Application of IAS 36 by Other Government Organizations

Purpose and scope

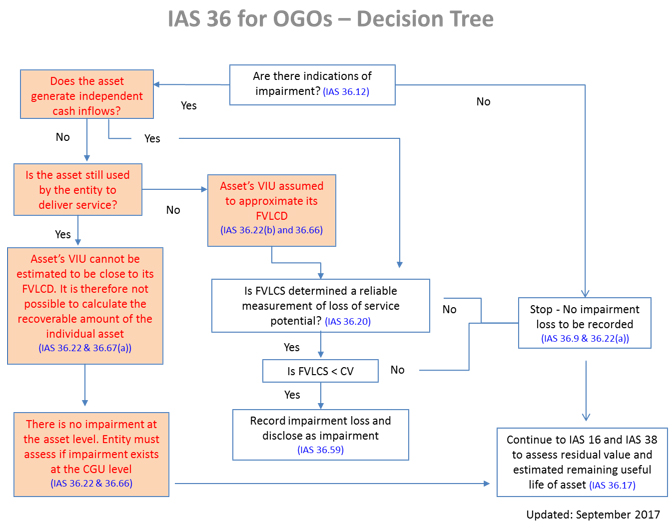

The purpose of this guidance is to assist with the application of IAS 36 by other government organizations (OGOs). OGO’s applying IFRS typically struggle to apply certain concepts of the standard (such as calculating recoverable amount or value in use) because their assets often do not generate cash flows and their dependence on parliamentary appropriations for some or all of their funding. Further, a traditional measurement of fair value of an asset can be challenging in a public sector environment where specialized assets or assets whose use is otherwise restricted are present.

The guidance assumes that the OGO has already assessed and concluded that it only has one cash generating unit (CGU)1 and no indication of impairment exists at that level.

Guidance

Indicators of impairment

IAS 36.12 provides indicators of impairment that must be considered as a minimum when assessing whether an asset may be impaired. Some of them are not relevant to an OGO such as market rates of return on investment, market capitalisation, and economic performance. IAS 36.13 indicates that the list in paragraph 12 is not exhaustive and an entity may identify other indicators that would also need to be considered in determining whether impairment may exist. IAS 36.14 provides examples of evidence from internal reporting that indicates that an asset may be impaired.

One may look to other standard-setting bodies such as IPSASB and PSAB2, which offer indicators of impairment more relevant to an OGO as they focus on an assessment of the service potential of the asset. Two examples found in IPSAS 21 includes cessation of the demand or need for services provided by the asset, and evidence indicating that the service performance of an asset will be significantly worse than expected.

Measuring impairment

An entity must assess whether there is any indication that an asset may be impaired at the end of each reporting period. If any such indication exists, the entity shall estimate the recoverable amount for the individual asset (IAS 36.9 and 36.66), which is the higher of an asset’s fair value less costs of disposal (FVLCD) and its value in use (VIU) (IAS 36.18), which is the present value of future cash flows expected to be derived from an asset or cash-generating unit.

The impairment loss is the amount by which the carrying amount of an asset or a cash-generating unit exceeds its recoverable amount. It is not always necessary to determine both an asset’s FVLCD and its VIU. If either of these amounts exceeds the asset’s carrying amount, the asset is not impaired and it is not necessary to estimate the other amount.

Level of impairment testing

Many assets generate cash inflows in combination with other assets as part of a larger CGU and therefore do not generate their own independent cash inflows. This is especially true in the public sector where assets often provide service potential rather than to generate cash inflows.

In order to assess impairment of any asset, whether they generate cash or not, an entity must assess if it is possible to estimate the individual asset’s recoverable amount. When this is not possible, an entity shall determine the recoverable amount of the CGU to which the asset belongs (IAS 36.22 and 36.66). Paragraph IAS 36.67 provides two criteria indicating when an asset’s recoverable amount cannot be determined:

- the asset’s value in use cannot be estimated to be close to its fair value less costs of disposal (for example, when the future cash flows from continuing use of the asset cannot be estimated to be negligible); and

- the asset does not generate cash inflows that are largely independent of those from other assets.

