Guide for Performance Audits and Special Examinations on Performance Management (November 2018)

Contents

Introduction

Purpose of this guide

Applicability and audience of this guide

Auditor’s responsibilities

Background and context

Key terms and concepts

Legislative and related requirements

Audit guidance

Why performance management is important

Identifying and assessing risks for audit selection and/or audit scoping

Recommended audit approach

Introduction

Purpose of this guide

The purpose of this guide is to assist audit teams who have identified a risk that the entity under audit does not have a performance management program in place that motivates and rewards employees whose performance has been assessed against established objectives to ensure that they effectively carry out their work and contribute to the achievement of strategic and operational goals. As a result, the audit team is considering and/or planning to carry out audit work in this area.

This guide provides audit teams with

-

an understanding of performance management, including legislative and related requirements;

-

guidance on determining whether performance management is an area of risk that should be examined; and

-

a recommended approach to auditing performance management. While this approach is comprehensive, audit teams may wish to tailor it to their audit context in consultation with the Human Resource Management Internal Specialist.

Applicability and audience of this guide

This guide applies to performance audits and special examinations. It is intended for engagement leaders and their respective audit teams.

Auditor’s responsibilities

Per the Direct Engagement Manual section 3081, audit teams are to consult with internal specialists when dealing with matters requiring specialized knowledge and experience.

Background and context

Key terms and concepts

Key terms

Performance management is a comprehensive approach to managing employee performance that includes performance planning, performance review and appraisal, and recognition and performance improvement.

Performance planning is the setting of commitments, performance and learning objectives, and expected behaviours.

Performance review and appraisal is the assessing of progress and results at mid-year and the end of the year and the provision of timely feedback.

Recognition and performance improvement is the recognition of employee performance by, for example, awarding performance pay, and taking action on improving employee performance by, for example, developing an action plan with specific improvement goals and deadlines).1

The performance management process and good practices

An effective performance management program aligns individual work with organizational and government-wide strategic and operational goals where strong performance is recognized and unsatisfactory performance is addressed promptly.2

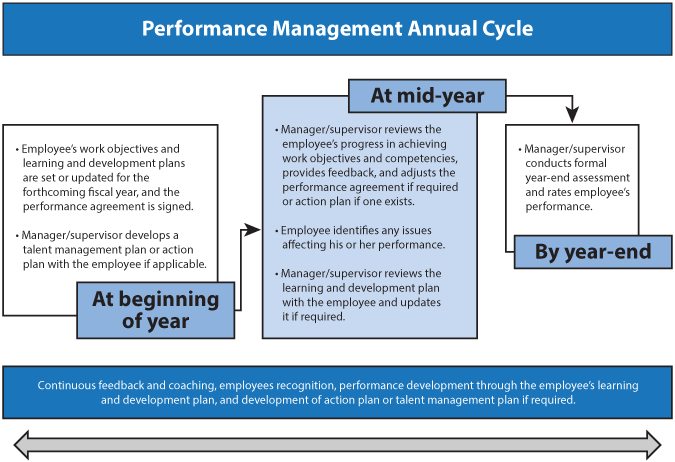

As outlined in Figure 1, from the Treasury Board of Canada Secretariat, the performance management process consists of the following steps:

-

Performance planning: At the beginning of the year, set work and learning objectives.

-

Performance review and appraisal: At mid-year, review progress against objectives and make adjustments as required. Timely and ongoing feedback, coaching, and employee recognition should occur throughout the year.

-

Recognition and performance improvement, based on final performance review and appraisal: At the end of the year, assess performance against objectives, and recognize and reward good performance and take steps to improve unsatisfactory performance as appropriate.

When developing annual work and learning objectives, organizations may also establish talent management plans and action plans for certain employees. Talent management plans go beyond the focused job-related training found in an employee’s learning and development plan and concentrate on developing the skills, competencies, and experience of employees with outstanding performance to position them for future career possibilities. Performance improvement action plans are developed for employees who demonstrate unsatisfactory performance, and include specific improvement objectives, actions, and timelines.3

Figure 1 Performance Management Annual Cycle4

Legislative and related requirements

The legislative basis for performance management in the public service is the Financial Administration Act and the Treasury Board of Canada Secretariat’s Directive on Performance Management and the Directive on the Performance Management Program (PMP) for Executives. The Act and directives establish the responsibility of deputy heads to

- implement a performance management program for employees and executives,

- determine the awards for outstanding performance, and

- establish standards of discipline and set penalties for unsatisfactory performance.5

