Presentation Issues Relating to Cash and Cash Equivalents Held Within Investment Portfolios

Overview: This document highlights some important considerations in determining the appropriate presentation of assets held within investment portfolios on the statement of financial position and in the cash flow statement. While this document is directed at Government Not‑for‑profit organizations (“GNPOs”), these considerations may also be relevant for other entities that hold investment portfolios managed externally by an investment manager.

This document summarizes the GAAP requirements for classification of cash, cash equivalents and investments under International Financial Reporting Standards (IFRS) and Public Sector Accounting Standards (PSAS). It also highlights the guidance on determining when investing cash flows can be presented gross or net in the cash flow statement.

While this document is directed at Government not‑for‑profit organizations, these considerations may also be relevant for other entities that hold investment portfolios managed externally by an investment manager. This guidance does not apply to pension plans. Pension plans use Part IV of the CPA Canada Handbook—Accounting, which does not require a cash flow statement to be presented, and which has its own definition for determining what constitutes investment assets held in their investment portfolio.

Guidance

The cash flow statement reconciles the changes in cash and cash equivalents for the period to the specific cash flows of the entity. Cash flows are inflows and outflows of cash and cash equivalents. Therefore, it is essential to determine what is presented as “cash” or “cash equivalents” in order to determine what are cash flows. In addition, cash and cash equivalents are generally separately presented on the statement of financial position.

All Canadian frameworks (IFRS and PSAS) include the same definitions of “cash” and “cash equivalents” as follows:

| Definition | Technical references | |

|---|---|---|

|

Cash |

Cash comprises cash on hand and demand deposits. |

PS 1201.104 PS 1200.096 IAS 7.6 |

|

Cash equivalents |

Cash equivalents are short‑term, highly liquid investments that are readily convertible to known amounts of cash and that are subject to an insignificant risk of changes in value. Cash equivalents are held for the purpose of meeting short‑term cash commitments rather than investing for other purposes. |

PS 1201.105 PS 1200.097 IAS 7.6-.7 |

A common situation for GNPOs is where an entity makes transfers of cash from their bank account into a separate investment account. The investment manager is authorized to use the funds in the investment account to make purchases of securities. Proceeds from the sale of securities is deposited in the investment account. Any interest or dividends earned on securities held is also deposited in the investment account. The investment manager may also invest the funds in items such as high interest savings accounts, T‑bills, short‑term commercial paper and other similar instruments. However, each GNPO may have different arrangements with their banks, brokerages and investment managers. It is important to obtain an understanding of the terms and conditions of the investment account and the nature of the deposits held therein. These instruments must be analyzed to determine how to classify these amounts on the statement of financial position and the cash flow statement.

Assets that are held separately due to external donor restrictions, such as restricted cash amounts, are out of the scope of this document.

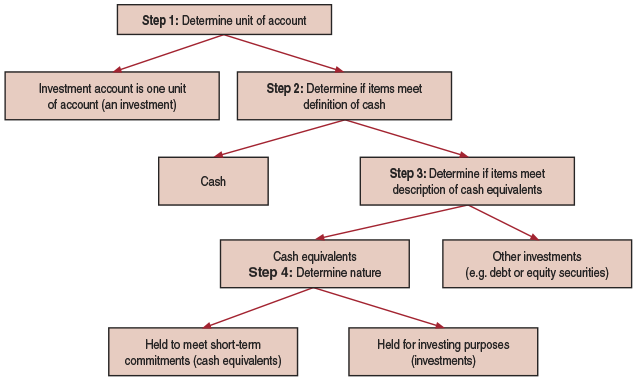

The following flowchart may be helpful in guiding audit teams through the classification considerations:

Step 1: Determine the unit of account for the investment account

Firstly, the GNPO will need to determine who controls the investing decisions made within the investment account. Typically, GNPOs will retain ultimate control over the investment account decisions as investments must comply with the Board approved investment guidelines which are often restrictive. The investment manager will often be considered an agent of the GNPO, even when significant day‑to‑day decisions have been delegated to an investment manager. If a client believes the investment manager, rather than the GNPO, controls the investment account activities, consultation with AAPT is recommended.

