Financial Instruments Specialists Team

Introduction

Financial instruments specialists can guide audit teams as they apply the financial instrument sections of the International Financial Reporting Standards (IFRS) and the Public Sector Accounting Standards (PSAS).

The Financial Instruments Specialists team also supports audit teams by

- assisting in understanding the nature and operation of financial instruments

- assisting in interpreting accounting standards on financial instruments

- reviewing the audit approach for financial instruments

- determining the need to engage external specialists

- testing the fair value of select types of financial instruments

- extracting financial information from Bloomberg (such as interest rates, foreign exchange rates, and credit ratings)

Foreign exchange rates

On a quarterly basis, the Financial Instruments Specialists team prepares a list of exchange rates for all currencies available on Bloomberg. The file contains the following rates for each quarter:

- closing exchange rates (foreign currency → Canadian dollars) extracted from Bloomberg (74 currencies)

The file can be accessed here: Exchange rates

For assistance, contact Nathalie Coletta, Nathan Anstey, or Stéphane Arbour.

References and publications on financial instruments

Our team is always available to help you. However, we understand that everyone has their own learning styles and learn at their own pace. To assist those who need or want to learn about financial instruments or stay on top of developments in the financial industry and financial instrument accounting, we have compiled a list of resources and publications in the table below. We encourage you to reach out to our team to share any other related resources that you believe may be of value to your colleagues.

| Source | Content | Website |

|---|---|---|

|

Knotia |

Standards are always a good place to start to understand financial instruments accounting. Knotia provides access to all IFRS and PSAS standards including

|

|

|

Khan Academy |

Khan Academy offers instructional videos for self-study in several areas, including finance and capital markets. Examples of topics covered in this area are stocks and bonds, derivatives, interest and debt, and investment vehicles. |

https://www.khanacademy.org/economics-finance-domain/core-finance |

|

Investopedia |

Investopedia is an online encyclopedia that strives to simplify complex financial information. |

|

|

PWC Viewpoint1 |

PWC Viewpoint is dedicated to IFRS 9—Financial Instruments and includes practical guides on applying the standard and updates on developments in the financial industry affecting the standard. |

https://www.pwc.com/gx/en/services/audit-assurance/ifrs-reporting/financial-instruments-ifrs-9.html |

|

Office of the Auditor General of Canada (OAG) INTRAnet: Transition to New Accounting Standards |

The OAG’s Transition to New Accounting Standards page provides videos, webcasts, and newsletters about the transition to IFRS 9. |

http://cmsprd.oag-bvg.gc.ca/intranet/financial-audits/19266_ENC_HTML_PROD.shtm |

|

International Private Equity and Venture Capital Valuation (IPEV) Guidelines |

IPEV sets out recommendations, intended to represent current best practices, on the valuation of private capital investments to help investors in private capital funds make better economic decisions |

|

|

Montréal Exchange (MX) |

The Montréal Exchange is a fully electronic exchange dedicated to developing Canadian derivative markets. The website includes publications and educational tools. It also includes a tool to calculate the prices of options. |

1 The OAG has access to this content through our strategic alliance with PWC. If you do not have access to this content, please contact the Library for assistance.