The people management component of the Treasury Board of Canada Secretariat Management Accountability Framework includes performance and talent management as a measure of organizational performance. The Framework states that successful performance and talent management facilitates the effective delivery of strategic and operational goals. The Framework includes a number of indicators to measure organizations’ compliance with performance management directives, which are collected and reported on annually by the Treasury Board of Canada Secretariat. These indicators include6

-

percentage of executives (EX-03 to EX-05) who completed a talent management questionnaire (per deputy heads’ governance requirement to participate in the annual executive talent management exercise for assistant deputy ministers [ADMs] and the EX-03 feeder group to ADMs),

-

percentage of employees who had documented performance expectations and objectives (as required by the Treasury Board of Canada Secretariat’s Directive on Performance Management),

-

percentage of employees who had mid-year conversation(s) with their immediate supervisor to review performance (as required by the Directive on Performance Management),

-

percentage of employees with a completed annual written performance assessment (as required by the Directive on Performance Management),

-

percentage of employees who have an action plan in place among those who require one (as required by the Directive on Performance Management),

-

percentage of employees who have accepted a talent management plan among those who have been offered one (as required by the Directive on Performance Management).

The importance of performance management was also referenced in the Clerk of the Privy Council’s 2014 and 2015 Annual Reports to the Prime Minister on the Public Service of Canada and in Blueprint 2020.7 One of the means identified to achieve the Clerk’s priority for a high-performing public service was a fair, equitable, and consistent approach to performance management. As of 1 April 2014, organizations were to have performance agreements in place for all employees as part of an ongoing process of providing feedback and evaluating employee performance each fiscal year.

Audit guidance

Why performance management is important

As stated by the Treasury Board of Canada Secretariat, “performance management is a tool for improving the work performance and productivity of individuals, teams and organizations. It is increasingly important in the public sector in responding to budgetary and fiscal pressures, increasing demands for public services, and the need for more transparency in reporting on the use of government funds. Its proper implementation in the public service can help build and maintain trust between employer and employee, and create conditions to allow all employees to maximize their contributions and provide world-class service to Canadians.”8

If an organization’s performance management program does not set clear expectations, provide ongoing feedback, evaluate performance, and reward or work to improve performance, it can have negative consequences.

- Employees may not know what is expected of them.

- Employees’ day-to-day activities may not align with the organization’s objectives and goals. This could

- impede the organization from cost-effectively serving the public and achieving expected results,

- lead to an ineffective use of time and resources, and

- put the achievement of organizational goals at risk.

- Employee morale may be affected, which could lead to increased sick leave usage and employee turnover.

If assessments of employee performance are not well documented, this may

- prevent supervisors from identifying and addressing unsatisfactory performance in a timely manner, and

- pose legal issues for the organization should it wish to terminate an employee for unsatisfactory performance.

Identifying and assessing risks for audit selection and/or audit scoping

To help determine whether performance management is a risk that should be considered for audit, audit teams should ask the following questions:

-

Do employee survey results and/or exit interviews indicate problems with how employee performance is managed?

-

Does the organization meet the Treasury Board of Canada Secretariat’s Directive on Performance Management9? Specifically:

-

The organization has a performance management program in place that includes the following elements:

- annual written performance objectives for all employees,

- mid-year reviews for all employees,

- annual written performance assessments for all employees,

- a rating scale to assess performance,

- monitoring of probationary periods, and

- monitoring to identify cases of unsatisfactory performance and steps to address it.

-

Does the organization establish, as part of its performance management program, an organizational review panel to review performance assessments?

-

-

Does the organization meet the Treasury Board of Canada Secretariat’s Directive on the Performance Management Program (PMP) for Executives10? Specifically:

-

Employees being paid as executives have valid performance agreements that are reviewed at least once a year.

-

Key Leadership Competencies11 and performance measures are used to assess the performance of executives.

-

There is a mechanism to review the assessment of each executive’s performance for equality and consistency.

-

-

Does the organization ensure that supervisors and managers who are responsible for evaluating employee performance take the mandatory online course on performance management from the Canada School of Public Service?

-

Does the organization provide supervisors and managers with guidance and tools to address performance issues and develop performance improvement action plans?

-

Does the organization recognize and reward employees for good performance? Is this ongoing throughout the year?

-

Does the organization provide a clear link between performance results and compensation (e.g., in-range salary movements, lump sum performance awards [at-risk pay and bonuses], other forms of compensation)?