When the investment manager controls the investment decisions within the investment account, the GNPO has a receivable from the investment manager and does not recognize the underlying investments within that account. In this case, the entire investment account is the unit of account for classification and measurement. In these circumstances, the investment account would not meet the definition of “cash” or “cash equivalents” as such an arrangement is not a demand deposit and has risks of significant changes in value. Instead, the receivable from the investment manager would be classified and measured as a financial instrument using an appropriate measurement model (fair value through profit or loss, or amortized cost) applied in accordance with the underlying accounting framework or designations made by the client.

The following accounting model would be applied in these circumstances:

Accounting guidance—Accounting for an investment account where the investment manager controls the investing activities

Statement of financial position presentation: The account would usually be presented within investments. As it is a single financial instrument it is classified as either current or non‑current according to its terms (IFRS and PSAS+4200). PSAS entities would classify the financial instrument as a financial asset. Risk disclosures relating to investments would reflect the nature of the account as one investment.

Income statement or statement of remeasurement gains and losses presentation (assuming investment carried at fair value): For GNPOs, any changes in the balance of the investment account, other than from contributions and withdrawals, would be recognized as a change in fair value in the statement of remeasurement gains and losses. For IFRS entities, such changes in fair value would be recognized in the statement of comprehensive income. If interest and dividends are earned on underlying investments within the portfolio, these would not be recognized as interest or dividend income, but rather would form part of the change in fair value noted above, because such interest and dividends does not reflect the characteristics of the investment account receivable itself.

Cash flow presentation: The account receivable in this example is excluded from cash and cash equivalents. Contributions into the account would be presented as investing outflows. Withdrawals from the account would be presented as investing inflows. Any dividends and interest amounts earned within the account are not cash flows of the GNPO. To the extent any change in fair value (including those attributable to interest and dividends) has been recognized in the income statement, an adjustment to operating cash flows for this non‑cash item would be shown when using the indirect method.

When the GNPO retains control of the investment account, it is acting as a principal in investing in the underlying portfolio securities. The characteristics of the underlying securities determine how they are classified and measured in the financial statements of the GNPO—see Steps 2, 3 and 4.

Step 2: Determine whether any deposits held in the investment account are “demand deposits” and hence meet the definition of “cash”

The accounting standards do not define what a “demand deposit” is. However, these are generally accepted to be deposits with financial institutions that are repayable on demand and available within 24 hours or one working day, without penalty (PwC IFRS Manual of Accounting FAQ 7.3.1).

There is no further guidance on what constitutes a deposit with a financial institution. In Canada, generally a financial institution is one that is regulated by the Office of the Superintendent of Financial Institutions (OSFI) as a deposit‑taking institution. Audit teams should consider the counterparty to the client’s investment account in determining whether this element of the definition is met.

Engagement teams should ensure they have an understanding of the mechanisms and timing of how a client can withdraw amounts from the investment account to determine whether the amount is available on demand (within 24 hours) and without penalty.

If the deposit meets the definition of a “demand deposit” it would be classified as “cash” on the statement of financial position and in the cash flow statement. See also FAQ 2 below.

Accounting guidance—Accounting for cash held within an investment account

Statement of financial position presentation: Cash is presented as cash on the statement of financial position and may be grouped with cash equivalents (if any). For IFRS and PSAS, the components of cash and cash equivalents should be disclosed in the notes.

Cash flow presentation: Transfers between cash deposit accounts are not cash flows and do not appear separately on the cash flow statement. Cash in the investment account is included in the opening and closing cash balances at the bottom of the cash flow statement. A reconciliation of the amounts presented as cash and cash equivalents in the cash flow statement to the equivalent statement of financial position items should be presented, unless the opening/closing cash flow statement balances are the same as the single statement of financial position line item for cash and cash equivalents. (References: PS 1201.126; PS 1200.118; IAS 7.45)

Step 3: Determine if items in the investment account meets the description of “cash equivalents”

Cash equivalents are short‑term, highly liquid investments that are readily convertible to known amounts of cash and that are subject to an insignificant risk of changes in value.

