Actuarial Awareness for Auditors—Selection of the Accounting Discount Rate (under IFRS)

31 December 2022

This document provides guidance to auditors in assessing the accounting discount rate used in the calculation of the defined benefit obligation for a Canadian employee benefit plan when determined by reference to high-quality corporate bonds (or high quality debt instruments) as required under the following accounting standards (referred to in this document as the “Accounting Standards”):

-

International Accounting Standard 19 (IAS 19) under IFRS; and

-

Section 4600 of part IV (Pension Plans) of the Handbook when, as per paragraph 22, a pension plan measures the pension obligation at the accrued benefit obligation amount determined by the plan sponsor when the plan sponsor’s financial statements are prepared using IFRS.

In instances where the defined benefit obligation exceeds the materiality level for the audit, engagement teams are strongly encouraged to seek assistance from the Internal Specialist—Actuarial and Pensions in reviewing the discount rate.

The guidance contained in this document is not appropriate for assessing discount rates in accordance with sections PS 3250 Retirement benefits and PS 3255 Post-employment benefits, compensated absences and termination benefits of the Public Sector Accounting Handbook.

Selecting the accounting discount rate

The discount rate under these Accounting Standards is based on high-quality corporate bonds and is re-evaluated at each measurement date. When long-term interest rates rise or decline, the accounting discount rate changes in a similar manner. Therefore, it is not permitted for an entity to determine a range of discount rates each year and continue to use the prior year’s discount rate assuming it falls within the range.

Also, it is not permitted for an entity to determine a range of discount rates and then arbitrarily select the discount rate to be used from within that range. The reasonable ranges below will generally apply for a large number of pension plans that use high quality long-term corporate bonds to determine the best estimate of the discount rate. You should consider asking an employer who expects to choose a discount rate outside the range of reasonable discount rates to support the use of that rate with analysis matching a specific bond portfolio to the liability cash flows. The discount rate should be chosen as the best estimate to match each plan’s expected cash flows.

The discount rate assumption is not management’s best estimate long-term assumption, but rather a market interest rate set in reference to high-quality corporate bonds.

Yield Curves used on the market

In Canada, there are different approaches used to determine an appropriate yield curve based on high quality corporate bonds. The most common ones are summarized below:

-

Fiera Capital Corporation yield curve (or the CIA curve)—The Canadian Institute of Actuaries (CIA) published an educational note in December 2020 that offers advice to pension actuaries who are engaged to provide guidance to a pension plan sponsor on the selection of the discount rate for a Canadian pension plan under Canadian, US, or International Accounting Standards. The educational note addresses the scarcity of high-quality corporate bonds with long maturities in Canada and suggests various ways to extrapolate the long end of the yield curve to account for this scarcity. At the same time, the CIA retained the services of Fiera Capital Corporation (Fiera Capital) to produce, on a monthly basis and free of charge, Fiera Capital’s CIA Method Accounting Discount Rate Curve that can be used by sponsors to select the appropriate accounting discount rate. To account for the scarcity of high quality corporate bonds with longer durations, the Fiera Capital curve includes high quality provincial bonds with longer durations and adjusts with an appropriate spread in the analysis. The link to the Fiera Capital website is: Fiera Capital’s CIA Method Accounting Discount Rate Curve.

-

Other curves—The CIA curve is not the only acceptable yield curve and other yield curves developed using similar approaches could also be appropriate for accounting purposes, such as yields curves based on the Mercer Model, RATE:Link and BOND:Link developed by Willis Towers Watson, or the models developed by LifeWorks and Aon Hewitt.

If the client proposes to use a rate based on a yield curve other than the Fiera Capital yield curve (or the CIA curve) or proposes to change the methodology used to determine the discount rate, the engagement team is encouraged to consult with AEA or the Internal Specialist—Actuarial and Pensions.