-

Is there a normal distribution of performance ratings (i.e., roughly 5–10 percent are below expectations, 80 percent meet expectations, and 5–10 percent are above expectations)?

-

Does the organization have a significant number of complaints and grievances regarding employee performance appraisals?

Audit teams should request and review relevant documents, such as

-

most recent employee survey results,

-

summary of exit interviews,

-

documentation that explains the organization’s performance management program for executives and employees,

-

performance management statistics provided to the Treasury Board of Canada Secretariat as required by the Management Accountability Framework,

-

documentation and analyses that show the distribution of performance ratings for the last two fiscal years,

-

corporate risk profile and risk register,

-

reports to senior management on the performance management program results,

-

performance appraisal-related complaints and grievances.

Recommended audit approach

The tables below outline the audit criterion and sources, as well as the audit questions, key interview questions and documentation, and audit steps and techniques recommended to carry out the examination work on performance management.

| Audit Criterion and Sources |

|---|

|

Audit criterion: The organization has a performance management program in place that enables it to assess employee performance against objectives that are aligned with strategic and operational goals, recognize good performance, and take corrective action to address unsatisfactory performance. Sources: NOTE: For audit entities that are not subject to the Treasury Board of Canada Secretariat Directive on Performance Management, refer to the organization’s own performance management policy and directives for criterion sources. For unionized organizations, also refer to their collective agreements for additional criterion sources as appropriate. Financial Administration Act, last amended 2016 (http://laws-lois.justice.gc.ca/eng/acts/f-11/) “Powers of deputy heads in core public administration” (…) “12 (1) Subject to paragraphs 11.1(1)(f) and (g), every deputy head in the core public administration may, with respect to the portion for which he or she is deputy head, (b) provide for the awards that may be made to persons employed in the public service for outstanding performance of their duties, for other meritorious achievement in relation to their duties or for inventions or practical suggestions for improvements; (c) establish standards of discipline and set penalties, including termination of employment, suspension, demotion to a position at a lower maximum rate of pay and financial penalties; (d) provide for the termination of employment, or the demotion to a position at a lower maximum rate of pay, of persons employed in the public service whose performance, in the opinion of the deputy head, is unsatisfactory; “Powers of other deputy heads (2) Subject to any terms and conditions that the Governor in Council may direct, every deputy head of a separate agency, and every deputy head designated under paragraph 11(2)(b), may, with respect to the portion of the federal public administration for which he or she is deputy head, (b) provide for the awards that may be made to persons employed in the public service for outstanding performance of their duties, for other meritorious achievement in relation to their duties or for inventions or practical suggestions for improvements; (c) establish standards of discipline and set penalties, including termination of employment, suspension, demotion to a position at a lower maximum rate of pay and financial penalties; and (d) provide for the termination of employment, or the demotion to a position at a lower maximum rate of pay, of persons employed in the public service for reasons other than breaches of discipline or misconduct.” Treasury Board of Canada Secretariat Directive on Performance Management, 2014 (https://www.tbs-sct.gc.ca/pol/doc-eng.aspx?id=27146) 6. Directive Requirements

Treasury Board of Canada Secretariat Directive on the Performance Management Program (PMP) for Executives, last modified 2008 (https://www.tbs-sct.gc.ca/pol/doc-eng.aspx?id=14226) 5. Requirements Appendix B—Requirements for Executive Performance Agreements 1. Alignment Performance agreements are to demonstrate alignment with

Appendix C—Requirements for the Management and Assessment of Executive Performance 2. Assessment of Performance 2.1 Assessment of performance includes, as a minimum

|

| Audit Question | Key Interview Questions and Documentation | Audit Steps and Techniques |

|---|---|---|

|

Q1—Does the organization have a performance management program in place for employees and executives? |

Key interview questions

Key documentation

|

Request and review documentation. Interview

Assess whether the organization has a performance management program in place for employees and executives that meet the Treasury Board of Canada Secretariat directives on performance management. Also assess whether roles and responsibilities for performance management are clearly defined and communicated to managers and employees. Document observations and respond to audit question. |

|

Q2—Does the organization ensure that managers and supervisors who are responsible for assessing employee performance receive the training and support they need to manage employee performance effectively? |