A cash equivalent normally has a short maturity of three months or less. More guidance on interpreting this definition can be found in the PwC IFRS Manual of Accounting FAQ 7.3.2; FAQ 7.3.3; FAQ 7.3.4; FAQ 7.3.5; FAQ 7.5.2 and FAQ 7.5.3. While this guidance applies directly to IFRS, it is also relevant to other frameworks as cash equivalents are defined the same way in PSAS.

If an investment account is controlled by the GNPO (see Step 1), but deposits into the account do not meet the definition of “cash” because the investment account is not with a financial institution, or the funds are not withdrawable on demand for no penalty (see Step 2), then it is possible that funds held in the account that have not yet been used for the purchase of securities would meet the definition of cash equivalents. This would only be the case when there is an insignificant risk of changes in value, for example, the counterparty to the account has very low credit risk and there is high liquidity of the amounts held therein. Items that do not meet the definition of either cash or cash equivalents in such a situation must be classified as investments. See “Accounting for investments” below.

Step 4: Determine if cash equivalents are held as cash equivalents, or held for investing purposes

Short‑term investments might meet the definition of “cash equivalents” but will only be presented as cash equivalents when they are held as a means of meeting short‑term cash commitments, such as for settling liabilities, and not as an investment or for other purposes. By contrast, an investment enterprise, whose portfolio consists largely of short‑term highly liquid investments meeting the “cash equivalents” definition, but which are not being held for short‑term cash commitments, may conclude that all items in that portfolio are treated as investments rather than cash equivalents. PwC IFRS Manual of Accounting FAQ 7.5.1 discusses when cash equivalents might be treated as investments.

Many GNPOs view any cash equivalents held in an investment account as held for investing purposes. The amounts are typically held in this account for re‑investment, and are withdrawn only when there is an intention to use those amounts to meet working capital liabilities or fund programming. We would generally not object to a client presenting these amounts as held for investing purposes in these circumstances, but an assessment of the specific circumstances would be necessary in each instance.

Accounting guidance—Accounting for cash equivalents held an investment account

Instruments that are classified as cash equivalents are treated the same way as cash. See “Accounting for cash held within an investment account” above. Transfers between cash and cash equivalents are not cash flows and do not appear separately on the cash flow statement. For example, if amounts in an investment account are classified as “cash equivalents” (rather than investments) under Step 4, then movements in and out of the investment account do not change the total “cash and cash equivalents” of the entity and would not appear on the cash flow statement as a “cash flow”.

Accounting guidance—Accounting for investments

Instruments that are not classified as cash equivalents because they are held for investing purposes are accounted for as investments.

Statement of financial position presentation: Investments are presented separately from cash and cash equivalents. The specific requirements of the accounting framework for statement of financial position presentation, including classification into current and non‑current, should be considered. (References: PS 1201; PS 1200; PS 4200; IAS 1)

Cash flow presentation—classification of cash flows: The purchase of individual investments using cash or cash equivalents are cash outflows in investing activities. The proceeds from the sale of individual investments are cash inflows from investing activities. If an investment (such as a T‑bill) is liquidated in order to purchase another investment, such as an equity security, there would be a cash inflow from the sale of the first investment and a cash outflow for the purchase of the second investment.

The receipt of dividends or interest on investments into an investment account is usually in the form of cash. These are cash flows and are presented as operating cash flows (PSAS+4200, PSAS), or as operating or investing cash flows according to the entity’s policy choice (IFRS). Any reinvestment of these amounts in new investments would be an investing cash outflow.

Cash flow presentation—gross vs net presentation: Cash flows from investing and financing activities are presented gross on the cash flow statement, unless one of the specific exceptions are met.

One of these exceptions applies to cash receipts and payments for items in which the turnover is quick, the amounts are large and the maturities are short. This exception exists in all accounting frameworks.