This means that if the asset’s VIU can be estimated to be close to FVLCD and FVLCD can be measured, the recoverable amount is determinable. By definition, these two values cannot be the same when as asset is held for continuing use by the entity since the manner in which the asset is used is specific to the entity and would not reflect the assumptions of a marketplace participant underlying the FVLCD. It is therefore not possible to calculate a recoverable amount for most individual assets held for continuing use. There are limited scenarios where an asset’s VIU and FVLCD would converge. Typically, a non-cash generating asset’s VIU can be estimated to be close to FVLCD when the asset is no longer in use or soon to be replaced or abandoned, such that the estimated future cash flows from continuing use of the asset are negligible, or when the asset is held for sale and the sole estimated future cash flows are presumed to come from the sale. At that point, the entity’s estimated VIU would approximate the estimated price of a willing marketplace participant.

In the public sector, we typically observe two common scenarios. Non-cash generating assets either contribute to the entity’s service delivery or stop contributing because of specific events or circumstances, such as obsolescence, destruction resulting from an accident, asset no longer usable due to change in entity mandate, or a specialized asset becomes redundant due to a change in technology. In summary, the above position can be applied to these scenarios as follows:

- When a non-cash generating asset is held for continuing use it is generally not possible to calculate a recoverable amount at the individual asset level (i.e., both criteria in paragraph 67 are met) and there would be no impairment loss recorded at the asset level. Rather than computing VIU to be nil, the standard states that it is not possible to compute its recoverable or VIU amount at the individual asset’s level. In these circumstances, it is assumed that the value of the asset’s service potential is at least equal to its carrying value and no impairment is required. The entity would however need to determine if an impairment testing is required at the CGU level. In a scenario where an OGO only has one single CGU and the OGO is expected to continue to operate as intended, there would be no indication of impairment at the CGU level and there would be no need to calculate an impairment at the CGU level.

- When an asset is no longer in use by the entity (e.g. asset destroyed or considered redundant), paragraph 67 (a) would typically not be met because it would be possible to assume that the asset’s VIU approximates its FVLCD since the lack of the asset’s utility would also be applicable to a marketplace participant. Paragraph 67 (b) would also not be met because the entity is now able to estimate the future cash inflows arising from the use of the asset, which are nil. Therefore, the entity would determine the impairment loss at the individual asset level as the smallest CGU is now the asset itself. It would estimate the FVLCD of the asset based on any resale or scrap value.

Where impairment indicators exist and no impairment loss is recognized for the asset, OGOs may need to review and adjust the remaining useful life, the depreciation (amortisation) method or the residual value for the asset in accordance with the Standard applicable to the asset (IAS 36.17). When an impairment loss exists, any related deferred appropriation balance would be reduced by an amount equal to the impairment loss, which would be recognized into income.

Fair Value less Cost of Disposal is determinable, but not a reliable measure of service potential

FVLCD using the cost approach is generally a reliable measure of an asset’s service potential, especially when the asset is expected to be disposed of. For assets in use, FVLCD typically understates the asset’s value from a service potential perspective (and therefore overstate impairment) because unlike the VIU concept, FVLCD does not consider entity-specific circumstances under which an asset may generate more value for the entity in the form of future service potential.

Audit teams should therefore be alert for indications of management bias in any assumptions and inputs used in the determination of recoverable amount. For additional guidance, refer to OAG Audit 7070—Auditing Accounting Estimates, Including Fair Value Accounting Estimates, and Related Disclosures. Care is therefore required to ensure a calculated impairment loss appropriately reflects the decline in service potential of the asset since there is no value in use figure which would serve as a further check on the impairment conclusion.

If the impairment calculation using FVLCD is deemed unreliable, the impairment calculation cannot be completed, and the entity would need to apply other requirements found in IAS 16 and IAS 38 (such as adjustments to useful lives or full write-off in accordance with the derecognition requirements).

Fair Value less Cost of Disposal is not determinable

There may be situations where FVLCD is not determinable. For example, a specialized piece of equipment with outdated technology is still being used by an OGO but that technology is no longer available on the market as it has been replaced by a more advanced technology. Calculating a replacement cost in this situation may not be possible.

Where FVLCD using the cost approach is not determinable at either an asset or CGU level, the necessary inputs to the impairment test and calculation of recoverable amount are not available. As a result, the OGO must apply other requirements found in IAS 16 and IAS 38 (IAS 36.17). In this scenario, should any adjustments to an asset’s carrying amount be recorded either in the current or future periods, the entity is no longer recording an impairment loss and should not present or disclose these adjustments as such. It would instead present a change in useful life or a full write-off resulting from derecognition.