Alternative approaches to the accounting discount rate used to measure service cost and interest cost

As mentioned in the standards interpretation issued by AEA in January 2016 (“Using Various Discount Rate Approaches to Develop Defined Benefit Plan Cost (under IFRS)”) alternative approaches to determine the discount rate for calculating the service cost and the interest on the net defined benefit liability (asset) are considered and now used in practice. We would normally expect the discount rate used to measure the service cost to be higher than the discount rate used to measure the obligation given that the service cost (a measure that applies only to active employees) typically has a longer duration than the obligation.

Reasonable Ranges for the Discount Rate

Table 1: Fiera Capital Information

The following table provides a reasonable range for the accounting discount rates at various dates for a typical pension plan, when an entity has adopted the Fiera Capital curve to determine its accounting discount rates.

|

Fiera Capital |

2021 |

2022 |

|

Date |

Reasonable range for typical pension plans 1 |

Reasonable range for typical pension plans 1 |

|

December 31 |

2.95% to 3.00% |

5.05% to 5.05% 2 |

|

November 30 |

3.15% to 3.20% |

4.90% to 4.90% 2 |

|

October 31 |

3.20% to 3.30% |

5.30% to 5.30% 2 |

|

September 30 |

3.20% to 3.30% |

4.95% to 4.95% 2 |

|

August 31 |

3.00% to 3.10% |

4.80% to 4.80% 2 |

|

July 31 |

3.00% to 3.10% |

4.60% to 4.65% |

|

June 30 |

3.10% to 3.20% |

5.00% to 5.05% |

|

May 31 |

3.20% to 3.30% |

4.70% to 4.75% |

|

April 30 |

3.25% to 3.35% |

4.60% to 4.65% |

|

March 31 |

3.25% to 3.35% |

3.95% to 4.00% |

|

February 28 |

3.05% to 3.15% |

3.60% to 3.70% |

|

January 31 |

2.70% to 2.80% |

3.40% to 3.50% |

|

1 The ranges provided above are applicable to typical pension plans and may not be appropriate in certain cases. Engagement teams are strongly encouraged to seek assistance from the Internal Specialist—Actuarial and Pensions in the review of the discount rate in instances where the defined benefit obligations exceed the materiality level for the audit. 2 The yield curves from August 31, 2022 to December 31, 2022 yield curves are flat from duration 14 years to 24 years, as such the low end of the range and the high end of the range results at the same rate. |

||

Frequently Asked Questions

1. How can I use this document to review the reasonableness of a discount rate?

-

We expect that the discount rate for a typical pension plan falls within the range set out above.

-

If the discount rate is outside the reasonable range it does not necessarily imply it is wrong; however the audit team should consider obtaining additional support from management. Plans with a lower duration than a typical plan (less than approximately 13 years) are likely to have a discount rate that is lower than the low end of the reasonable range. Plans with a higher duration than a typical plan (more than approximately 16 years) are likely to have a discount rate that is higher than the high end of the range.

-

We expect consistency within the range year over year. For example, for plans with a discount rate that fell near the high end of the reasonable range last year, they would also fall near the high end of the reasonable range this year.

2. Why is this document not appropriate for a valuation for funding purposes?

This guidance is not appropriate for reviewing the reasonableness of the funding discount rate for a pension plan. The funding discount rate is determined with reference to the expected return of the plan assets and will depend on how the assets are invested (equities, bonds, private investments, etc.) as well as the investment strategy (passive, active, etc.), and will generally be net of plan expenses (either investment-related expenses or all expenses). A reasonable range for a funding discount rate (for a plan invested roughly 60% in equities and 40% in fixed income) is between 5.00% and 7.00%; this is a long term assumption and is not expected to vary every month. However, with pension de-risking activities, it is not uncommon to see pension assets invested primarily in fixed income, resulting in a much lower funding discount rate.

3. Can I distribute this document to my audit entity?

No. The purpose of this document is to assist the audit teams in determining the reasonableness of the discount rate assumption selected by management. Management should determine the appropriate discount rate using the same methodology as prior years and, often, in consultation with its actuaries. To maintain independence, the audit team should be careful about providing information to management. This document should not be shared with audit entities; however the engagement leader may use discretion in providing to audit entities information contained in this document.