If a client is presenting net cash flows for investing activities, that is, cost of new investments less proceeds from sales as one line in their cash flow statement, the audit team should determine whether the method of managing the investment portfolio meets the criteria for quick turnover, large amount and short maturities. Most GNPO portfolios will not meet this criteria, as they are not actively managed on a trading basis. This reflects that, generally, GNPOs invest in longer‑term assets for long‑term financial security, such as the receipt of interests and dividends, rather than to earn returns from short‑term profit taking and day‑trading activity. (References: PS 1201.120‑121; PS 1200.111‑.112; IAS 7.21‑.22)

Next steps

The above guidance is applicable immediately and should be considered for all audits.

If the audit team determines there is an error in either the statement of financial position or the cash flow statement, this would result in a presentation or recognition issue (relating to financial statement line items in the primary financial statements) rather than a disclosure issue (relating to the notes to the financial statements), and should be treated accordingly. The following additional guidance may be helpful:

Additional guidance

-

OAG Audit 2105 permits designation of a separate SUM posting threshold for statement of financial position or income statement reclassifications up to overall materiality.

-

If the effects of uncorrected misstatements related to prior periods are determined to be material to the current period, the engagement team should consult in accordance with OAG Audit 3081.

-

The amount of the error should be quantified. If the amount cannot be quantified by the audit team (for example, the gross cash flows for investing activities), this should be discussed with AAPT.

-

For all other scenarios, consultation is encouraged if the facts and circumstances are such that more than one reasonable conclusion could exist, there is a likelihood that the conclusion could be challenged or where an otherwise immaterial matter could become material or create a precedent as outlined in OAG Audit 3081.

Frequently Asked Questions

-

Does a client need to disclose their accounting policy for determining cash and cash equivalents?

Yes. All accounting frameworks in use in Canada require that the policy for determining the composition of cash and cash equivalents be disclosed. (References: PS 1201.126; IAS 7.46)

-

My client has a cash deposit in an investment account that qualifies as “cash” under Step 2. They say it forms part of their investment portfolio and is held for investment purposes. Can they classify this as an investment and not cash?

Generally no. The requirement to determine whether an investment is held to meet short‑term cash commitments or for investing purposes (Step 4) applies to cash equivalents, but not to items that meet the definition of cash. However, the terms of the investment account should be carefully considered to ensure that the amounts meet the definition of a demand deposit, prior to concluding that there is cash within the investment account.

-

Is it a choice whether cash equivalents held in an investment account are classified as “investments” or as “cash equivalents” on the statement of financial position and cash flow statement?

The classification is determined by consideration of facts and circumstances, and the purpose for which management is holding cash equivalents in the investment account. Management’s stated purpose and intention should be assessed in light of any documented investment strategy and past actions. We would expect management to take a consistent approach to cash equivalent amounts held within investment accounts year over year, unless there is evidence to support a change in intention.

-

My client has invested in some high interest savings balances. Are these cash, cash equivalents or investments?

They may be any of the above. The terms should be considered carefully to determine if the amounts meet the definition of cash or if they meet the definition of cash equivalents. The ability to withdraw amounts and the extent of any loss of interest on the amount withdrawn may affect the classification of such accounts.

-

All management requests to withdraw amounts from an investment account must be approved by the Board of the GNPO. Does this mean the amounts in the investment account cannot be “cash”?

No. Board approval for transactions is an internal governance process and does not affect the determination of whether a deposit in an investment account is a demand deposit. Whether a deposit is available within 24 hours is measured from the date the request is made to the financial institution.

-

My client’s investment portfolio does not meet the exception to permit investing cash flows to be on a net basis. However, management has stated that they cannot quantify the gross amounts of purchases and sales in the portfolio. Does this mean they can present the cash flows net?

Usually the client has or can obtain the necessary information from the investment manager for the cost of purchases made in the year and the proceeds from sales (fair value of investments when sold). This is because the underlying investments are the client’s investments and they should be able to access the underlying accounting records to support these investments as part of their internal control processes. Quantification may involve a significant work effort, but this does not negate the requirement under GAAP to present these amounts on a gross basis.

Situations where the investment manager will not and cannot be compelled to provide this information, may indicate the investment account is controlled by the investment manager and the client’s investment is limited to contributions and withdrawals from the investment account. In this case, the guidance for “Accounting for an investment account where the investment manager controls the investing activities” discussed above should be followed.

This document is for internal use only.