Key interview questions

Key documentation

|

Request and review documentation. Interview

Analyze documentation that identifies which managers and supervisors are required to take the mandatory course on performance management provided by the Canada School of Public Service, and determine whether they received it. Assess whether the organization ensures that managers and supervisors have the training and support they need to manage and assess employee performance. Document observations and respond to audit question. |

|

Q3—Does the organization monitor its performance management program(s) to ensure it complies with the Treasury Board of Canada Secretariat directives on performance management and is achieving intended results? |

Key interview questions

Key documentation

|

Request and review documentation. Interview

Perform a walkthrough of key HR information systems (electronic or paper-based) that collect and maintain performance management data to determine what information exists, its quality, and how it is used and reported on, if this was not already done in the planning phase. Analyze a sample of employee and executive performance assessments and determine whether they comply with the Treasury Board of Canada Secretariat directives on performance management. Analyze the distribution of employee and executive performance ratings for the last two fiscal years and determine whether the ratings follow a normal distribution (roughly 5–10 percent are below expectations, 80 percent meet expectations, and 5–10 percent exceed expectations). Analyze the administration of performance pay and awards to employees for the last two fiscal years and determine whether they

Assess whether the organization monitors and evaluates its performance management program(s) to ensure it complies with the Treasury Board of Canada Secretariat directives on performance management, is achieving intended results, and is making adjustments if required. Document observations and respond to audit question. |

|

Q4—Does the organization annually evaluate its performance management program(s) per the Treasury Board of Canada Secretariat Directive on Performance Management to determine whether it is achieving intended results, and make adjustments as required? |

Key interview questions

Key documentation

|

Request and review documentation. Interview

Assess whether the organization evaluates its performance management program(s) to determine whether it is achieving intended results, and make adjustments as required. Document observations and respond to audit question. |

1 Treasury Board of Canada Secretariat Directive on Performance Management: https://www.tbs-sct.gc.ca/pol/doc-eng.aspx?id=27146; Treasury Board of Canada Secretariat performance management program for employees: https://www.canada.ca/en/treasury-board-secretariat/services/performance-talent-management/performance-management-program-employees.html

2 Treasury Board of Canada Secretariat Directive on Performance Management: https://www.tbs-sct.gc.ca/pol/doc-eng.aspx?id=27146

3 Treasury Board of Canada Secretariat Directive on Performance Management: https://www.tbs-sct.gc.ca/pol/doc-eng.aspx?id=27146; Treasury Board of Canada Secretariat performance management program for employees: https://www.canada.ca/en/treasury-board-secretariat/services/performance-talent-management/performance-management-program-employees.html

4 Source: Treasury Board of Canada Secretariat, Performance management program for employees: https://www.canada.ca/en/treasury-board-secretariat/services/performance-talent-management/performance-management-program-employees.html

5 Financial Administration Act: http://laws-lois.justice.gc.ca/eng/acts/f-11/; Treasury Board of Canada Secretariat Directive on Performance Management: https://www.tbs-sct.gc.ca/pol/doc-eng.aspx?id=27146; Performance Management Program for Executives: https://www.canada.ca/en/treasury-board-secretariat/services/performance-talent-management/performance-management-program-executives.html

6 Treasury Board of Canada Secretariat Management Accountability Framework: https://www.canada.ca/en/treasury-board-secretariat/services/management-accountability-framework/maf-methodologies/maf-2016-2017-people-management-methodology.html

7 Clerk of the Privy Council’s Twenty-First Annual Report to the Prime Minister on the Public Service of Canada (PDF 10.8 MB); Twenty-Second Annual Report to the Prime Minister on the Public Service of Canada (PDF 4.2 MB); Blueprint 2020 (PDF 853 KB)

8 Treasury Board of Canada Secretariat Directive on Performance Management: https://www.tbs-sct.gc.ca/pol/doc-eng.aspx?id=27146

9 Note that the Treasury Board of Canada Secretariat Directive on Performance Management applies to the core public administration as defined in the Financial Administration Act; i.e., organizations listed in Schedule I and Schedule IV of the Financial Administration Act, unless excluded through specific acts, regulations, or Orders in Council. The Directive does not apply to separate agencies or Crown corporations.

10 Note that the Treasury Board of Canada Secretariat Directive on the Performance Management Program for Executives applies to the core public administration as defined in section 11 of the Financial Administration Act, unless excluded through specific acts, regulations, or Orders in Council. The Directive does not apply to separate agencies or Crown corporations.

11 Key Leadership Competency profile: https://www.canada.ca/en/treasury-board-secretariat/services/professional-development/key-leadership-competency-profile/examples-effective-ineffective-behaviours.html