Process for consultation

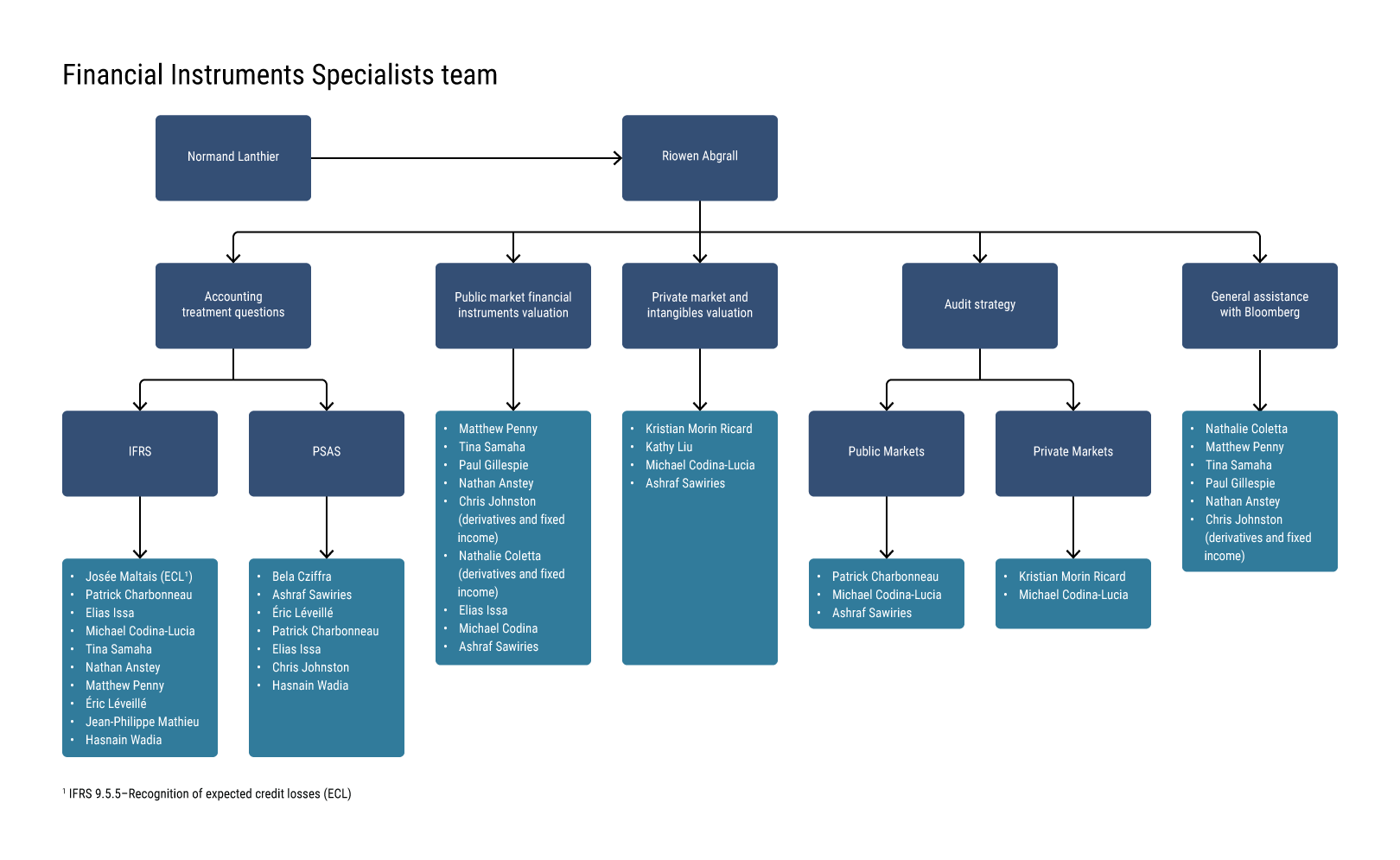

To help audit teams identify which specialist they should consult about specific topics, the Financial Instruments Specialists team developed the following organizational chart:

Financial Instruments Specialists team

1 IFRS 9.5.5 – Recognition of expected credit losses (ECL)

When requesting a consultation, please include the following information in your email:

- product code and client name

- standards applicable to your entity (IFRS, PSAS, or other)

- year-end date

- materiality, performance materiality, and Summary of Unadjusted Differences (SUD) threshold

- brief description of the reason for consultation

- the entity’s and audit team’s positions regarding this matter

A financial instruments specialist will respond to your request and confirm timelines for the team’s review and response.

Members

- Normand Lanthier (directeur principal)

- Riowen Abgrall (directeur principal)

- Nathan Anstey

- Stéphane Arbour

- Patrick Charbonneau

- Michael Codina

- Nathalie Coletta

- Bela Cziffra

- Paul Gillespie

- Elias Issa

- Chris Johnston

- Éric Léveillé

- Kathy Liu

- Josée Maltais

- Bianka Maheu-Chauvin

- Jean-Philippe Mathieu

- Kristian Morin Ricard

- Matthew Penny

- Sean Powers-Kelly

- Tina Samaha

- Ashraf Sawiries