4. What is normally considered “high quality corporate bonds”?

In Canada, “high quality” has generally been interpreted as referring to market yields on corporate bonds rated Aa or higher (or the two highest ratings of a rating agency).

5. What is the duration of a defined benefit pension plan and how is it calculated?

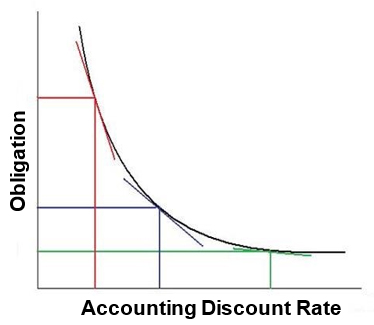

The duration of a pension plan is a similar concept to the duration of a bond. Duration measures the defined benefit obligation sensitivity to a change in the accounting discount rate. In this graph, notice that the lower the accounting discount rate, the higher the obligation. At a certain level of discount rate the duration represents the slope of the “obligation curve”. If a plan has a duration of 15 (or 15 years), this means that for a 1% change in the discount rate, the obligation will change by 15%. The actuaries normally calculate the duration by recalculating the obligation at a slightly different discount rate, and determining the percentage change in the obligation divided by the change in the discount rate. The duration also represents the weighted average time until the expected benefit payments of the plan are paid.

Text version—This graph shows the inverse relationship between the discount rate and the obligation whereby the lower the discount rate, the higher the obligation.

6. Why is it that a plan with a longer duration can typically justify a higher accounting discount rate than a plan with a lower duration?

Let’s take 2 examples: Plan A has one benefit payment that is expected to be paid in 10 years from today, and Plan B has one benefit payment that is expected to be paid in 20 years from today. To determine the appropriate discount rate, we need to “hypothetically buy” a high quality corporate bond that will match in amount and timing the cash flows of the plans (in this case it is a single payment, for simplicity).

In a normal yield curve environment, short-term debt instruments have a lower yield than long‑term debt instruments of the same credit quality. This gives the yield curve an upward slope. This means that if you invest for 20 years, you should get a higher yield (and a higher return) than if you decide to invest your money for 10 years.

So, a plan that has a longer duration (the payments are payable, on average, further in the future) will be able to buy high quality bonds that have a longer maturity and, as a result, a higher yield (in situations of a normal yield curve). So, the discount rate for a plan with a longer duration will be higher (and the obligation lower) because bonds with higher yields would be “hypothetically purchased.” We say hypothetically because this is only a theoretical exercise and no bonds are actually purchased to determine the appropriate discount rate of a plan.

7. Can you give me examples of characteristics of a defined benefit plan that result in a higher duration?

All other things being equal, examples of characteristics that result in a higher duration are as follows:

-

Proportion of active versus retirees—A pension plan that has only retirees will have a low duration because we are currently paying benefits to the retirees. On the other side, a pension plan that has only active employees will have a higher duration since no benefits will be paid until the first active employees retire (so we do not need to “hypothetically buy” those bonds with a lower maturity and a lower yield).

-

Pension indexed after retirement—A pension plan that provides for post-retirement indexing benefits will have a higher duration than a similar pension plan that does not provide for post-retirement indexing. For the plan with the indexing provision, we will have to buy more bonds with a higher yield as the payments are increasing.

8. Can you give me examples of characteristics of a defined benefit plan that result in a lower duration?

All other things being equal, examples of characteristics that result in a lower duration are as follows:

-

Payment payable for a limited period of time—A post-employment benefit plan that pays benefits from the retirement age (say age 58) up to age 65 will have a lower duration than a similar plan that pays benefits for the lifetime of the retiree.

-

Older active employees—Two similar plans where one has on average active employees older than the other plan will have a lower duration. The plan with the youngest employees is expected to pay benefits further in the future, and as a result will “hypothetically buy” bonds that have a longer maturity and a higher yield, resulting in a higher discount rate than the other plan.

-

Lump-sum payment instead of annuities—A plan that pays a lump-sum payment at retirement will have a shorter duration than a similar plan that provides for a lifetime pension.

If you need further details regarding the content of this newsletter, please contact AEA.

This document is for internal use only.