited financial statements, and compare to prior year value used in the sponsor’s financial statements. This gives an indication of how well the investment manager has valued these investments in the past.

- Consider if the investment manager has any incentive to inflate the value. This can be done by understanding the management fee structure—does the manager earn fees on a “realized basis” or “unrealized basis”? If the former, fees are only earned when the private equity investment is sold, therefore the incentive to overstating the unrealized value is significantly reduced.

- Consider recent transactions—purchases of sales of these securities.

- Finally, consider involvement of valuations specialists as needed to identify or execute a test plan. Audit teams should first contact the FI Specialist team before considering external experts.

3. My entity’s pension invests in a mutual, pooled, segregated or hedge fund. There is no independent source for the price of the pooled fund. Audited financial statements of this fund are not available at the time of auditing the sponsor. What valuation testing can I do?

These pooled funds are valued at the net asset value (NAV) at a point in time.

The following procedures are useful in testing the valuation of mutual, pooled, segregated or hedge funds that comprise the pension asset of a sponsor. This is because this asset forms a small part of the audited financial statements as a whole. When auditing a pension plan itself, further procedures would normally be undertaken, such as obtaining audited financial statements of the fund for the current year. The following substantive procedures are based on obtaining a moderate level of assurance (with no controls reliance).

The key steps to test this value are:

- Obtain an understanding of and document who the investment manager, fund administrator, custodian and auditor are and what the underlying investments consist of for each pooled fund. All of this information can be readily obtained by reading the pooled fund’s offering memorandum or most recently issued financial statements. Consider what we know about these key players. For example, is the administrator independent of the investment manager? Does the administrator of the pooled fund have a CSAE 3416 type 2 report available? Are the auditors a well-known and reputable firm? Is the custodian well-known? What is the underlying investment strategy and how risky is it? Consider the responses to each of these and apply professional judgment, as no single risk factor is necessarily the overriding factor. A combination of the risk factors and the risk of a material misstatement should be considered where multiple risk factors are present. If you are unsure of the significance of the issue or how it impacts your overall strategy, be sure to consult.

- Send a confirmation request directly to the fund administrator of the pooled fund to confirm the number of shares held and the net asset value (NAV) per share.

- Consider redemptions or purchases near the balance sheet date.

- Obtain the prior year audited financial statements of the pooled fund and check whether the NAV per these financial statements (see FAQ 4a for additional guidance) is the same or different from the price used in the prior year valuation of the pooled fund at the time of the sponsor audit.

3a. In the audited financial statements of the pooled funds, there is a net asset per unit in the statement of net assets and there is a net asset value per unit in the notes to the financial statements; which figures should I use when verifying the NAV from the Record Keeper confirmation to the NAV of the audited financial statements of the pooled funds?

The transactional net asset value (Transactional NAV) in the notes to the financial statements should be used instead of the net asset per unit as shown in the statement of net assets. The net asset per unit in the statement of net assets is disclosed for financial statement reporting purposes (this is often referred to as the GAAP NAV), while the net asset value per unit as disclosed in the notes is the value that is used for purchase and redemption of units based on the fair value of the pooled funds’ financial assets and financial liabilities.

4. We obtained a confirmation from the Record Keeper which includes a detailed listing of all pooled, mutual or hedge funds that the pension invests in and/or the investment manager. Is this sufficient to support the existence assertion?

Likely No. The transfer agent is the entity that is responsible for maintaining the listing of which parties own the units of the pooled, mutual or hedge funds. It is important to note that the Record Keeper may often have custody of common shares, bonds and debentures (CIBC, RBC, and Northern Trust etc.) but likely will not have custody of the pooled, mutual or hedge fund units. Pooled, mutual or hedge funds are not assets that can physically be held in custody (i.e. there are no share certificates). Therefore confirming with the transfer agent is essential to obtaining comfort over the existence of the pooled, mutual or hedge funds (confirming that the pension does indeed own the units).

For pooled, mutual or hedge fund investments, engagement teams should work with the client to determine the transfer agent of the pooled, mutual or hedge fund investments.

For segregated funds, the life insurance company that is the Record Keeper is also the Transfer Agent of their own segregated funds, and therefore, no further confirmation is required.

Consider the following scenarios:

Scenario 1:

CIBC Mellon is the Record Keeper of the pension plan; the pension plan invests in the State Street Global Advisors S&P/TSX Composite Index Fund. As confirmed by the investment manager of the pooled fund (State Street Global Advisors), State Street is also the transfer agent of the State Street Global Advisors S&P/TSX Composite Index Fund. Therefore, the engagement team should send a confirmation to State Street in its capacity as the transfer agent. The engagement team should also send a Record Keeper confirmation to CIBC Mellon and agree the number of pooled fund units in the CIBC Mellon confirmation to the number of pooled fund units in the State Street confirmation.

Scenario 2:

CIBC Mellon is the Record Keeper of the pension plan; the pension plan invests in the AGF Global Core Equity Pooled Fund. As confirmed by the investment manager of the pooled fund (AGF), Citigroup is the transfer agent of the AGF Global Core Equity Pooled Fund. Therefore, the engagement team should send a confirmation to Citigroup in its capacity as the transfer agent. The engagement team should also send a Record Keeper confirmation to CIBC Mellon and agree the number of pooled fund units in the CIBC Mellon confirmation to the number of pooled fund units in the Citigroup confirmation.

5. When testing the existence of pooled, mutual or hedge funds, is the use of accept-reject testing methodology appropriate?

Yes. The use of accept-reject methodology is considered appropriate as the non-monetary attribute in this case is whether the pooled, mutual or hedge fund units in the Record Keeper confirmation exist. If there is a difference between the number of units between the Record Keeper and the transfer agent and the difference is not explainable and supportable, then this is considered to be an error. The projection of this error to other pooled, mutual or hedge fund investments owned by the pension plan is not appropriate as this error may not be applicable to other pooled, mutual or hedge fund investments. When this error occurs, engagement teams will need to consider the existence assertion of the other pooled, mutual or hedge fund investments in the Record Keeper confirmation; the engagement team should determine the exposure of this error by testing the existence of all pooled, mutual or hedge fund investments, or alternatively, the team may reject the test and request the Record Keeper to correct all information in the Record Keeper confirmation and re-perform the accept-reject test.

6. We obtained a confirmation from the Record Keeper which includes a detailed listing of all derivatives that the pension holds, and/or from the investment manager. Is this sufficient to support the existence assertion?

In order to obtain comfort over the existence of the derivatives, it is important to obtain a confirmation from the counterparties. The counterparty is the other party to a derivative, with whom a contract is held. As derivatives are not ‘held’ in custody, comfort over existence cannot be obtained from a custodial or Record Keeper confirmation. Confirming the derivative contract with the counterparty is the way to support the existence assertion. If a counterparty confirmation is not obtained, then alternative procedures such as liquidation testing should be performed or obtain broker statements from the client.

1 While the guide refers for simplicity purposes to pension plans, it is also meant to cover other post-employment benefit plans.

2 According to paragraph A16 of CAS 402 Audit considerations relating to an entity using a service organization, a type 2 report issued under CSAE 3416 provides assurance on the operating effectiveness of controls at a service organization, while a type 1 report only covers the description and design of the controls.